Prices

March 5, 2020

Hot Rolled Futures: How Much Slowing to Expect from Global Supply Chain Disruptions?

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

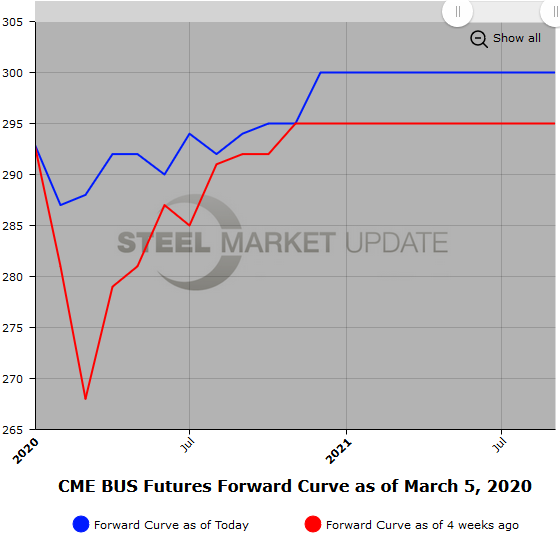

In the midst of a fairly volatile news cycle in the last month with the COVID-19 virus stealing the headlines, the HR futures markets have been surprisingly active with good two-way business, which is probably due to folks replenishing inventories that reportedly were getting a bit thin. Recent physical spot prices appear to be in the $560/ST area, however the announced mill price increases in the last week have buoyed expectations and thus HR futures prices in the nearby months. The futures curve has shifted a touch higher with the front months up an average of about $28/ST from early February. The spot month value has risen $36/ST to $588/ST. So the curve, which was in slight contango in early February, has shifted higher into a backwardated curve due to the strong price rise in the front months. The Q2’20 HR futures are up about $20/ST from early February to yesterday. June’20 through Feb’21 HR futures are roughly flat with just a slight uptick as they trade in a $555 to $565 range. The current uncertainty in global growth is reflected in the flatter futures curve. Perhaps the surprise 50 bp cut by the Fed will offset some of the anticipated slowdown in business activity.

HR futures have traded almost 300,000 ST in the last month or so. The bulk of the interest has been in the front four months with over 150,000 ST trading.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

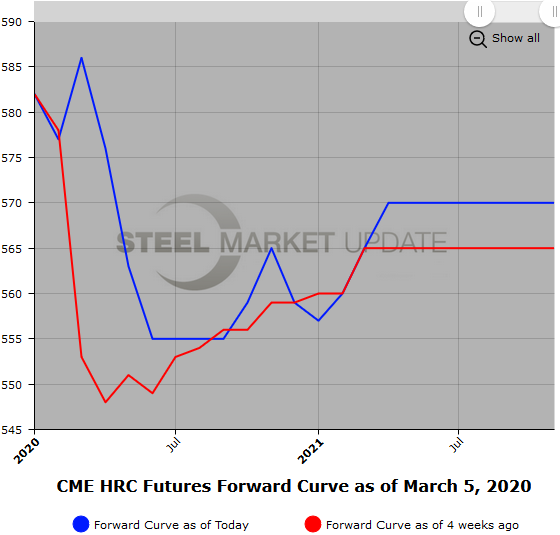

Early market talk had BUS up $10 to $20/GT, but early buying indications suggest it will probably be up on the lower end of expectations. Recent BUS futures trading pushed up above $300/ST, but has since retraced slightly and is now trading just under $300/GT. Market curve shapes are very flat with concern regarding supply chain disruption expectations. Export scrap price strength has given some of the obsolete grades a bit of a boost. We could see shred prices gain on BUS prices this month.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.