Overseas

March 12, 2020

CRU: Covid-19 Further Disrupts Global Sheet Markets

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores, from CRU’s March Steel Sheet Products Monitor

Covid-19, the novel coronavirus, has severely disrupted China’s economy. While new cases in China have slowed, thanks particularly to a historically significant containment strategy, Covid-19 has moved on to other countries. These include Italy, Iran and South Korea, but also other areas in Europe. In countries such as the U.S. and India, new cases have been slow to emerge, though they seem to follow the same unfortunate trajectory as other countries that have over 1,000 confirmed cases.

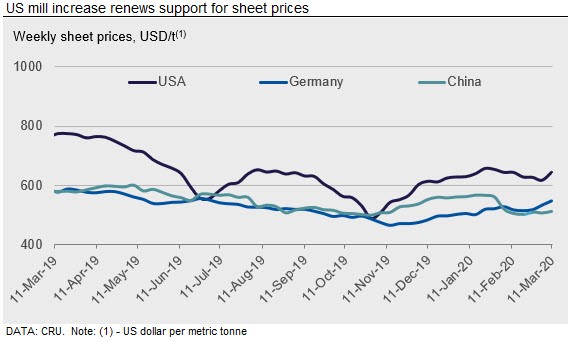

This virus has not only disrupted China, the world’s largest producer and user of steel sheet, but it is now negatively affecting end demand in more advanced economies. To date, sheet prices have not fallen dramatically. On the contrary, CRU’s Global Flat Products Price Indicator (CRUspi flats) has remained somewhat stable in March versus both January and February levels. Indeed, the March CRUspi flats decreased by 1.5 percent m/m to 151.3.

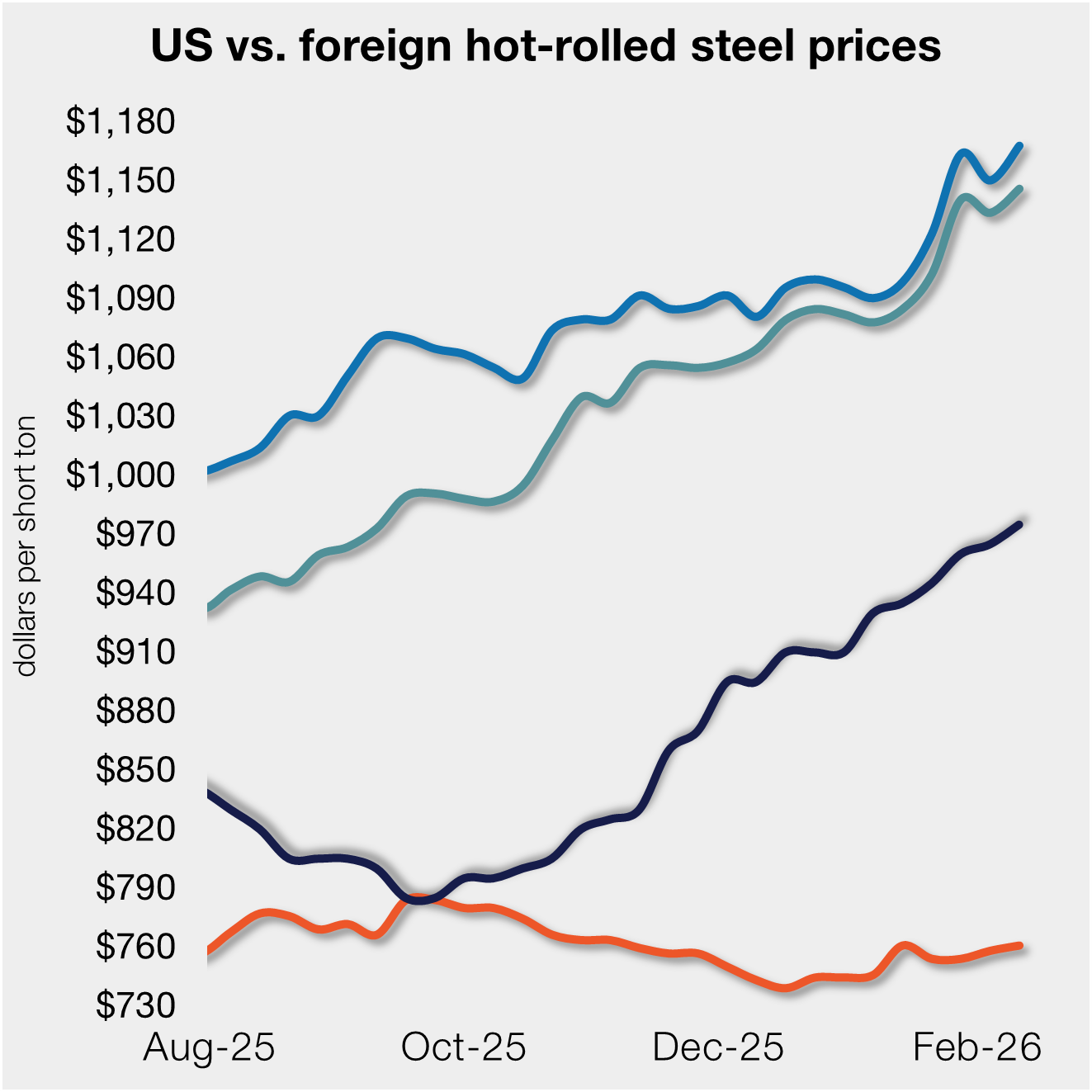

Regional sheet prices reflect this steadiness in the CRUspi flats. In Asia, Chinese and South East Asian prices have fallen, though this recent downtrend has been limited. These declines stemmed from a build-up of Chinese stocks that have pressured regional markets. During this time, Chinese demand, in particular, was extremely limited. In North America, U.S. sheet prices had fallen from their late January peak as seasonal demand gains have slowed, yet a recent mill price increase has been the recent catalyst for higher sheet prices. In Europe, sheet prices were slightly higher m/m, which stems from the tail end of price gains since November. European mills continue to show extended lead times, partly driven by numerous outages announced in 2019 H2.

Outlook: Oil Price Collapse Adds Further Downward Pressure to Sheet Prices

While China appears to be slowly recovering from an absence of economic activity over the past several weeks, other global markets are only now starting to experience early stages of economic disruption. Amidst this sudden loss of overall activity, our view of global industrial demand has been revised lower. China’s pause in economic activity has left a gap in demand for many products, one of which is oil. Due to lower demand for oil, OPEC producers (Organization of the Petroleum Exporting Countries) plus Russia were in discussions for a production cut, in order to support prices. These discussions failed and, so far, the end result has been the Kingdom of Saudi Arabia exerting their influence by lowering oil selling prices and increasing production. The result of this was a historic collapse in in oil prices.

In the world of steel sheet, oil prices are a leading indicator for both sheet demand as well as steelmaking costs. Lower oil prices will drive steelmaking costs down due to their role in mining, processing and transporting steel and steelmaking materials. As for demand, oil prices are directly related to steel consumption via active drill rigs using OCTG products as well as oil field services, which require steel for platforms, storage tanks and transportation. Therefore, the sudden drop in oil prices, if sustained, will lower steelmaking costs and demand for sheet products across multiple regions. If lower oil prices persist, we expect that the CRUspi flats will move lower through 2020 H1. Further insight from our economics team on this issue can be found at this link.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com