Government/Policy

February 11, 2020

Commerce Finds Circumvention on CORE Products Originating in China and Taiwan

Written by Sandy Williams

In a self-initiated investigation, the Department of Commerce announced an affirmative circumvention ruling regarding corrosion-resistant steel products (CORE) made from substrate from China and Taiwan.

Commerce preliminarily determined that Chinese steel substrate shipped to Costa Rica, Malaysia, and the United Arab Emirates for minor processing, and then exported to the United States as CORE, is circumventing the antidumping duty and countervailing duty orders on CORE from China.

Commerce also determined that Taiwanese steel substrate shipped to Malaysia for minor processing, and then exported to the United States as CORE, is circumventing the AD order on CORE from Taiwan.

An investigation into CORE products exported from Guatemala and South Africa found that the products were not made with Chinese substrate, resulting in a negative circumvention ruling.

Following the initiation of the original AD/CVD investigations on CORE imports from China and Taiwan, shipments of CORE from Costa Rica, Guatemala, Malaysia, South Africa, and the UAE to the United States increased in value by 29,210 percent, 35,944 percent, 151,216 percent, 629 percent, and 5,571 percent, respectively.

AD and CVD cash deposits will be collected on imports of CORE completed in Costa Rica, Malaysia, and the UAE using China-origin substrate, as well as imports of CORE completed in Malaysia using Taiwan-origin substrate.

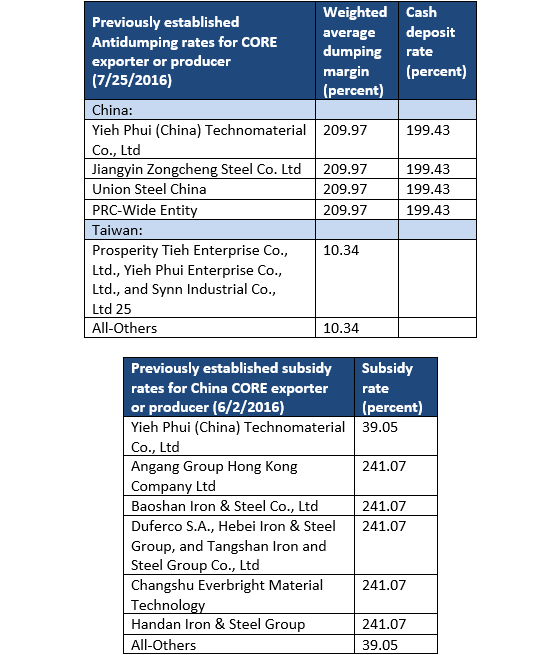

The cash deposit rates will be equal to the rates previously established for CORE from China and Taiwan, as applicable. Suspension of liquidation and cash deposit requirements will apply to unliquidated entries on or after Aug. 12, 2019.

The investigation, initiated in August 2019, is particularly significant in that it is the first time Commerce self-initiated a circumvention inquiry based on its own monitoring of trade patterns.