Prices

April 16, 2020

Hot Rolled Futures: Falling Demand, Supply/Capacity Mismatches Add Volatility

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

Falling demand and mill capacity utilization rates below 60 percent do not seem to have damped the HR futures curve since the beginning of the month. While the index the CME uses to calculate the settlement of the HR futures contract has been lagging some of the other HR indexes in its declining spot price, the HR futures have proved a bit more resilient. Since the beginning of April, Q2’20 HR futures prices have risen $11/ST to $493/ST as of yesterday’s settlement, Q3’20 prices have risen $30/ST to $509/ST as of yesterday’s settlement, and Q4’20 prices have risen $19/ST to $533/ST as of yesterday’s settlement. The strong rise in Q3’20 and Q4’20 HR futures prices could signal that the market hedgers are looking for a surge of demand as the economy starts back up sometime in the second half of the year. This could leave the market short production capacity while the integrated steel mills slowly bring their operations back online.

What is clear is that much uncertainty remains. Futures volumes have pared back since our last look, as participants became bystanders due to an inability to forecast. Much of the recent HR futures volume is related to calendar spreads as participants try to tweak their portfolios of hedges.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

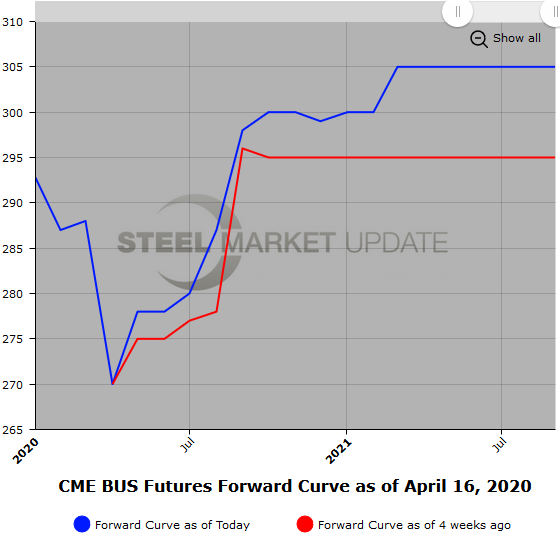

April BUS settled at $273/GT, down $24/GT from March. Interestingly, the huge drop-off in steel production, auto production and energy-related tube production in the last month has seen a parallel rise in BUS futures prices. This is potentially due to the expectation that falling demand will likely not outstrip potential capacity shortages for prime scrap as the sources for scrap are related to production, which has been dramatically reduced. In addition, some of the alternatives to prime scrap have also declined due to the virus.

In the near end of the BUS futures curve, May’20 and Jun’20 months have been active as the price has risen about $40/GT in each month for the period of April 1 to yesterday. They are currently trading between $275 and $280/GT. There is some early chatter that BUS will push back up to Mar’20 settlement levels ($297). For hedgers, getting the timing right will be difficult in this newly contracted economy.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.