Market Data

March 29, 2020

CRU: Global Pandemic Triggers Global Recession

Written by Jumana Saleheen

By CRU Chief Economist Jumana Saleheen, from CRU’s Global Economic Outlook Overview March 2020

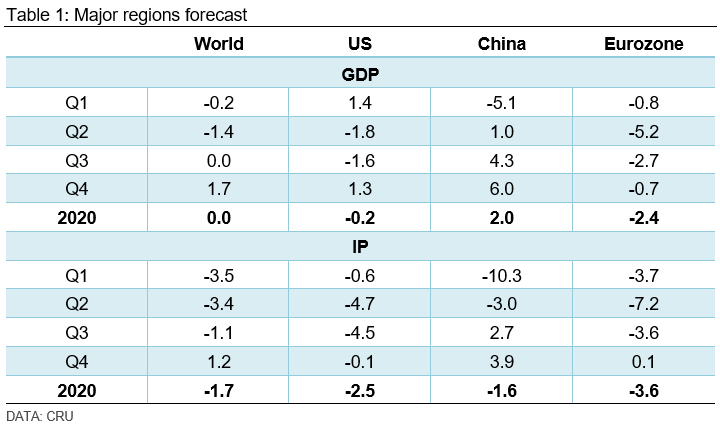

The global impact of Covid-19 has been profound. Lockdowns of countries and regions are now the norm. Uncertainty about the “end game” has fueled financial market volatility and prompted unprecedented government support. CRU is now forecasting a global recession in 2020; GDP in the EU and the USA is expected to fall, and China suffers a “hard landing” as economic growth drops sharply to 2 percent. World GDP is expected to come to a halt, and world industrial production to contract (by -1.6 percent y/y). Global growth is expected to bounce back in 2021. In such unprecedented times, the uncertainty around our forecasts is larger than normal. Our figures are predicated on the assumption that the virus is successfully contained in major regions in Q2 (as it was in China in Q1) and that there is no second Covid-19 wave.

Deafening Sound of (Pandemic) Alarm Bells

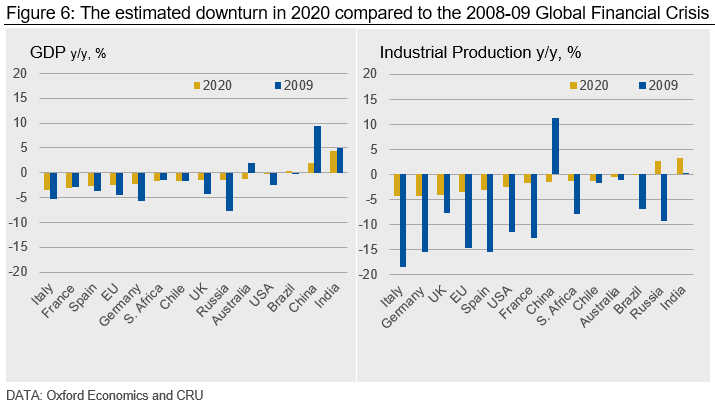

The global impact of Covid-19 has been profound. Scientists declare that the public health threat is the most serious seen since the 1918 influenza pandemic. The economic effects are equally large; some organizations (e.g. the IMF) compare the consequences to the 2008-2009 Global Financial Crisis (GFC), the last major contraction in world GDP and world Industrial Production (IP).

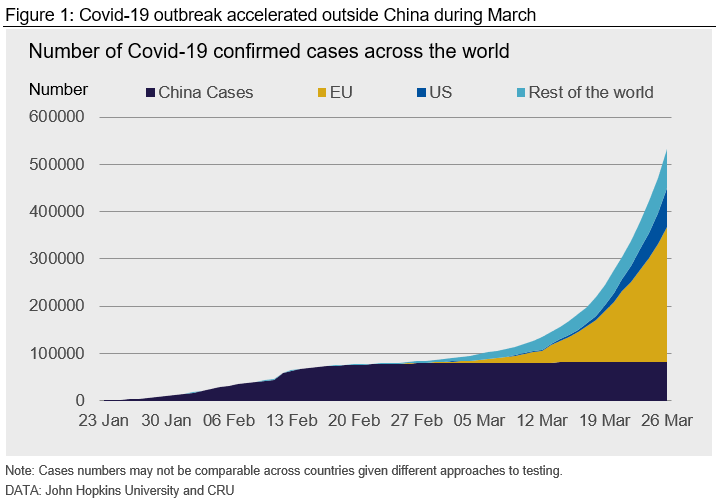

The main factor that has led us to revise and lower our forecasts heavily this month is that Covid-19 has spread to most countries around the world. This is clear from Figure 1, which shows that the number of cases has now plateaued in China, whereas the number of cases outside China has exploded, and exceeded the number of cases within China. In anticipation of this, on March 11 the WHO officially declared Covid-19 a global pandemic, saying that “we have rung the alarm bell loud and clear” so that countries can act now to protect the health of their citizens.

