Plate

February 17, 2020

Import Market Share for Sheet, Plate, Longs and Tubulars

Written by Peter Wright

This report examines the import share of sheet, plate, long and tubular products and 16 subcategories.

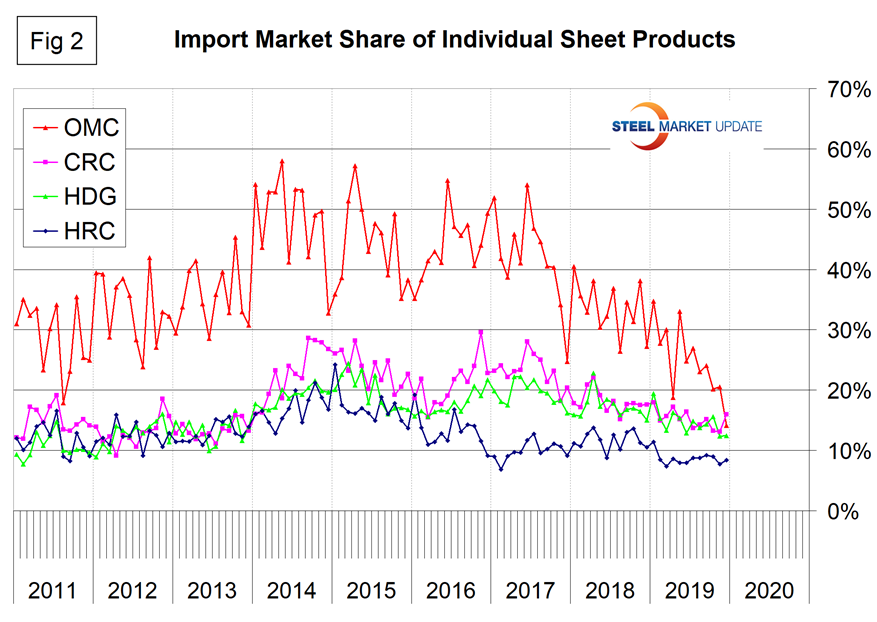

Since January 2019, the import market share of total sheet products has been below 15 percent with an 11-month average of 14.0 percent. The import share of HRC has been below 10 percent since January 2019. The most striking result in this analysis is the data for other metallic coated sheet, which shows the import share has declined by more than half in two years, not just because imports were down but also because domestic shipments have increased by almost 50 percent since mid-2017.

