Prices

March 19, 2020

Hot Rolled Futures: Commodity Smack Down

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

While our focus in this article is commodity futures and markets, we do not mean to take the focus off of people who may be impacted by the current virus outbreak and hope that everyone will remain healthy and safe.

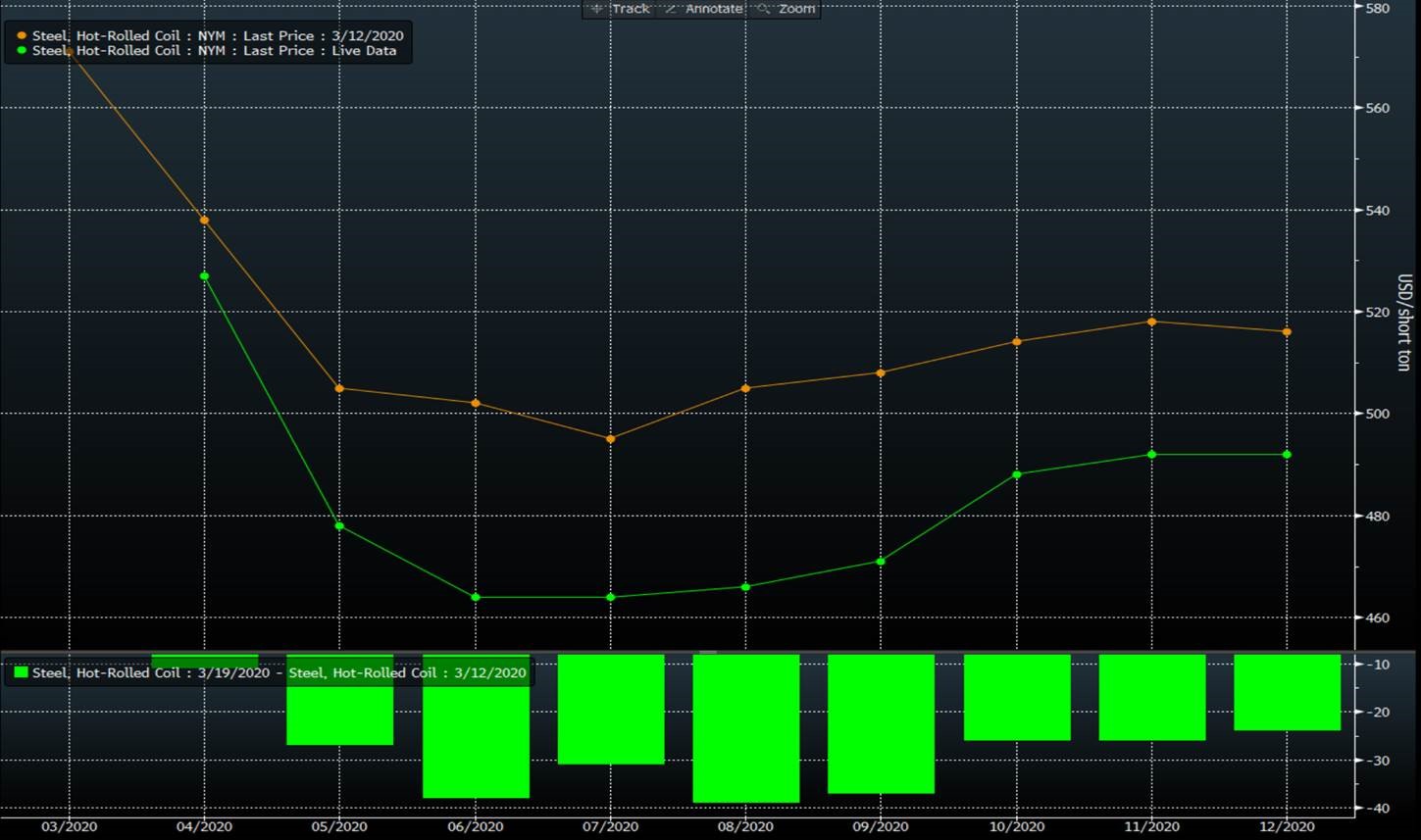

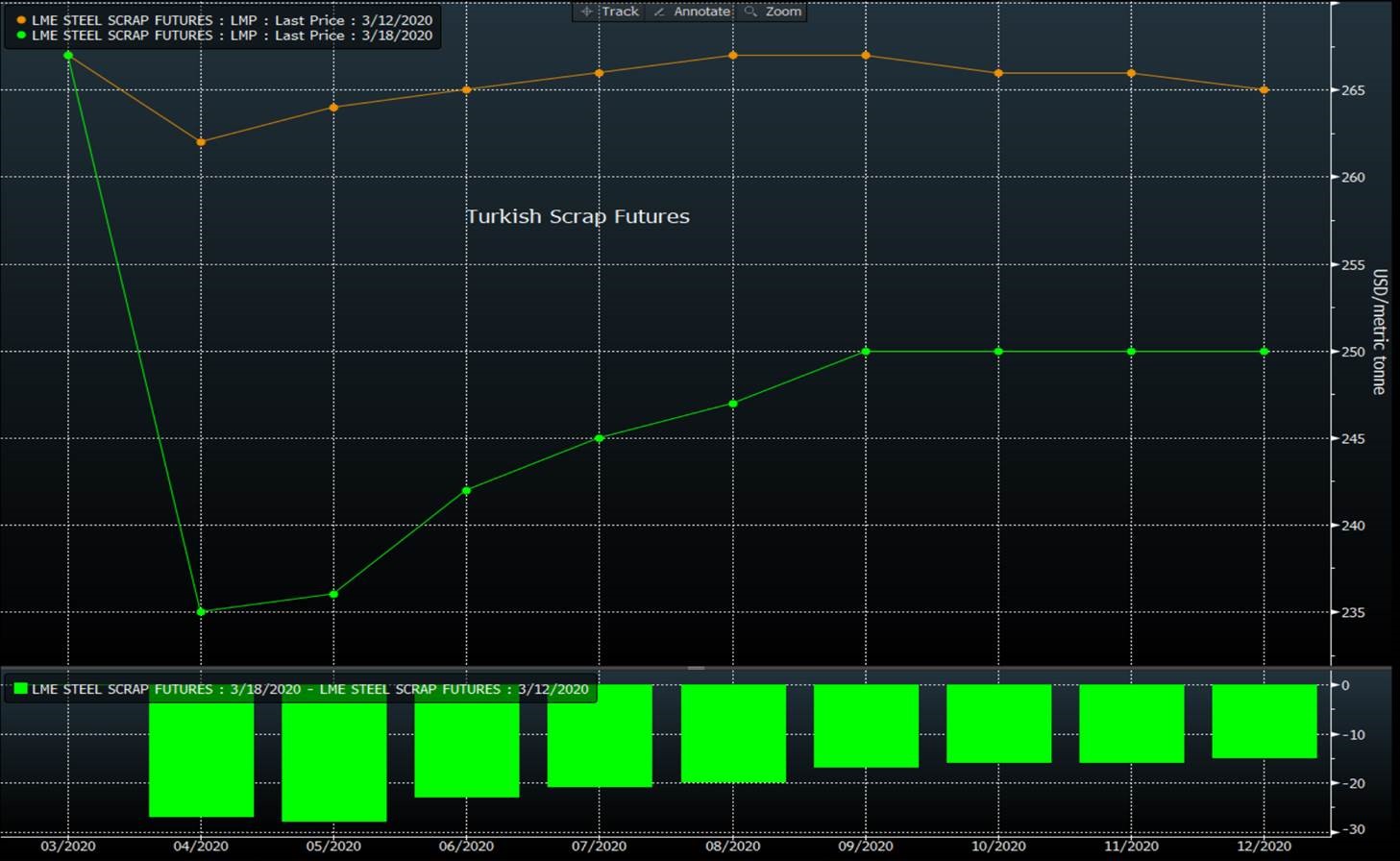

Most commodity markets have been under intense pressure as the virus has spread. Traders have been trying to analyze the impact of demand disruptions as well as supply dislocations. I’ll start with some charts showing the week/week changes in various steel related commodities:

Not to dwell on further challenges, but the dollar is a very important factor in commodity pricing. As this crisis has unfolded, the dollar came under pressure starting in mid-February, which is not normally the case. While this was happening, gold was rallying significantly. In recent days the dollar, as measured by the DXY Index, has been on a stunning rally as investors seek the relative “safe haven” of U.S. dollar denominated assets (the index is calculated by measuring the value of the dollar vs other major currencies in the world):

As the dollar rallies, it normally puts pressure on commodity prices. The logic here is that many commodities around the world are priced in dollars. If you are in a country that sees its currency decrease in value versus the dollar by 10 percent, you need to come up with 10 percent more of your local currency to buy that same commodity. Thus, demand is hurt as the price in local terms rises. Given this rise in the dollar, commodity demand is usually expected to decline, all else equal.

