Analysis

March 13, 2020

January Heating and Cooling Equipment Shipments

Written by Brett Linton

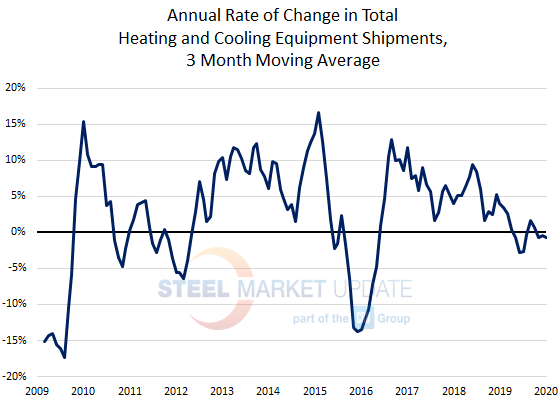

January heating and cooling equipment shipments came in at 1.56 million units, down 3.2 percent from the same month one year ago, according to recent data from the Air-Conditioning, Heating, and Refrigeration Institute (AHRI). This is the largest year-over-year decline in total shipments since June 2019 (down 5.8 percent). As a three-month moving average, total heating and cooling shipments were down 0.7 percent, the third consecutive monthly decline.

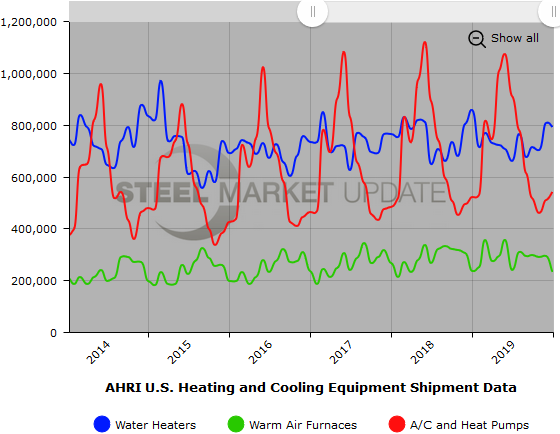

Residential and commercial storage water heater shipments fell 7.9 percent year over year to a combined 790,337 units; 770,504 units were shipped for residential use and 19,833 units for commercial use.

Shipments of warm air furnaces totaled 230,104 units in January, down 2.5 percent compared to the same month last year. This is the seventh consecutive month warm air furnace shipments have decreased on a year-over-year basis.

Central air conditioners and air-source heat pump shipments rose 4.1 percent over a year ago to 540,179 total units; 308,311 air conditioners and 231,868 heat pumps were shipped. This is the seventh consecutive month air conditioners and air-source heat pump shipments have increased on a year-over-year basis.

The full press release is available on the AHRI website here.

Below is a graph showing the history of total water heater, warm air furnace and air conditioner shipments. You will need to view the graph on our website to use it’s interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, contact info@SteelMarketUpdate.com.