Market Data

February 1, 2020

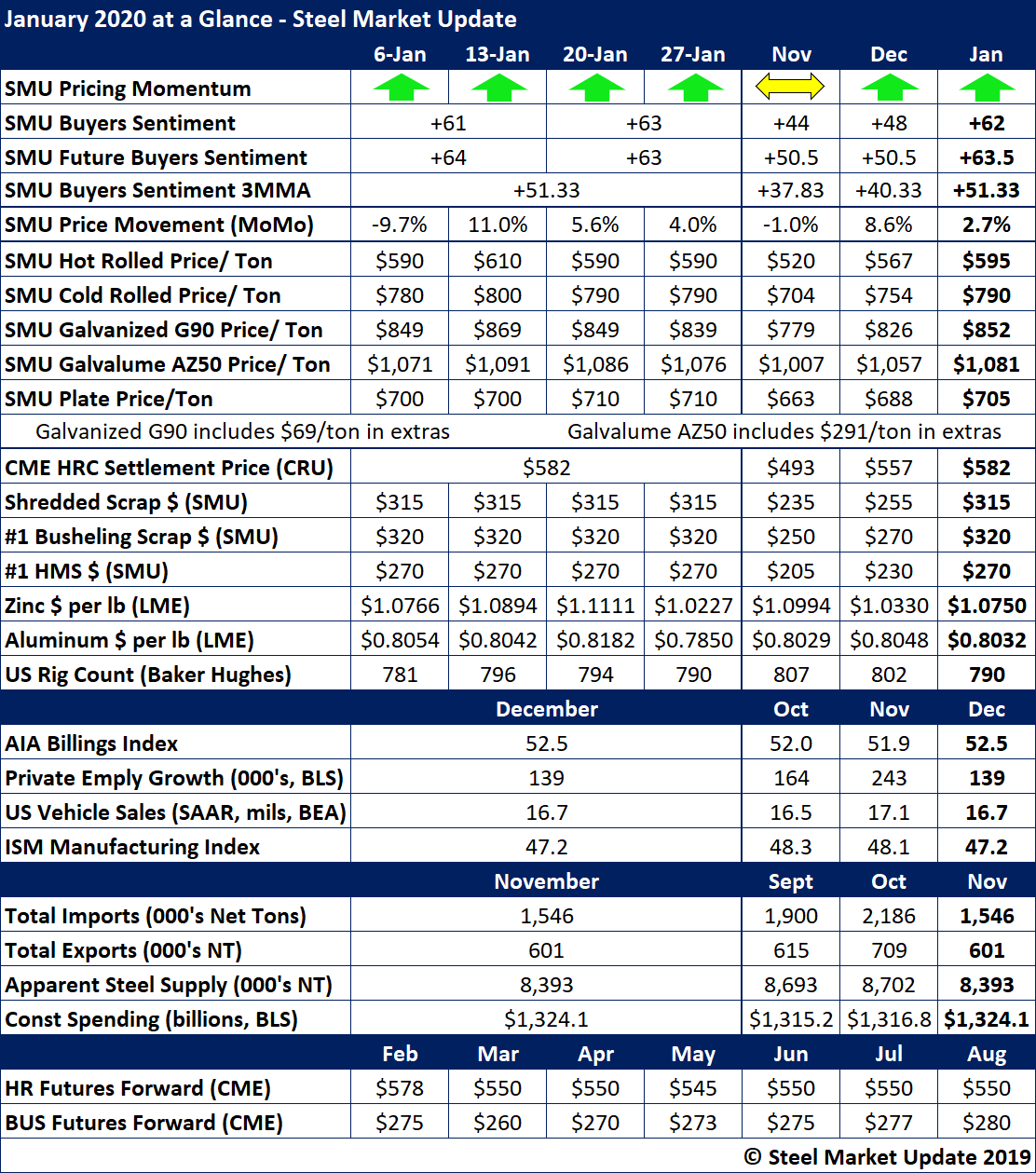

SMU's January At-a-Glance

Written by Brett Linton

Both steel and scrap prices increased in the month of January, raising with them optimism levels over market conditions one month into the new year. The average price for hot rolled steel rose by about $30 per ton in January. The benchmark price for hot rolled peaked at $610 per ton in mid-January, but ended the month slightly lower at $590 per ton. Steel Market Update’s Pricing Momentum Indicator continued to point upward through the end of last month, but the price trend was beginning to show signs of potential slowing.

SMU Buyers Sentiment Index readings showed significant improvement over December with Current Sentiment at +62, Future Sentiment at +63.5 and the three-month moving average at +51.33, quite an improvement from the lower readings seen in December and for most of 2019.

Key indicators of steel demand were mixed with the AIA’s Architectural Billings Index rising to 52.5, showing improvement in planned construction, while ISM’s Manufacturing Index declined to 47.2 indicating contraction in manufacturing, according to December data to be updated soon. In the energy sector, the U.S. rig count dipped below 800 in January, showing reduced demand for oil country tubular goods. Auto production slowed to a still-healthy annualized rate of 16.7 million vehicles at the end of 2019.

See the chart below for other key metrics in the month of January: