Prices

February 11, 2020

SMU Market Trends: Still Some Upside for Steel Prices?

Written by Tim Triplett

Have steel prices peaked or do they still have some upside? That’s the question on steel buyers’ minds. Is today the time to buy or will steel be cheaper tomorrow? Information from Steel Market Update’s market trends questionnaire last week and our canvass of the market today is mixed.

Steel prices rose in November and December on a series of price hikes by the mills with the benchmark price for hot rolled hitting $610 per ton by early January from a low of $470 in October. Since then the price has lost that momentum and backtracked by about $30 to the current average price of $580 per ton. Comments from executives polled today show that most feel prices are most likely to move sideways or down further in the near term. SMU has shifted its Price Momentum Indicator to Neutral until the market establishes a clear direction.

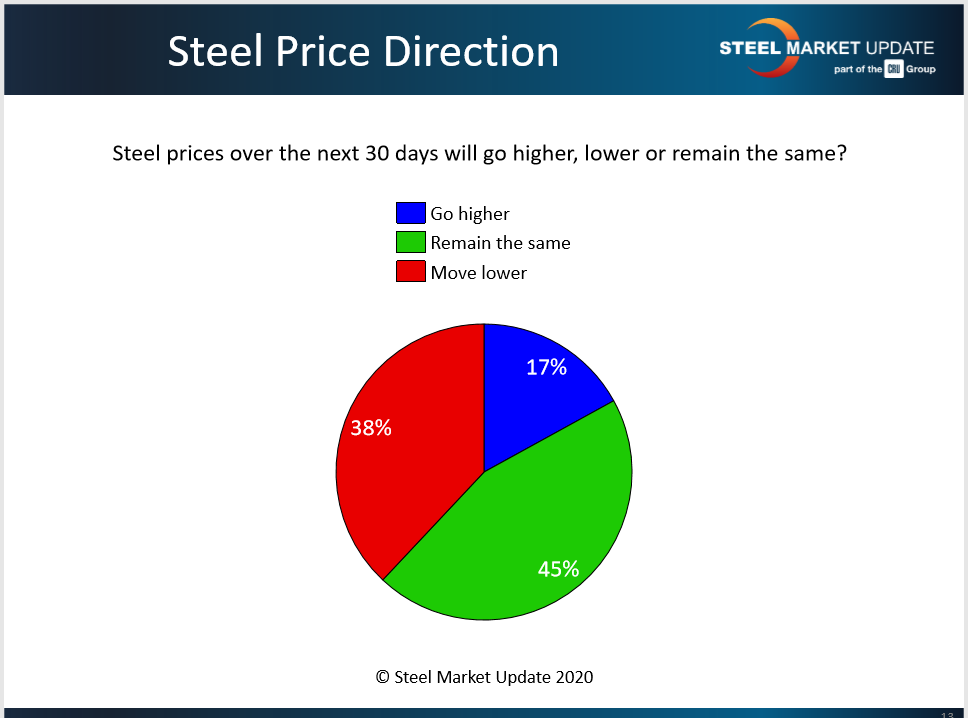

SMU asked: Will steel prices over the next 30 days go higher, lower or remain the same?

Forty-five percent of those responding said steel prices will remain the same—which essentially means they don’t know which direction prices will take in the coming weeks. Thirty-eight percent expect prices to move even lower. Just 17 percent higher. Thus, twice as many of those venturing a guess expect further declines in steel prices.

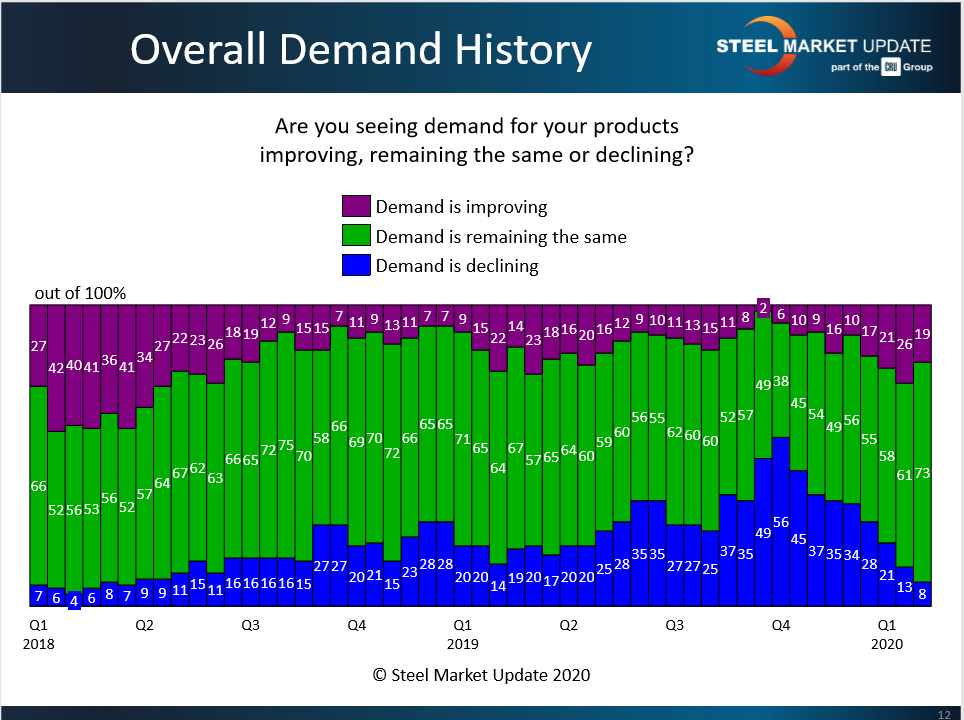

SMU asked: At this time, are you seeing demand for your products improving, remaining the same or declining?

The leveling of steel prices may reflect a flattening in demand. Roughly three out of four steel buyers (73 percent) characterized demand as flat or stable, while 8 percent saw demand from their customers declining. Only 19 percent saw demand improving. Here are some of their comments:

“Demand seems soft this past month. Even while prices increase, risks of imports are high.”

“We expect shipments to slow in the second quarter.”

“Sales are good, people seem to be stocking up as usual in January. The milder winter this year also seems to be helping sales.”

“Demand is high right now.”

“The improvement is a seasonal pick-up in business.”

SMU asked: Are you having difficulty passing along higher prices to your customers?

It’s always a challenge for service centers to collect higher prices from their customers. In the last survey, 87 percent said they are having trouble passing along higher prices; while that number sounds high, it’s a pretty typical percentage. As comments reveal, some place at least part of the blame on their competitors.

“Nobody ever wants to pay more. There is always someone else willing to undercut the market.”

“Distributors’ bearish tenancies are accelerating. Although we expect prices to settle lower than current asking prices, we don’t expect a return to the lows of 4Q. Yet those who grew inventories seem afraid to hold onto anything despite the low cost and are unnecessarily undercutting not only the current market price, but also pricing from months ago. These undisciplined actions are eliminating the necessary margin to undertake the risk of holding inventory and accelerating the eroding market…”

“Prices are starting to stagnate.”

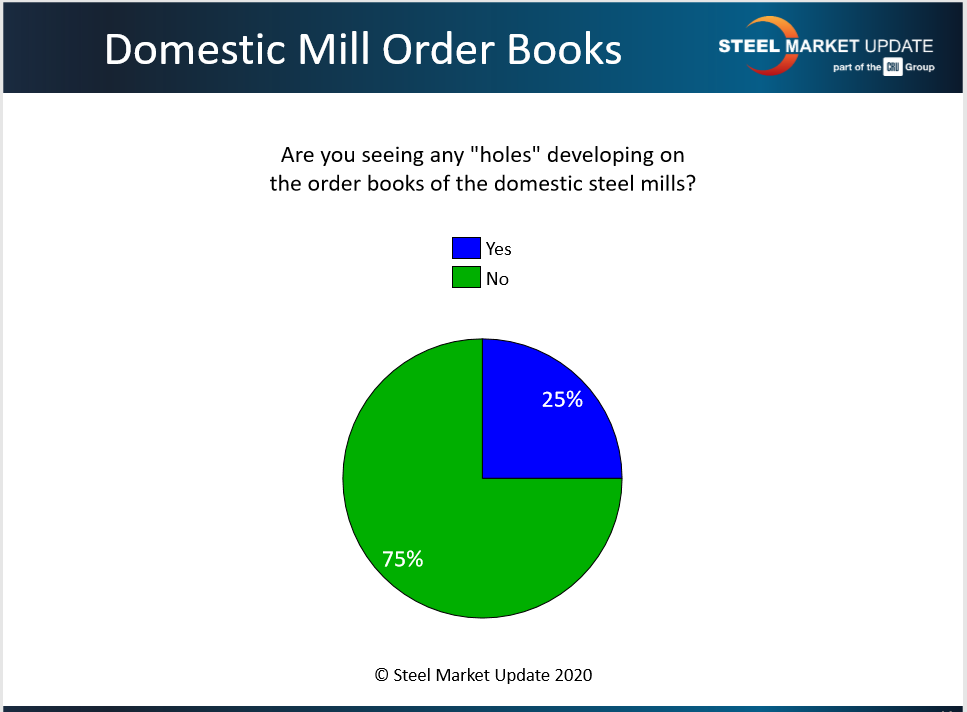

SMU asked: Are you seeing any “holes” developing in the order books of domestic steel mills?

Mills that don’t have full order books are more likely to negotiate on price to fill in the gaps, but only about one-quarter of those responding to SMU’s questionnaire said they see “holes” developing in mill order books. Three-quarters see mill order books as fairly full, which suggests steel prices may still have some legs. But respondents’ comments cast some doubts:

“Not a hole, but a re-pricing downward.”

“No holes, but I do think we are looking at inflated bookings to close out March availability and support mill increases.”

“Some orders of hot rolled and galvanized are arriving early.”

“ArcelorMittal and U.S. Steel are quoting April lead times for HR when everyone else is in early to mid-March. I am guessing holes will begin to appear in those lead times.”

“If we were still in a pinch for February, we could probably still find some HRC production to cover it.”

“Lead times seem stagnant and not moving out much for some mills.”

“Some mills are taking a hard look and are willing to come off the price if you have tons to place.”

“Supply discipline on HDG was lacking at the end of 2019, and the carryover into January is evident in the CRU numbers the last 3-4 weeks.”

“No holes yet. Supply issues at AM USA are keeping things tight.”

“There is some spot availability, some smaller holes at some mills in HR.”

“Each mill seems to have opportunities where they are willing to negotiate.”