Italy went into complete lockdown on March 9. In a matter of days, reflecting the rising outbreak, Spain, France, UK and California and New York were in lockdown. As of March 26, the U.S. recorded the largest number of confirmed Covid-19 cases in the world, and 22 states had been issued stay-at-home orders. The introduction of lockdowns is seen as the only way to control the spread of the disease. And even with lockdowns in force, most major economies are still expecting the number of Covid19 cases to rise, following the path set by China and now Italy. A worrying picture.

Covid-19 is a Major Shock to Global Demand

Lockdowns come with consequences. On the one hand, they are necessary to preserve health and prevent the virus from spreading (see Imperial College Covid-19 Response Team). On the other hand, they damage economies, as they force people to stay at home, sharply reducing expenditures and therefore reducing demand. The fall in demand is likely to result in job losses and business closures, although this effect may be mitigated by Covid-19 related government aid. Production and the supply side of the economy may also be affected. However, we see the supply side disruption to the global as a secondary impact; the fall in demand is the factor of primary importance.

Oil Prices Hit Rock Bottom in 2020

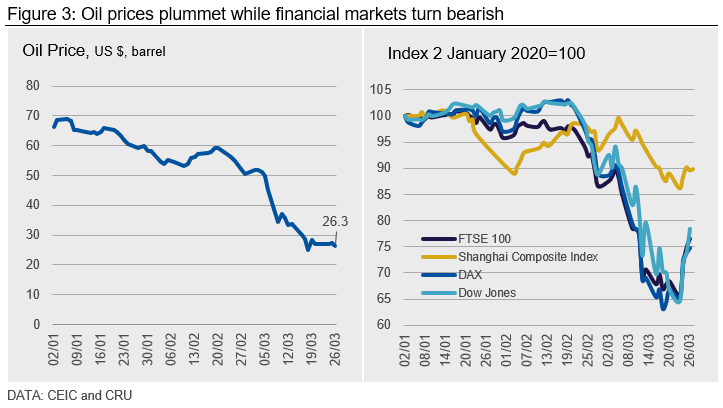

Lockdowns and travel bans have caused significant damage to travel and tourism. Many airlines have issued profit warnings and some smaller airlines have gone bankrupt (e.g. Flybe). Reduction in travel has led to a fall in the demand for oil. Brent crude fell to $45/bbl on March 6, well below OPEC’s target range of $60-$70/bbl. At that point, CRU and markets had expected further production cuts to be agreed by OPEC+ at its meeting on March 5-6 in order to support the oil price. But no agreement was reached. Instead the opposite happened, as set out in a recent insight, Saudi-Russia price war begins as oil crashes 30%. The market was flooded with more (not less) oil, which caused the oil price to crash. Oil is currently trading in the $20-$30/bbl range. CRU expects the oil price war to continue in the near term. We now forecast Brent Crude oil to average $42/bbl in 2020, ~$20 lower than our forecast last month.

Financial market participants have been uncertain and nervous about the Covid-19 “end-game” and the size of the ultimate loss in economic output. This has given rise to a bear market in leading stock exchanges; major equity indices fell by 30-40 percent from mid-January (Figure 3). In response, financial conditions have tightened significantly. These developments have prompted a variety of policy responses (see Policy responses to Covid19 compiled by the IMF). Notable are the two emergency Fed interest rate cuts, and pledges by major governments and international institutions to do “whatever it takes” to support economies, jobs and businesses. Markets appeared to find a bottom around March 23, from which there has been some recovery.

China is Blueprint for Covid-19 Downturn

Economists are asking two important questions: how bad is the global downturn likely to be, and how long will it last? The outbreak of the virus started in China and China is also the first country to see new cases plateauing, so events in China are being seen as a blueprint for what might happen in the rest of the world.

Depth of the Downturn

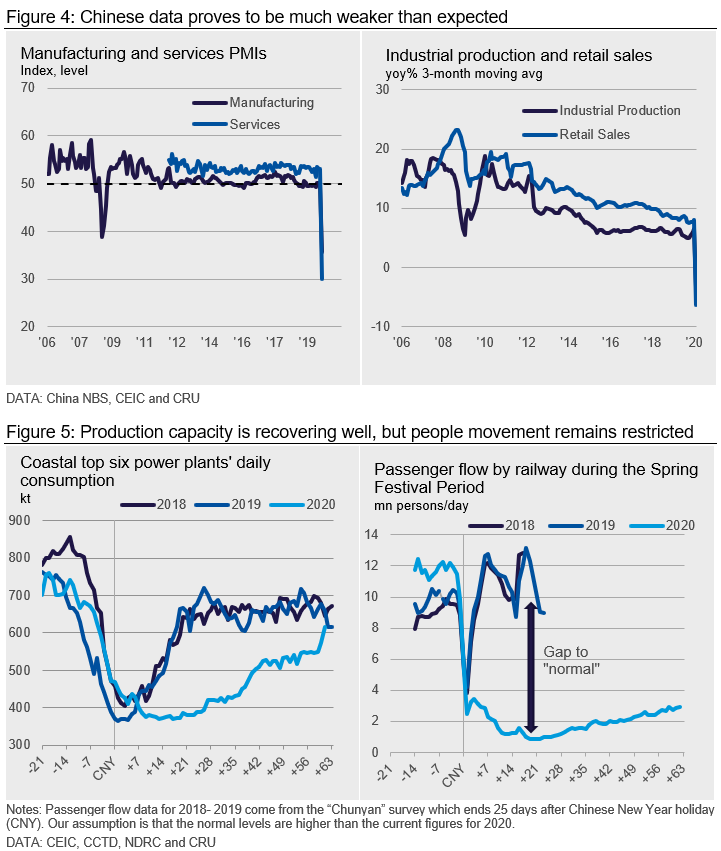

It is becoming clear that the Chinese economy has weakened by much more than analysts had originally expected. Combined data for January and February show that industrial production in China, which had been forecast to fall by 3 percent compared to a year earlier, was down by 13.5 percent. Retail sales also fell, not by the predicted 4 percent, but by a staggering 20.5 percent. Fixed-asset investment, a measure of expenditures on machinery and infrastructure, fell by 24 percent, six times more than what had been expected. That has led economic forecasters around the world to review and revise down their predictions. Economic activity in Q1 will have been very weak; we are expecting a contraction in GDP of 5 percent (see Table 1).

In 2020 as a whole China is expected to grow by a mere 2 percent, down from 6.1 percent in 2019. Such a low growth rate means that the government will fail to meet its target to double the level of GDP by 2020, a pledge made to its people back in 2010. But the virus threatens lives, so beating the virus has understandably become the number one priority for the Chinese leadership.

Length of the Downturn

The number of new cases originating within China is currently low, so the focus is shifting away from virus containment to returning the economy to normality. According to CRU’s China office, 90 percent of the workforce is now back at work. Production has even re-started in Wuhan, the epicenter of the crisis. However, this does not mean that production is back to full capacity. Our view is that capacity utilization is around 80-95 percent of normal levels, with some differences across sectors. In the industrial sector, activity has returned more quickly, with almost no gap in coal consumption rates (Figure 5). It has been slower to recover in the entertainment and service sectors, as measures of social distancing remain in place, which has meant the level of free people movement is still below normal levels. If recovery continues at these rates, one can expect China to return to normality by the end of the second quarter. As a result, we expect positive, but low, growth of 1 percent y/y in China in 2020 Q2.

China’s Stimulus Will be Modest in 2020

As noted last month, we expect additional fiscal stimulus measures to be announced in H1, which should help growth to bounce back to 6 percent by Q4. We expect a further recovery in growth in 2021 to 8 percent y/y. Our forecast assumes that there will be an additional cut of 25 basis points in the central bank interest rate, and a further reduction in banks’ Required Reserve Ratio (RRR). We also expect the government to increase the local government quota for special bond issuance to RMB 3.15 trillion. However, we are not expecting a fiscal stimulus of the size that we saw during the GFC of 2008-9. We also expect a variety of additional policies to provide liquidity and temporary credit, in order to provide relief to businesses affected by Covid19. But these policies, while crucial to the functioning of the financial system, are likely to have only a small impact on the real economy.

