Market Data

February 29, 2020

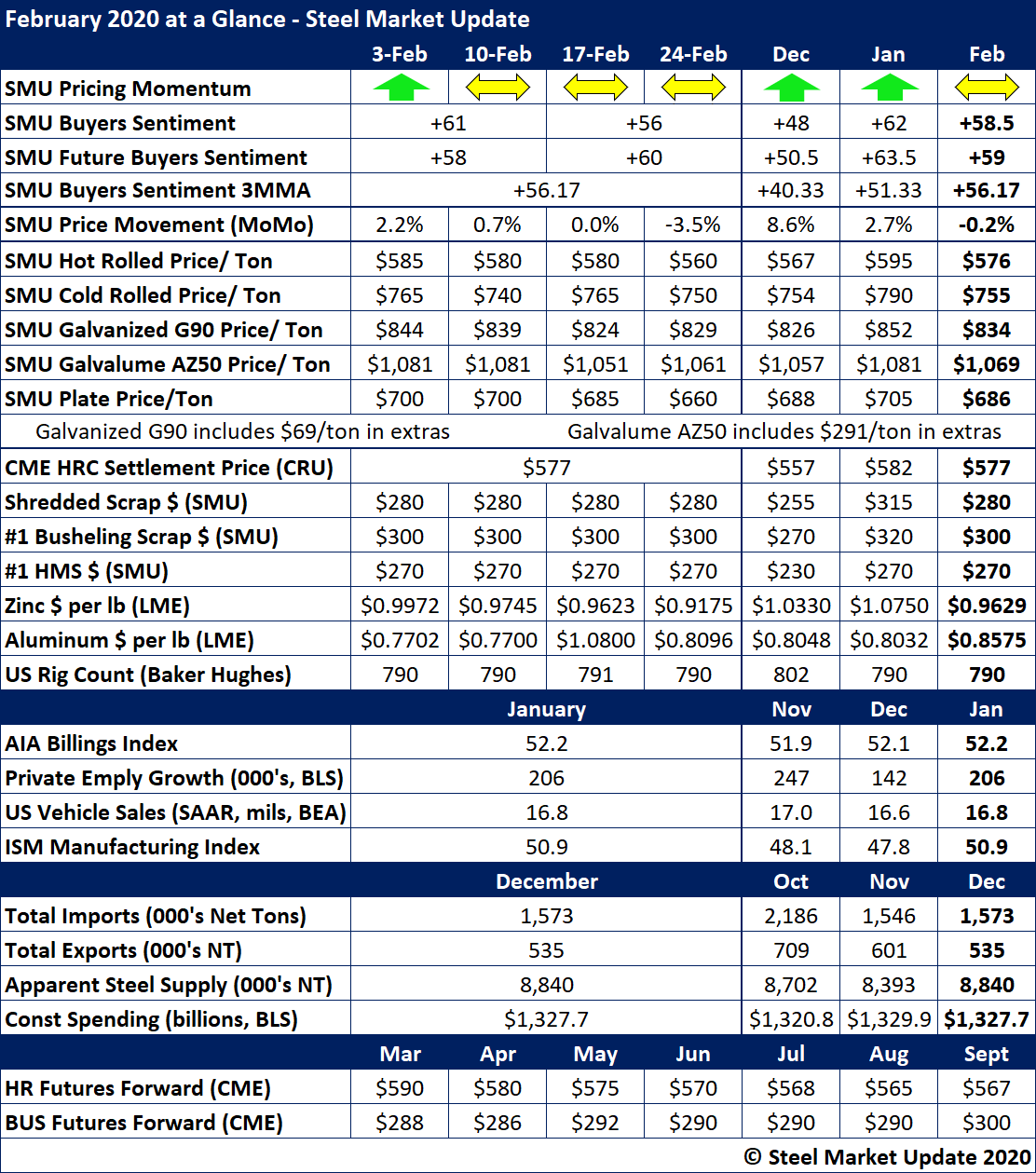

SMU's February At-a-Glance

Written by Brett Linton

Looking back at the numbers for February, flat rolled steel prices declined from January, with the benchmark price of hot rolled dipping to a monthly average of $576 per ton. Steel Market Update’s Current and Future Steel Buyers Sentiment Indexes showed some erosion, likely as a response to the weak steel prices and concerns over the cornonavirus outbreak in China and its potential to disrupt global supply chains.

SMU’s latest market canvass puts the average price of hot rolled at $560 per ton, down from a January high of $610 per ton. As for most of February, SMU’s Price Momentum Indicator is currently set at Neutral until the market establishes a clear direction. Several of the domestic mills announced a $40 increase in flat rolled on Thursday in the hopes of firming up prices in March.

Scrap prices also declined in February from the prior month, adding to the downward pressure on finished steel prices. SMU sources expect higher scrap prices in March, which should lend support to the mills’ price increase effort.

See the chart below for other key metrics in the month of February: