Overseas

March 22, 2020

CRU: Pandemic Disruption Spreads Worldwide

Written by CRU Americas

By CRU Principal Analyst Matt Watkins, from CRU’s Global Steel Trade Service

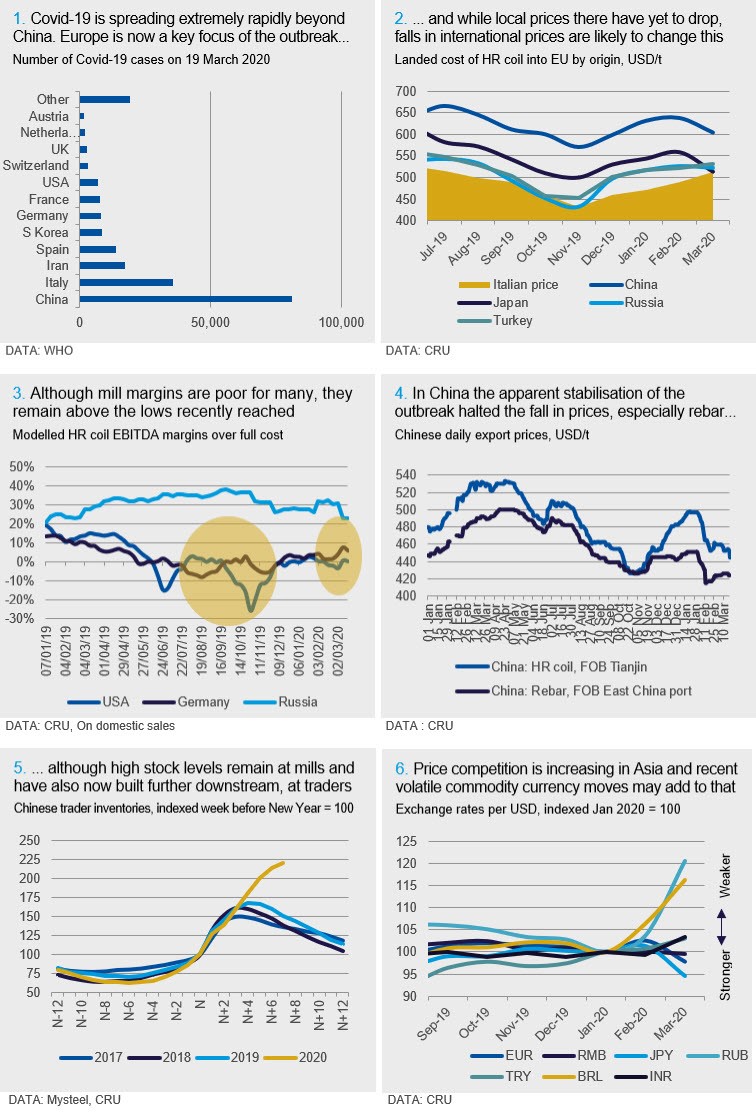

Covid-19 is now the major driver of developments in the global steel industry, as indeed it is in the wider economy. Over the past month the virus has spread rapidly outside China and its growth remains uncontrolled. Europe has become a new epicenter of the outbreak (see chart 1) but there are a huge and growing numbers of cases in many other regions.

As governments scramble to impose movement restrictions and as a multitude of attempted stimulus and support measures are announced, the impact on steel is growing. There is a mix of supportive and depressive forces acting on prices, though overall at the current stage in the pandemic the balance is towards lower prices.

European Prices are Holding on the Edge…

Despite the number of Covid-19 cases in Europe now outnumbering those in China, European steel prices have yet to see definitive falls. Indeed, for sheet products, many domestic mills have until very recently been attempting further price increases, driven in part by Europe’s earlier cheap price levels relative to the rest of the world. However, this seems likely to change. There have been falls in internationally traded steel prices from many origins over the past month, notably from suppliers in Asia. These are moving the landed cost of steel into Europe much closer to local prices (see chart 2) and so adding pressure to local mills to make compromises on price for their buyers.

… as Local Demand Collapses and Producers Try to Follow

Those buyers are becoming rapidly scarcer. There are widespread shutdowns of manufacturing capacity across Europe, especially but not exclusively in the automotive sector.

In response to the demand collapse many European steel mills are idling capacity. The experience from China has been that demand can stop faster than supply, especially when that supply is based on BF/BOF, so it remains to be seen whether the market can stay balanced in the short term. With customers already delaying orders, mill stocks—and cash needs—are likely to rise.

Margins Low But Could Go Lower

Following the rise in global prices since Q4 2019 mill margins have certainly improved. For many they remain poor in absolute terms. Our modelling of representative mills in the USA and Germany suggests spot margins on domestic HR coil sales remain in the mid-to-low single-digit range. That might suggest limited downside for steel prices, absent a fall in costs. However, experience from last year (see chart 3) shows that margins can be compressed significantly below their current levels for brief periods, as mills cut towards their variable costs. On that basis there appears no short-term margin barrier to prices falling with demand.

China Appears to be in Recovery For Now

Steel prices in Asia have already fallen a lot and as we have seen this is flushing out cheaper offers into the global market. Mills in Japan and South Korea in particular are struggling with disrupted local demand, though there are also cheaper offers from other sources, including India.

China looks to be moving differently, for now. The scale and stringency of the Chinese response to Covid-19 has meant that, measured by official figures, the number of new cases has slowed dramatically. Accordingly, the country is returning to work. Demand for steel is returning and being assisted by government stimulus measures—though as discussed below, sentiment may be running ahead of reality. This apparent stabilization of the outbreak has halted export price falls for rebar and slowed it for HR coil (see chart 4). Having said that, steel inventories remain extremely high in China after several weeks of continued supply in the absence of demand. Mill stocks look to have peaked for now, but material has clearly flowed downstream to traders, where reported inventories are at very high levels (see chart 5).

Outlook: Chinese Recovery Uncertain, Everywhere Else is Shutting Down

The pace of China’s recovery remains uncertain. At present it is in line with CRU’s base case demand modelling (see last month’s Insight). But two things are notable. First, that sheet prices continue to lose ground, and in fact daily HR coil export prices took a big step lower today, down by $8/t. Second, that prices of steels exposed to infrastructure are outperforming, apparently driven by strong sentiment around the prospect of government stimulus. But the magnitude of special bond issuance for infrastructure is not particularly large this year relative to the last two years, so it is not clear there will be a much stronger boost to growth in 2020. Further, on the flats side, recovery in manufacturing areas such as automotive and appliances are likely to run into still-subdued personal consumption. Movement restrictions have not gone away; for example, CRU’s China team remains working from home, two months after Lunar New Year.

As the rest of the world shuts down, China is likely to face two problems. Chinese steel demand will be hurt by lower demand outside China for imports of its steel-containing goods. China is also likely to find it increasingly difficult to secure steel export opportunities. Mills are increasingly scrapping over what demand remains and in Asia this has meant intense price-based competition. A further aspect of the disruption wrought by Covid-19 is the foreign exchange market. Currencies of some notable commodities exporters have weakened sharply over recent weeks, including the rouble and real (see chart 6). Such weakening may provide a commercial lever for mills in those countries to pull if they need to place steel on the export market in the short term.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com