Prices

February 20, 2020

CRU: Zinc Trades Down to $2,110/t as Hubei Extends Shutdown

Written by CRU Americas

By CRU Senior Analyst Helen O’Cleary, from CRU’s Zinc Monitor

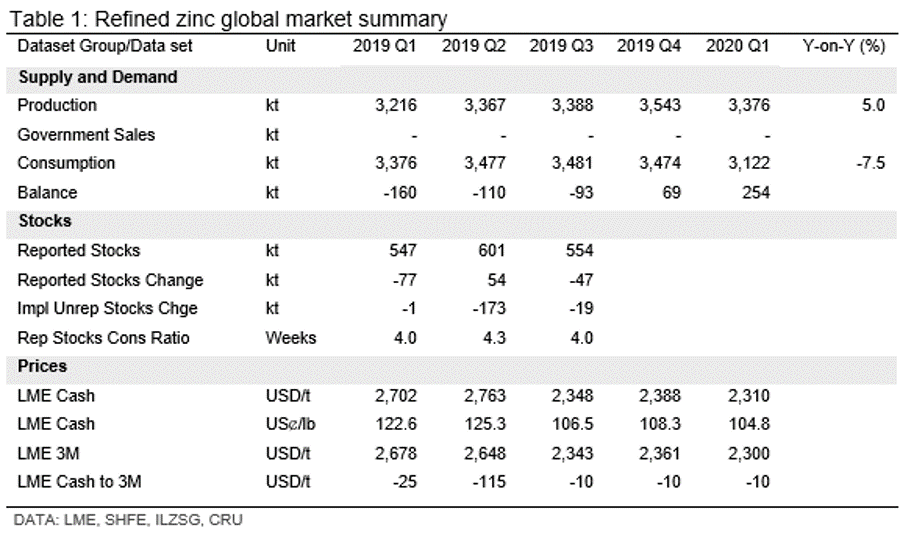

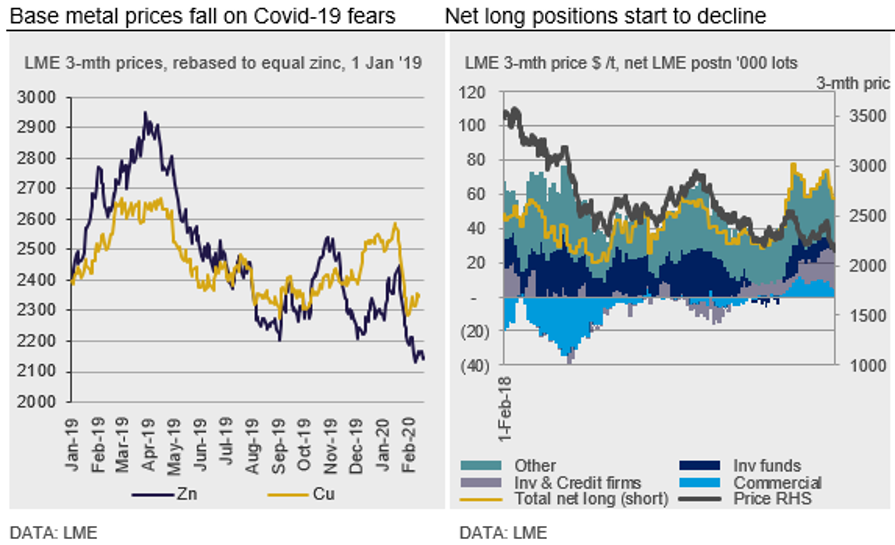

Disruption caused by the Covid-19 outbreak has cut Chinese demand and visible stocks have risen sharply, placing downward pressure on prices. In Hubei, where restrictions on the movement of goods and people was due to be lifted tomorrow, the local government has just announced today that these will be extended until March 11. We revised our first-quarter supply and demand numbers for China prior to this announcement and may need to make further downward revisions as the impact of this becomes clearer.

Today’s announcement by Hubei’s local government that restrictions on all but essential businesses will be extended until March 11 has pushed zinc’s price on the LME to $2,110/t. The implications of this for the rest of China are not yet clear but the prospect of another two weeks of limited business activity in Hubei has weakened sentiment further. Our Chinese supply and demand estimates for Q1 were revised lower at the start of this week and do not yet take into account the prolonged shutdown in Hubei. At this stage we still expect to see a rebound in Chinese demand in Q2 and expect the price to rally accordingly.

Although Hubei has no refined zinc output, it was the fifth largest auto-producing province in 2018, accounting for around 9 percent of Chinese light vehicle output.

