Market Data

April 6, 2020

CRU: Dollar Remains Strong as Commodity Currencies Hit

Written by Ross Cunningham

By CRU Senior Cost Analyst Ross Cunningham, from CRU’s Steel Monitor

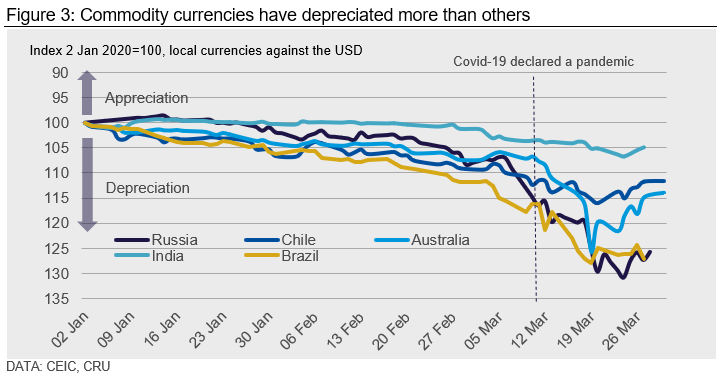

Covid-19 has spread across the world at alarming rates. As of March 28, the pandemic has reached 177 countries and shows little sign of letting up. When fighting a global health and economic crisis unlike anything ever seen before, there will be no winners—only those that lose a little less than others. Commodity currencies have fallen sharply since the start of the year due to Covid-19. This fall reflects two factors—a large decline in the global demand for commodities; and a “risk off” sentiment that led to record capital flight out of emerging markets (EMs). All of the capital that entered EMs in 2019 was taken out in the first three months of 2020.

Demand Destruction

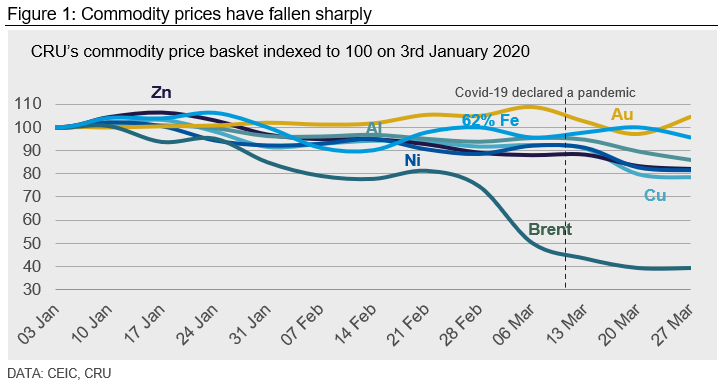

China is the world’s largest consumer of almost all commodities. The virus outbreak in China during January and February led to a sharp slowdown in manufacturing activity and travel. As a result, the demand for copper, aluminum, nickel, zinc and crude oil fell, as did the prices of these commodities. The escalation of the outbreak to other countries in the world, and the WHO declaration of a pandemic on March 11, led to a further leg down in commodity prices as fears over further demand destruction intensified. Copper and nickel prices have fallen 20 percent since the turn of the year. Brent crude prices have fallen by 60 percent, reflecting the impact on demand for travel, and the oil price war between Saudi Arabia and Russia.

Weak Confidence Leads to Capital Flight

Financial market participants have been uncertain and fearful about the Covid-19 “end-game” and the size of the ultimate loss to economic output. This has given rise to a bear market in leading stock exchanges: major equity indices fell by 30-40 percent between January and March, before recovering somewhat in the final seven days of March.

Covid-19 uncertainty has led to a capital flight out of emerging markets, including commodity producers, towards safer assets such as advanced economy assets, and ultimately the U.S. dollar (cash is seen to be the ultimate safe asset in times of extreme uncertainty). Such a record EM capital outflow (~$90b year to March), or “sudden stop” from places like Brazil, Chile and Russia is damaging because it gives rise to a tightening of domestic financial conditions, which subsequently weighs on domestic spending and growth.

The Brazilian real and Russian rouble have depreciated ~25 percent against the U.S. dollar since Jan. 2 with the Chilean peso losing 10-15 percent of its value against the greenback. Since Covid-19 was declared a pandemic on March 11, the rate of depreciation of commodity currencies has been faster than the two months prior. This is due to the added risk off sentiment and capital outflows. Those reliant on low commodity prices to aide their economic growth haven’t fared much better. The Indian rupee, a currency that generally benefits from cheap commodity prices, has depreciated ~6 percent since January. The lockdown leading to much less domestic demand has outweighed the benefit of cheaper imports.

Underlying Issues Have Not Helped

Prior to the Covid-19 pandemic some commodity currencies were already facing rough waters. Since October, Chile has seen a rise in social unrest, the peso has depreciated markedly as confidence in the economic growth of the normally dependable South American country waivered. Similarly, the Russian rouble and Brazilian real had been under depreciation pressure as economic sanctions on Russia and high debt levels in Brazil had spooked investors sufficiently to look elsewhere.

Until the virus is contained and demand returns, commodity currencies may continue to feel the pressure. A weak exchange rate against the U.S. dollar usually aides’ exports, however, this is doing little to help the economies when demand is not there to meet export volumes.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com