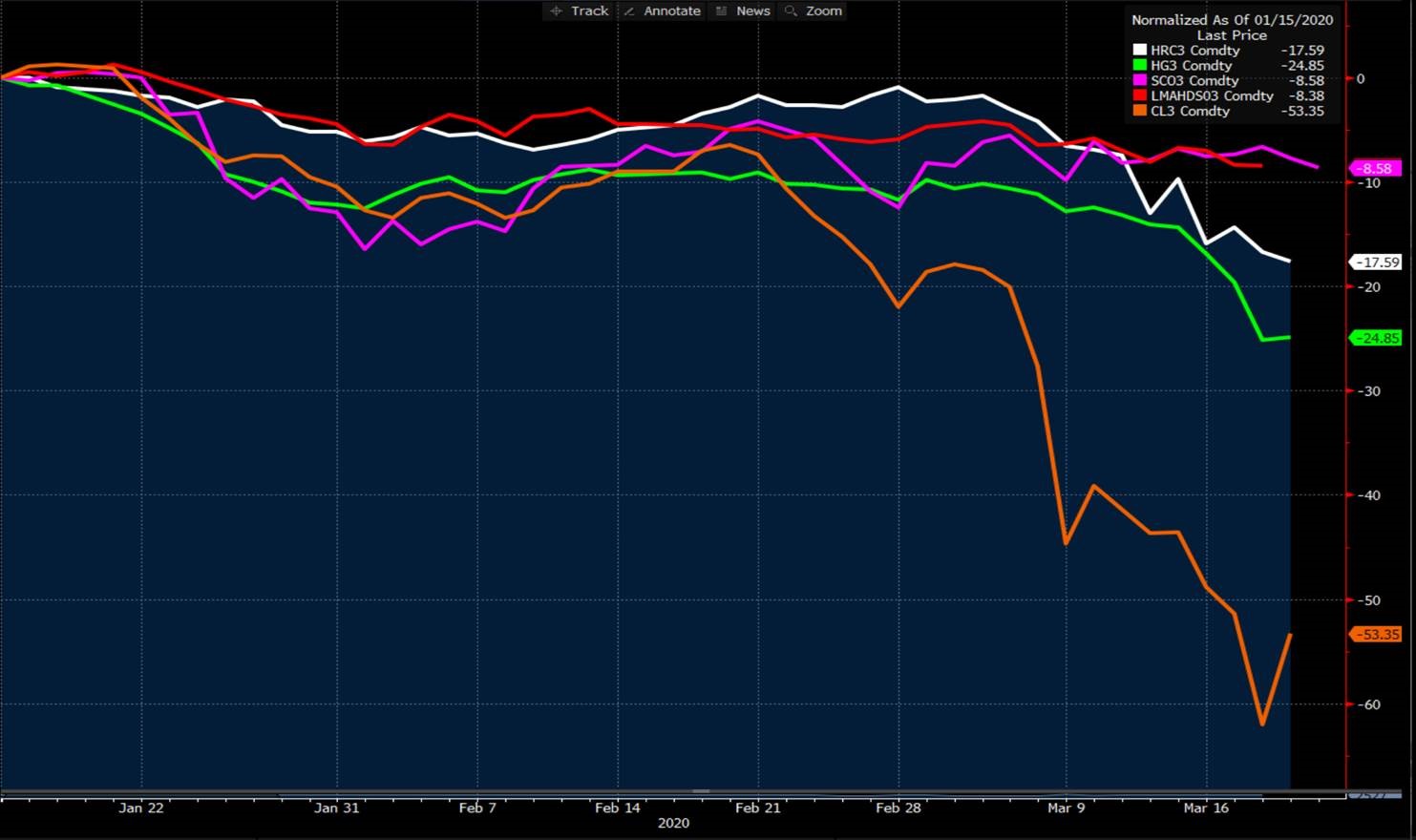

While we focus on steel in this newsletter, another interesting chart to share is how steel has done relative to a number of other commodities (Purple = Iron Ore, Red = Aluminum, White = U.S. HRC, Green = Copper, Orange = WTI Crude Oil):

I have two observations here. First off, the outperformance of iron ore is stunning. This may be driven by the expectation that China’s government will put the “pedal to the metal” on stimulus efforts once the virus impact on the country is behind them, but still…. Secondly, crude oil is the other standout—and has truly collapsed under the weight of the new Saudi production in the face of a massive demand disruption caused by the virus. One has to wonder how long the Russians and Saudis will be willing to live with oil in the $20s.