Warehouse stocks we follow in China (SHFE, Nanchu and bonded) have risen by 115,000 t since the end of January, placing additional downward pressure on prices. We understand smelter stocks have also increased. An increase in refined stocks is typical for seasonal reasons following the New Year Holiday period, as smelters tend to continue operating even though many end-users shut down. However, the increase is already more than double what it was a year ago and we expect that stocks will continue to rise in the coming weeks as demand is being hit much harder than supply. We currently believe that virus-related disruptions will linger well into March. However, there is a risk that disruptions could continue until the middle of the year; at which point 2020 Chinese GDP could come in 1 percent lower than originally forecast.

There has also been an increase in LME stocks, up from multi-decade lows. After hitting 49,625 t on the 3rd and 4th of February, total stocks increased to 74,825 t by the 13th of February. The largest inflows were into Vlissingen warehouses, at almost 19,000 t in total, with some smaller volumes entering Bilbao and Singapore. The timing of these inflows was unexpected as the worst of the backwardation had already passed, but some market participants believe that metal was held off warrant during long-term contract negotiations in order to make the market appear tighter. The number of cancelled warrants on the LME also declined, with around 3,800 t of metal re-warranted on the 10th of February alone in Vlissingen and Rotterdam.

Inflows of metal and rising warrant availability has helped to drive the LME cash to 3-month spread back to contango, reaching $17.5 /t on the 19th of February, providing some relief for consumers holding metal. However, stocks remain near record lows and further large warranting would be required for the risk of a fresh squeeze to dissipate.

LME commitments of traders data show that non-risk-reducing investor net longs (which we take to mean speculative) had increased to 74,349 lots (1.85 Mt) by the 24th of January, yet have since declined to 48,330 lots (1.2 Mt) as of the 14th of February as the Covid-19 outbreak turned investor sentiment to risk-off. For context, this is the smallest net long position on the LME since October 2019.

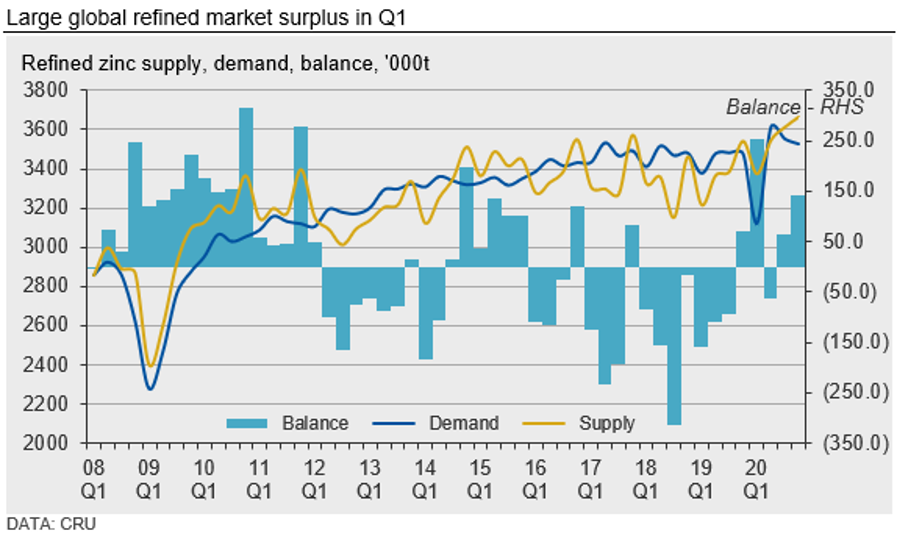

We anticipate a steep fall in China’s Q1 demand. As a result of the Covid-19 outbreak, we have revised down our Chinese zinc demand number significantly for Q1, but understand that the impact on smelter output so far has been much less severe. However, our estimates were made prior to the announcement that restrictions would remain in Hubei province until March 11 and we may therefore make further downward revisions depending on how this impacts activity in other provinces. We currently estimate that Chinese demand will decline by more than 16 percent y/y, tipping the global market into a surplus of over 250,000 t.

We have also revised down our estimate of refined net imports due to logistical issues and the lack of demand. We anticipate a rebound in Chinese demand in Q2 as industry ramps up after the extended shutdown to lead to a modest global deficit of 64,000 t in Q2. We estimate that the refined zinc market will register a 191,000 t global surplus in 2020 H1 and will remain in surplus for the balance of the year.

To date we have not adjusted our expectations of ex-China supply and demand in light of the outbreak, but there will clearly be a knock-on effect.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com