Prices

March 31, 2020

CRU: Iron Ore Prices Rise Despite Worsening Global Outlook

Written by Eduardo Tinti

By CRU Credit Research Analyst Eduardo Tinti, from CRU’s Steelmaking Raw Materials Monitor

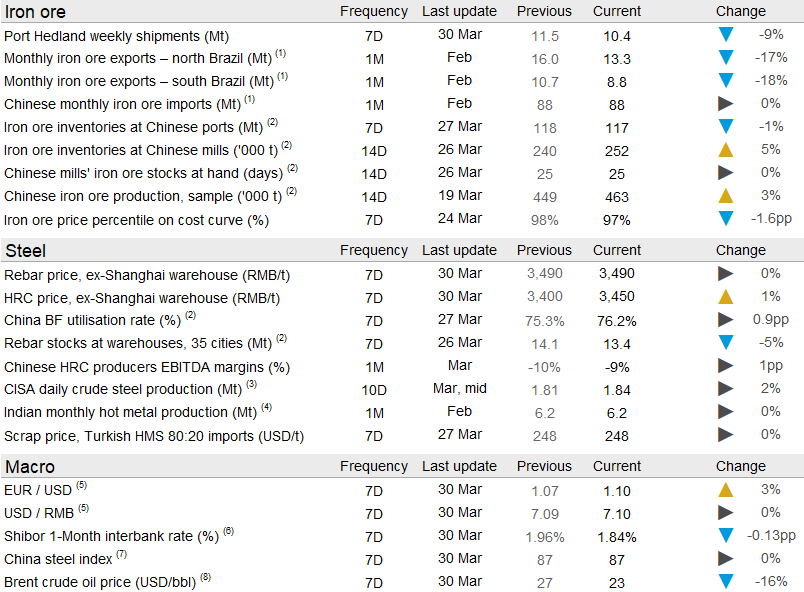

Last week iron ore prices increased, supported by news of mining bans in Canada and South Africa before being pulled down due to the worsening global demand outlook after the spread of the COVID-19 pandemic led governments around the world to adopt containment measures. On Tuesday, March 31, CRU assessed the 62% Fe fines price at $83.0 /t, $2 /t higher w/w.

In China, demand is starting to improve from the COVID-19 outbreak and the government measures taken to contain its spread. Integrated mills have been increasing operations, although blast furnaces’ utilization rate is still low at 76 percent. Halted EAFs are also restarting activities. As a sign of end-use recovery, steel inventories fell w/w both at mills and traders, notwithstanding still being at very high levels. Mills also have a healthy level of iron ore inventories at hand, around the 2019 average. However, iron ore inventories at ports are at a very low level, which is expected to provide some support to prices. Outside China, the situation is worsening at a fast pace as lockdowns are enforced and steel producers announce production cuts and the idling of blast furnaces in Europe, the U.S., northeast and south Asia. A worsening economic performance elsewhere may end up constraining Chinese iron ore demand further ahead as steel producers and downstream sectors that rely on exports see their demand shrink.

Meanwhile, seaborne supply was stable w/w. Australian shipments remained robust despite falling w/w while Brazilian exports rose thanks to mild rains throughout the country. Looking ahead, supply from major producers is expected to improve in the absence of new cyclones in Australia and as rains ease in southeastern Brazil. At the same time, the mining restrictions announced in Canada and South Africa last week were revised and iron ore mines will be allowed to operate, though at a reduced rate.

Oil prices fell further last week, assessed at $23 /bbl on March 30. This contributes to reducing freight rates and keeping iron ore production costs low.

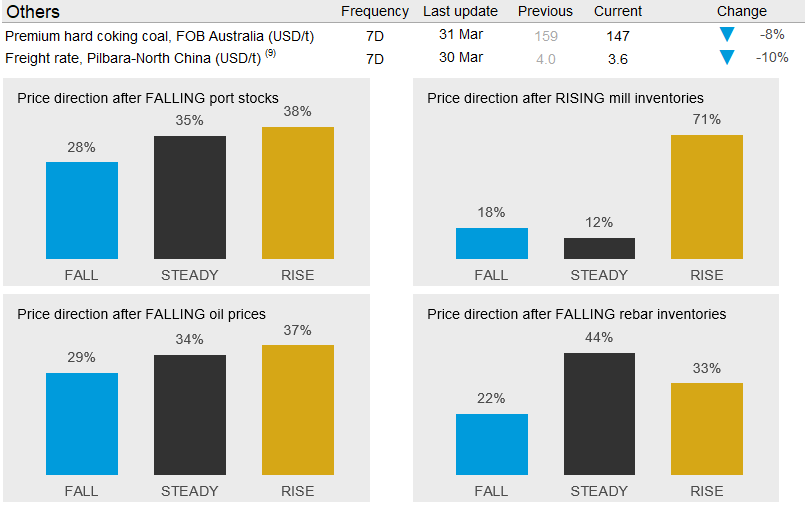

Looking ahead, we expect low iron ore stocks at Chinese ports and rising steel production in the country to support prices. At the same time, seaborne supply has not been largely affected by COVID-19 containment measures as of yet and is expected to improve through the coming weeks as Brazilian production is less impacted by rains. The deterioration of the economic outlook outside China will reduce iron ore demand elsewhere and affect market sentiments, representing a downward risk to prices. Within these trends pointing to different directions, we expect iron ore prices to remain stable in the coming week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com