Market Data

May 1, 2020

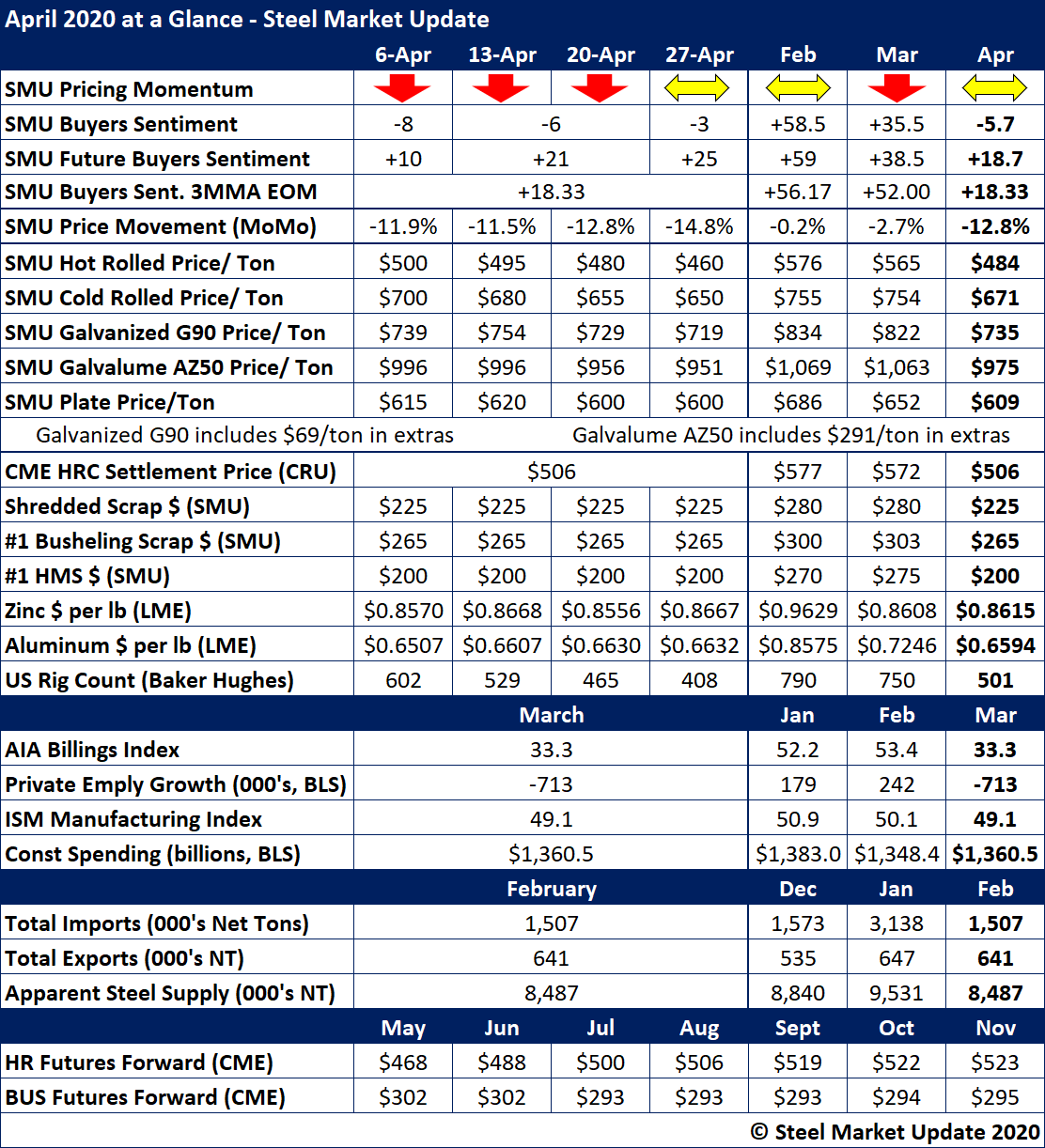

SMU's April At-a-Glance

Written by Brett Linton

Both steel and scrap prices decreased in the month of April, down anywhere from $15 to $75 per ton between each product, as the effects of the coronavirus shutdowns impacted the market.

SMU Buyers Sentiment Index readings showed significant declines over March, with Current Sentiment sliding into negative territory and reaching a low of -8, Future Sentiment as low as +10, and the three-month moving average at +18.33 as of Friday.

SMU moved its Price Momentum Indicator to Neutral from Lower as the market showed signs of firming and the mills announced price increases on flat rolled products.

Key indicators of steel demand were mixed, with only some of our data points reflecting the downturn. The AIA Billings Index fell to 33.3, and private employment shrunk by 713,000 jobs.

See the chart below for other key metrics in the month of April: