Market Segment

February 13, 2020

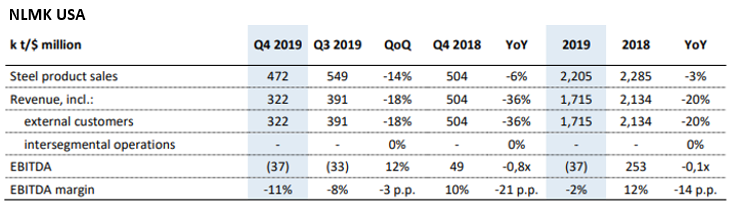

NLMK USA Revenue and Sales Fall in Q4

Written by Sandy Williams

NLMK USA saw sales decrease 14 percent to 470,000 metric tons during the fourth quarter of 2019. Revenue from the segment dropped 18 percent quarter-over-quarter to $322 million. Declines were attributed to softer demand and lower steel prices. NLMK Group noted weaker demand in energy, automotive and machinery segments and a 4 percent drop in average selling price during the quarter.

For the full year 2019, the USA segment posted a 20 percent year-over-year decline in revenue to $1.72 billion. Prices fell an average of 17 percent during the year due to oversupply following the removal of Section 232 tariffs from Canada and Mexico.

NLMK USA also incurred higher costs for slabs from Russia that were subject to import duties in the first quarter of 2019. Shipments of slab from Lipetsk were stopped during the second quarter. EBITDA for the year showed a loss of $37 million.

NLMK USA was denied exclusion from Section 232 tariffs for slab imports from its Russian parent NLMK Group. Increased costs led to layoffs at its facilities in December.