Prices

April 14, 2020

CRU: Iron Ore Rising Along with Higher Steel Prices in China

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

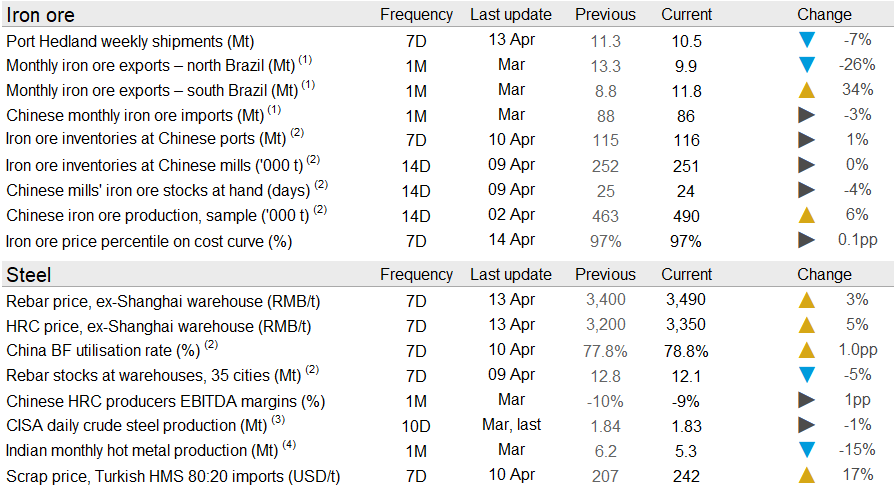

The iron ore price rose by $3.0 /dmt in the past week, driven primarily by optimism in the Chinese market, where both rebar and HRC jumped sharply from the bottom. On Tuesday, April 14, the 62% Fe fines price has been assessed at $86.0 /dmt.

In China, demand continues to be strong as steelmakers are ramping up production and the BF utilization rate below keeps increasing. We have also seen Chinese EAF production increase, although the output level is still well below similar levels 12 months ago. The stronger steel prices resulted in margins recovering somewhat, but they are still at a low level of around 0 percent. Chinese domestic iron ore production has continued to increase, which has resulted in higher pellet production in the country. This is reducing lump demand somewhat and is seen as one of the reasons why the lump premium has been declining in recent weeks.

Seaborne supply has remained steady in the past week. Shipments from Port Hedland fell w/w, but 10.5 Mt shipped in a week is still considered a high level. In April 2019, Port Hedland shipped an average of 9.9 Mt/w. Rio Tinto’s exports have declined in the past week while we have seen an increase in Brazilian exports, although from a low level. Strong seaborne supply at end-March, particularly from Australia, is one reason why Chinese port inventories have stopped falling and even rose somewhat w/w. South African exports have fallen since the mining restrictions have been implemented, while Canadian exports are still at a relatively high level, despite the mining restrictions in Quebec.

In the next week, we expect iron ore prices to remain steady. Our indicators below show that there is a relatively small chance of price decreases in the coming week. However, steel margins are still weak and seaborne supply from Australia is expected to remain strong, while supply in Brazil and China is expected to improve.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com