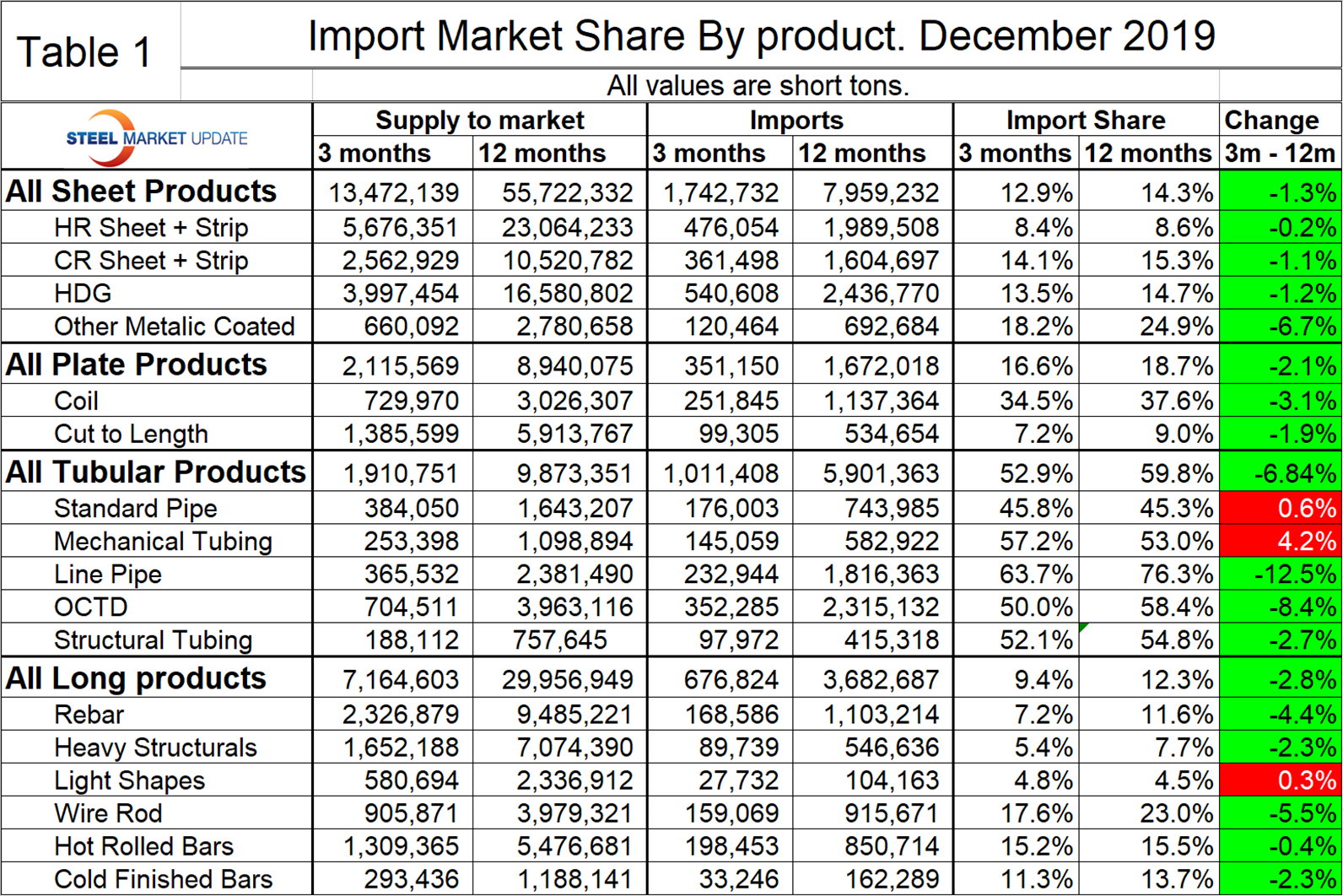

Table 1 shows total supply to the market in three months through October and in 12 months through October for the four product groups and the 16 subcategories. Supply to the market is the total of domestic mill shipments to domestic locations plus imports. It shows imports on the same three- and 12-month basis and then calculates import market share for the two time periods for 16 products. Finally it subtracts the 12-month share from the three-month share and color codes the result green or red. If the result of the subtraction is positive, it means that import share is increasing and the code is red. The big picture is that import market share declined in three months compared to 12 months for all except three of the 16 products considered.