Probable Extent of Recessions in Other Parts of the World

This month we have lowered our forecasts for nearly all economies that we cover. At the time of preparing these forecasts, very little data was available to help us estimate the size of the downturn in demand. Therefore we must rely on evidence from previous downturns (e.g. the GFC), lessons from China, and anecdotal data, such as falls in demand for power (in Italy, for example, electricity consumption in the first two weeks of March dropped by 10-15 percent, the worst decline since WWII); data relating to restaurants and other places of entertainment (e.g. open table restaurant bookings) can also provide some indications.

China has been in lockdown since the end of the Chinese New Year holiday during the last week of January. From that we learn that a 7-12-week lockdown gives rise to a sharp contraction in output for one quarter, followed by a recovery towards normality in the next quarter. Lockdowns have started in March in the EU and the USA, so we expect the EU and U.S. downturns to be sharpest in Q2. But the virus is spreading at different speeds in different regions, so our working assumption is that additional lockdowns in other areas will follow, which means that weakness in demand lingers into Q3. By Q4 we expect a return to y/y growth. And 2021 is forecast to see a bounce back in growth.

The Longest U.S. Expansion in History Finally Ends

The U.S. economy has experienced its longest expansion in history. We had been expecting it to endure for one more year, at least until the Presidential Election in November 2020. But Covid-19 has disrupted all expectations. According to the Center for Disease Control, the virus has now spread to all 50 U.S. states. It has resulted in school closures and strict limits on social gatherings across the country. As of March 26, 22 states had issued stay-at-home orders. These disruptions are expected to severely interrupt travel and tourism, force consumers to reduce expenditures (rather than spend), deter business investment and create supply chain disruptions (as it has done in China). As a result, GDP is expected to contract by -0.2 percent y/y in 2020, taking the U.S. into recession. U.S. IP had been weak before the outbreak of Covid-19, and recent events lead us to downgrade it to a 2.5 percent contraction in 2020.

The brunt of the economic loss is expected to be felt in Q2, so we forecast a GDP contraction of ~2 percent y/y. This is one quarter behind China, and a few weeks later than Europe, which aligns with the trajectory in Figure 2. Facing a combination of financial market fears, surging corporate spreads, reduced liquidity and a dollar funding squeeze, the Fed announced major measures: two emergency interest rate cuts on (March 3 and March 15) totaling 150 basis points and the launch of unlimited asset purchases; and on March 25 the government agreed to a $2 trillion (around 10 percent GDP) fiscal stimulus package. However, there is a lag before such measures take effect, so we cannot expect them to help the economy until the second half of the year. Focus in this package has been on cash transfers to households, extension of unemployment insurance, among other things. This will be a welcome relief to the record 3.3. million workers who put in an initial claim for unemployment insurance during the week ending March 21. This is many times the previous peak in initial claims of 695k, which was recorded in 1982.

Covid-19 Derails the Fragile Eurozone Recovery

Last month, Covid-19 disruptions in China spilled over to the Eurozone (EZ), mainly through its trade links with Asia. However, the outbreak of the virus in Italy and other parts of Europe, and developments in China, have led us to lower our Eurozone forecast further this month to -2.4 percent (from a fragile +0.9 percent last month). That takes the region into recession, with the weakest GDP figures since the GFC. The March flash PMI’s were very weak, and the services sector was significantly worse than the manufacturing sector. However, it is worth remembering that the PMI is a diffusion index. It tells us that most businesses surveyed expect a deterioration in economic activity, but it cannot tell us how bad that deterioration will be.

European leaders have stepped up to the challenge offering unprecedented support. The ECB required two attempts to convince markets that it would do everything necessary to support the EZ economy. At its regular meeting on March 12 it announced an extra €120bn of net asset purchases, and a new program of cheap loans to banks. However, President Lagarde slipped up at the press conference, saying it was not the ECB’s job to close the gap between the Italian and German bond spreads, which had widened after the virus outbreak in Italy. This triggered a sharp fall in the bond market. On March 18, the ECB tried again by announcing a new Pandemic Emergency Purchase Programme (PEPP) worth €750 bn. That pacified markets. A number of fiscal packages have also been announced, but they are unlikely to have an impact until the second half of the year. The additional fiscal measures amount to ~2 percent of EZ GDP, and the liquidity support schemes also put in place by governments were equivalent to ~13 percent of EZ GDP. Moreover, the suspension of the self-imposed Stability and Growth Pact (SGP), which otherwise caps governments’ fiscal deficits at 3 percent, means more stimulus is likely to come.