Meanwhile, some of the first U.S. economic data has been released that is starting to show the impact of the virus. The weekly unemployment claims number had a huge jump:

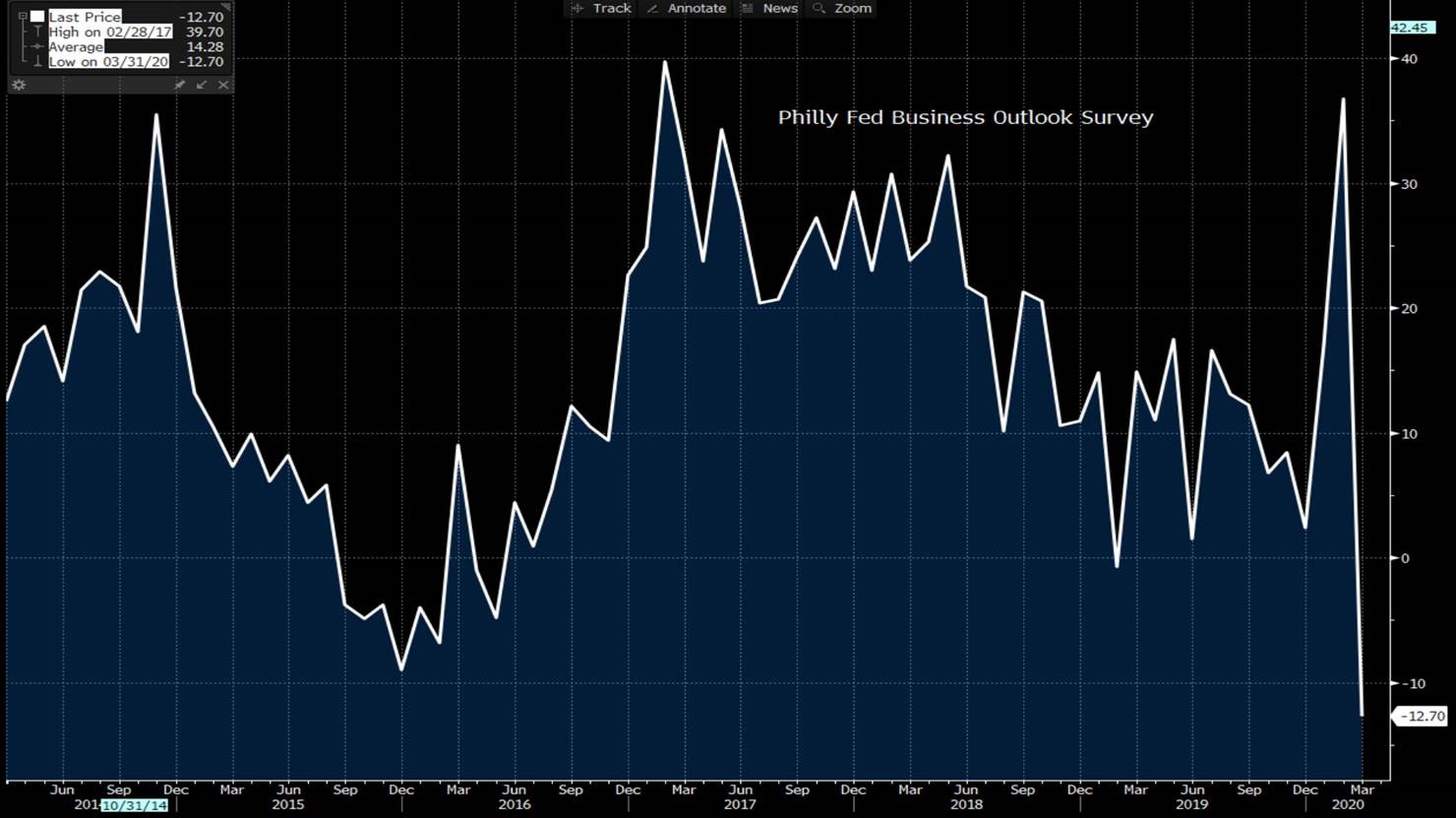

The Philly Fed Index hit the skids:

We should all be mentally prepared to see many more charts that look like this in the coming weeks. It will not be fun, but the focus should be on doing what is best for our families and customers, and working on managing through difficult times.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information