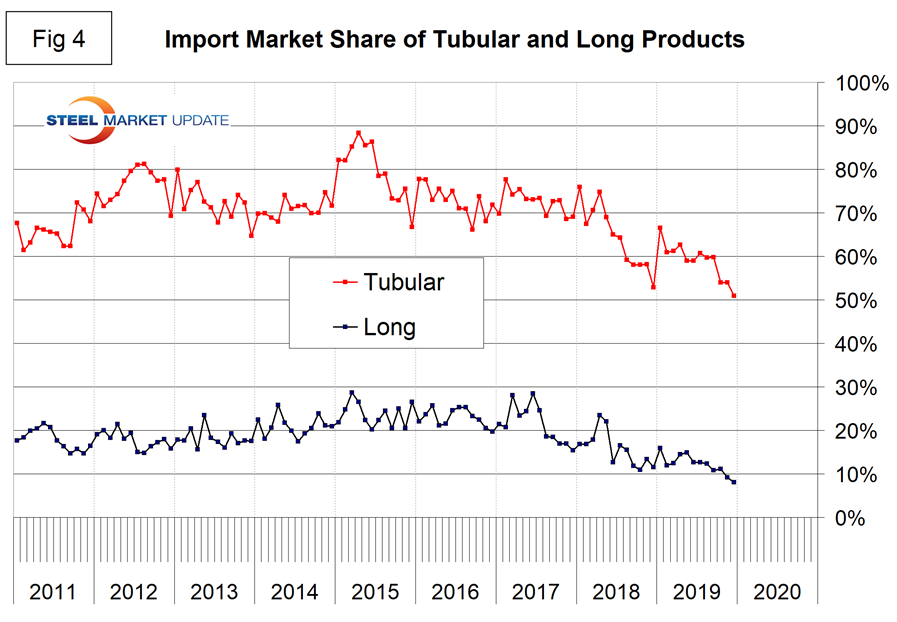

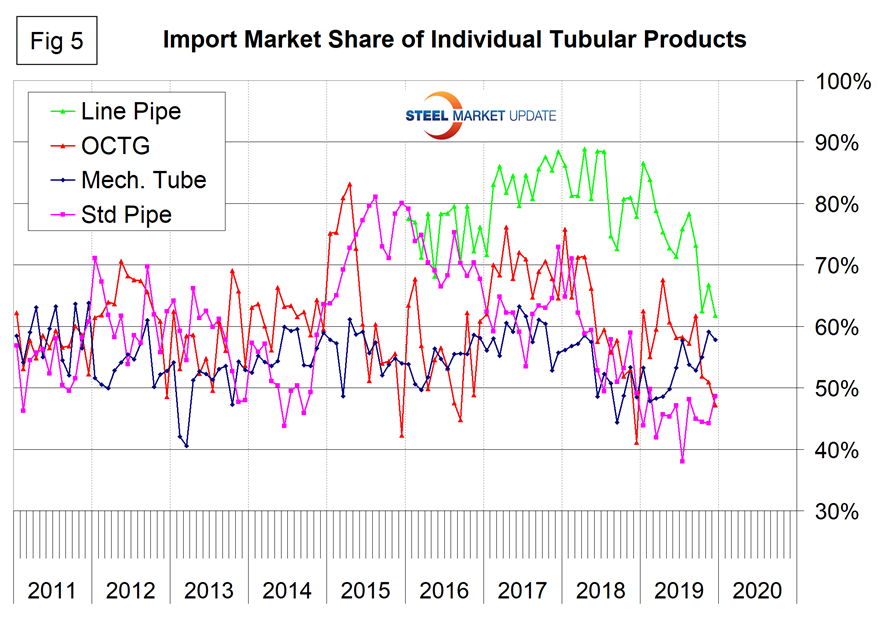

There is a huge difference in import market share between products with each of the tubular products and coiled plate being the worst cases. See note below about tubular products.

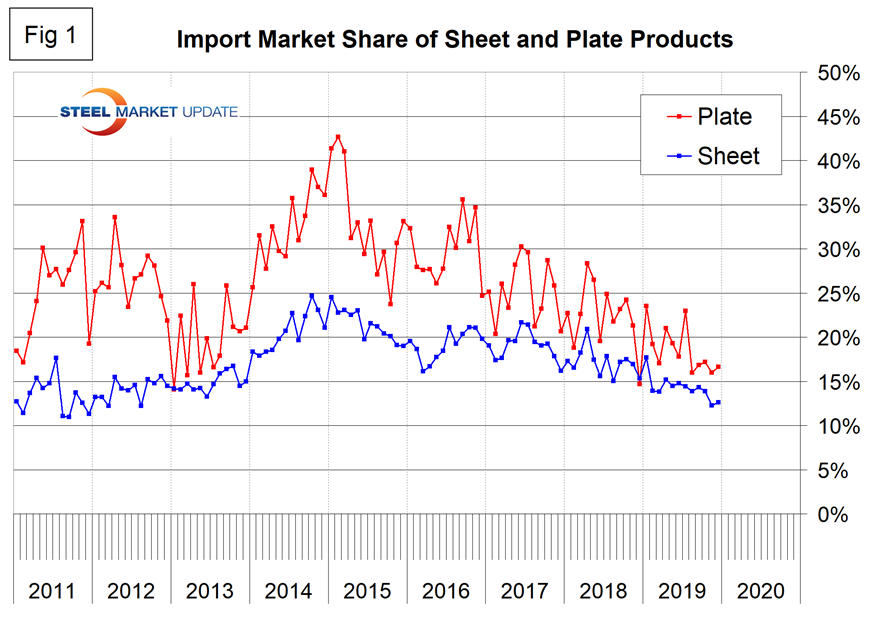

Figure 1 shows the historical import market share of plate and total sheet products. The import share of plate has been decreasing erratically since February 2015. There has been a downward drift of sheet product import share for almost three years.

Figure 2 shows the import market share of the four major sheet products. Other metallic coated (mainly Galvalume) has traditionally had by far the highest import market share, but the gap has closed since late 2017. Domestic producers have made major inroads into the supply picture of OMC products. Since 2008, domestic shipments of OMC have increased by 71.3 percent as those of HDG have increased by only 14.3 percent. For the last four years, hot rolled coil has had the lowest import market share of the major sheet products.