Emerging Market Economies Feel the Recession Pinch

This month we have lowered our forecasts for major commodity producers, such as Brazil, Chile and Russia. Many of these economies are hit by two adverse developments. First, they are suffering because of weaker global demand for commodities, which lowers their export income. Second, emerging market commodity producers have also been hit by a global reduction in willingness to take on risk; investors have withdrawn large amounts of capital in favor of safer assets in advanced economies such as U.S. dollar assets and/or cash. Such a sharp outflow of capital (or “sudden stop”) is damaging because it gives rise to a severe tightening of domestic financial conditions, which subsequently weighs on domestic spending and growth. Reports suggest that ~U.S.$90bn of capital left EMs so far in 2020, equal in size to capital inflows seen during 2019. It is not helpful that these shocks have come at a time when these economies were already weak, for a variety of different reasons (e.g. social unrest in Chile, sanctions in Russia and high debt levels in Brazil).

Global Picture

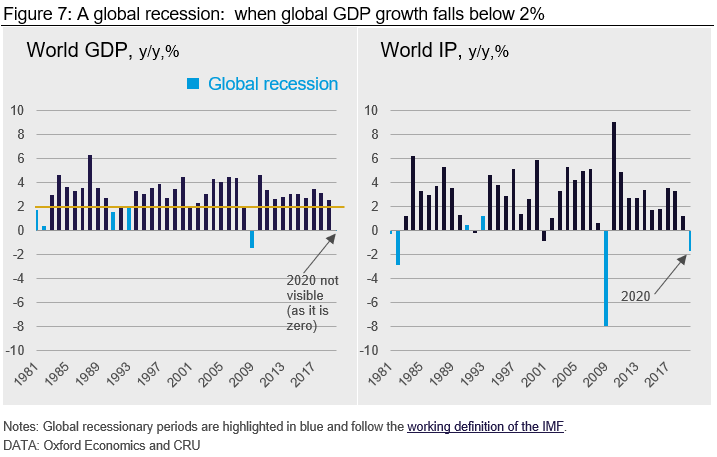

Where does this leave us? The IMF defines a global recession as a period of decline in world GDP per capita, backed up by a decline or worsening for one or more of the seven other global macroeconomic indicators: industrial production, trade, capital flows, oil consumption, unemployment rate, per‑capita investment, and per‑capita consumption. According to this definition, the following years have been identified as a global recession: 1975, 1982, 1991 and 2009. And they all coincide with world GDP growth below 2 percent.

Figure 7 shows that we are forecasting a global recession in 2020. We expect world GDP growth to halt (0 percent y/y in 2020). The 2020 recession is likely to be as bad as the 1991 global recession, but not as bad as the GFC. Industrial production is also weak, contracting by 1.6 percent y/y, although it too is not expected to be as weak as the GFC.

Warning: Second Covid-19 Wave Would Rule Out 2021 Bounce Back

In such unprecedented times, the uncertainty around our forecasts is much larger than usual. That is partly because we are forecasting outlooks for the year ahead based on very little data for the year to date, and with the knowledge that recent data trends are no longer going to hold. As a result, we must look to previous periods of downturns as a guide. The GFC is a useful benchmark. However, that comparison has its limitations because the trigger that led to that recession, a U.S. housing downturn and excessive financial leverage, is very different from the health crisis that is the main trigger this time.

CRU’s latest forecasts assume that the number of coronavirus cases in the U.S. and EU will reach a peak in the next few months, and then plateau before the summer (following the pattern seen in China).

Our base case view also assumes that households and businesses will be reassured by the unprecedented support that has been offered by policy makers around the world. It assumes that the private sector will go on to act in a way that will allow the economy to resume normal levels of activity, once the lockdowns end. For example, it would mean that employees are retained on short-time working or can return to work quickly if laid-off, and that the majority of production capacity is maintained (i.e. “mothballed”) for future use rather than dismantled.

It is however possible that some combination of our assumptions is not borne out. Lockdowns may go on for longer, and a second Covid-19 wave is possible. Pessimism among households and businesses could give rise to a negative spiral of actions, such as the closure of one business which leads to the irrevocable closure of many more. That in turn hurts jobs, spending and economic growth. At this stage we see scenarios such as these as a clear downside risk to our forecast rather than the most likely course. Should those downside risks materialize, they would lead to a more protracted global downturn, and one that lasts beyond 2020.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com