Market Segment

March 1, 2020

CRU Webinar: Coronavirus—Impact on Global Steel and Raw Materials Markets

Written by Tim Triplett

Gauging how COVID-19 will impact global commerce, specifically the world’s steel industry, is almost as difficult to predict as the spread of the virus itself. CRU analysts will tackle the subject in a new webinar this week.

As CRU Senior Analyst Erik Hedborg reports, the news is not all bad. For one, the pace of new infections is starting to slow. While infections grew at a double-digit rate in the early days of the epidemic, the current daily growth rate is just 1 percent as the total nears 80,000 worldwide. Two, the number who have already survived the virus is nearing 20,000. “Nearly 20 percent of all the infected people have completely recovered from the virus,” he said. And three, while the virus has spread outside of China, the number of cases remains low at just over 1,000 as of this past week.

The virus is believed to have originated in Hubei province, an important transportation hub and home to some 60 million Chinese. Hubei is China’s sixth largest steelmaking province. Since January, curfews and transportation restrictions have disrupted commerce as the Chinese government has attempted to prevent the spread of the virus from one worker to another.

How has the steel market reacted? “Since the end of the Chinese New Year on Feb. 3, both rebar and HRC prices have fallen quite sharply,” reports CRU Analyst Irina Melkonyan. CRU estimates the current Chinese HRC price has declined to nearly 3,500 rmb per ton (roughly $500 U.S.). It could go as low as 3,050 rmb ($436 U.S.) by April before beginning to rebound.

Behind the plummeting prices is weak steel demand as the virus has slowed Chinese manufacturing and construction. Steel inventories have also built up to alarming levels at both mills and trading companies, say the CRU analysts. Some EAF production has been curtailed, but the nation’s many blast furnaces, which are not so easy to dial back, have continued to produce steel. “Our contacts in China report that some mills have actually run out of space to store their products. They no longer have anywhere to put their rebar or billet,” adds Melkonyan. Transportation restrictions continue to make it difficult to ship the excess to customers or traders.

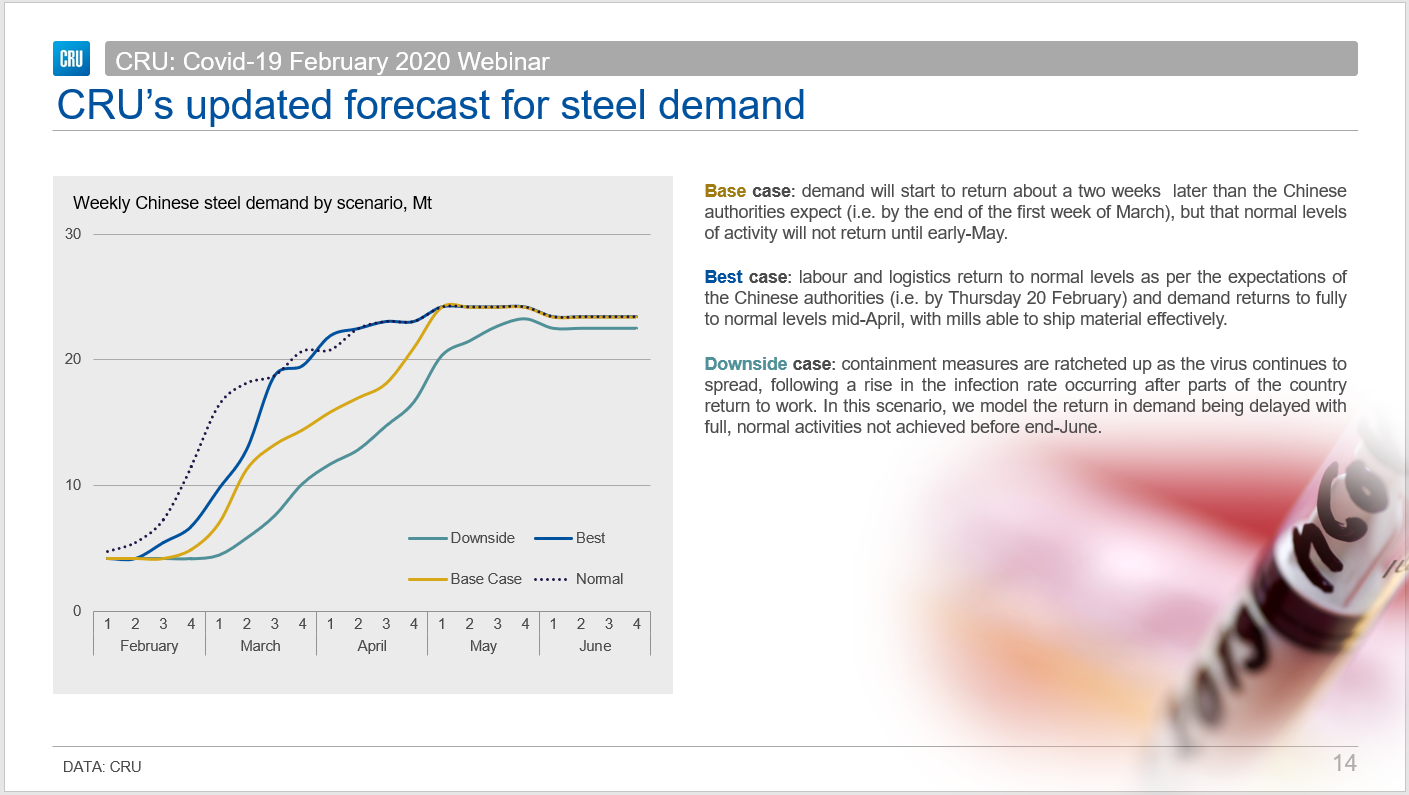

CRU envisions three possible scenarios for how the situation could play out. In the best case, the epidemic could end rapidly and business could normalize by the first part of March. In the worst case, disruptions will continue to plague commerce until late May. CRU’s base case, the one considered most likely, calls for demand to return to normal by late April (see chart).

CRU analysts also will explore the impact of the virus on iron ore and coal prices. Join CRU’s steel experts for the latest webinar covering the impact of the coronavirus on global steel and steel raw materials markets. The webinar focuses on Asia, while other markets will continue to be covered in additional insights and webinars.

Date: Wednesday, March 4, 2020

Times: Session I: 9:00 – 9:30 AM GMT

Session II: 3:00 – 3:30 PM GMT (10:00 AM EST)

For additional details about the agenda and to register, please follow the link below:

The webinar provides a glimpse at the analysis provided in CRU’s Global Steel Trade service.

Enquire about this service here.