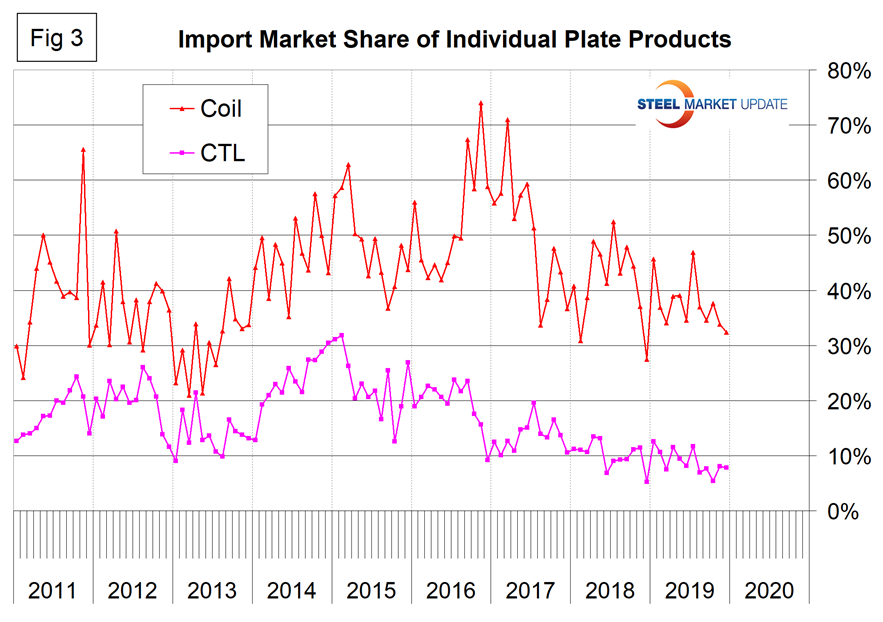

Figure 3 breaks out coiled and discrete plate from the flat rolled total and shows that in Q4 2019, coil imports had almost five times the market share as CTL imports.

Figure 4 describes the total import share of tubular goods and long products. It is evident as we work the numbers that data for the domestic production of tubulars is greatly understated. This is probably because of a more fragmented supply chain and the independent tubers not reporting to the extent that the steel mills do for other products. This has the result of increasing the apparent import market share. Even though we don’t believe these numbers for tubulars, we are including them here in the belief that trends should still have some validity. Since May 2018 the import market share of long products has been historically low.

Figure 5 shows the import market share of the individual tubular products. Based on the available information, all are very high compared to other steel product groups. Line pipe is the highest, but declined dramatically in 2019. We hope that the errors in the tubular data are consistent and the shape of the curves in Figure 5 is useful to industry professionals.

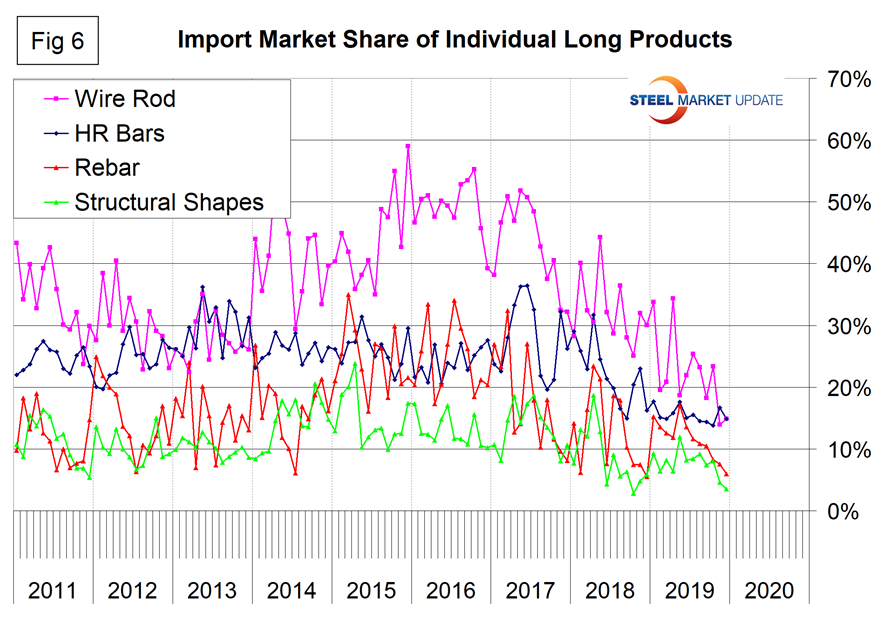

Figure 6 shows the detail for the four major sectors of the long product group. The most significant reduction is for wire rod, which in the years 2014 through most of 2017 had double the import market share of the other long products. In the second half of 2017, the gap began to narrow to the point that in November 2019 the import share of wire rod fell below that of hot rolled bars. Rebar has been very erratic, but the import share fell to a historically low level in December 2019. After increasing for six months in 2018, the import market share of structural shapes has been declining for the last six months.