Market Data

January 27, 2020

Regional Employment: South-Central U.S. Created Most Jobs

Written by Peter Wright

The South Central region of the U.S. created the most jobs in the fourth quarter of 2019, with the Pacific in second place, based on government employment data.

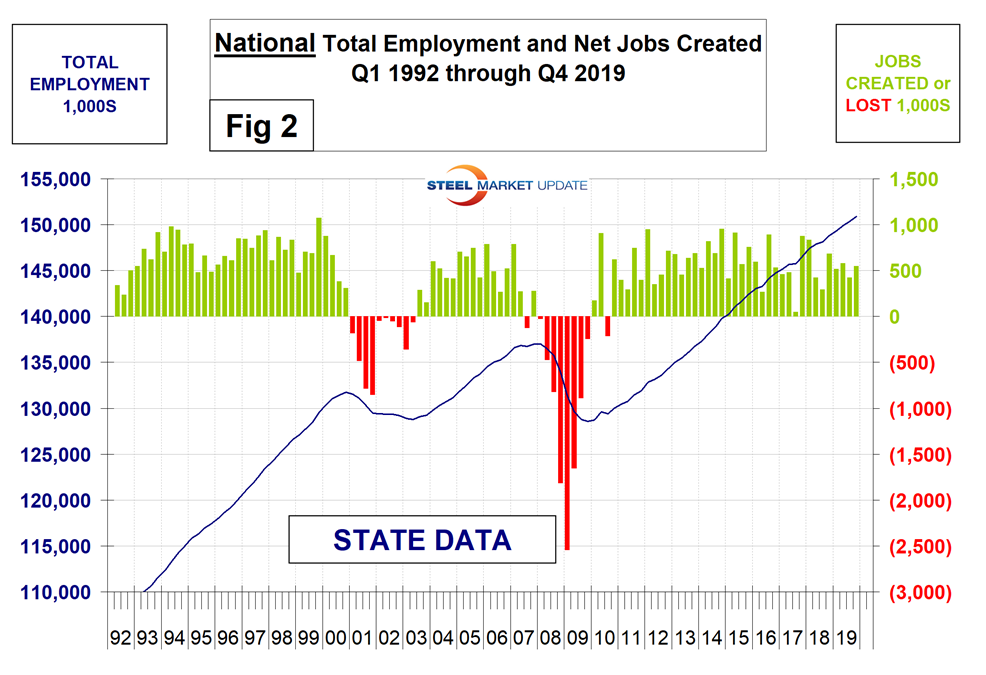

![]() Fourth-quarter regional employment data by state was released by the Bureau of Labor Statistics (BLS) on Friday. The state data follows and confirms the employment situation that we reported at the national level two weeks ago. In the fourth quarter, the states reported a total of 547,000 jobs created. The national report indicated a total of 553,000 jobs.

Fourth-quarter regional employment data by state was released by the Bureau of Labor Statistics (BLS) on Friday. The state data follows and confirms the employment situation that we reported at the national level two weeks ago. In the fourth quarter, the states reported a total of 547,000 jobs created. The national report indicated a total of 553,000 jobs.

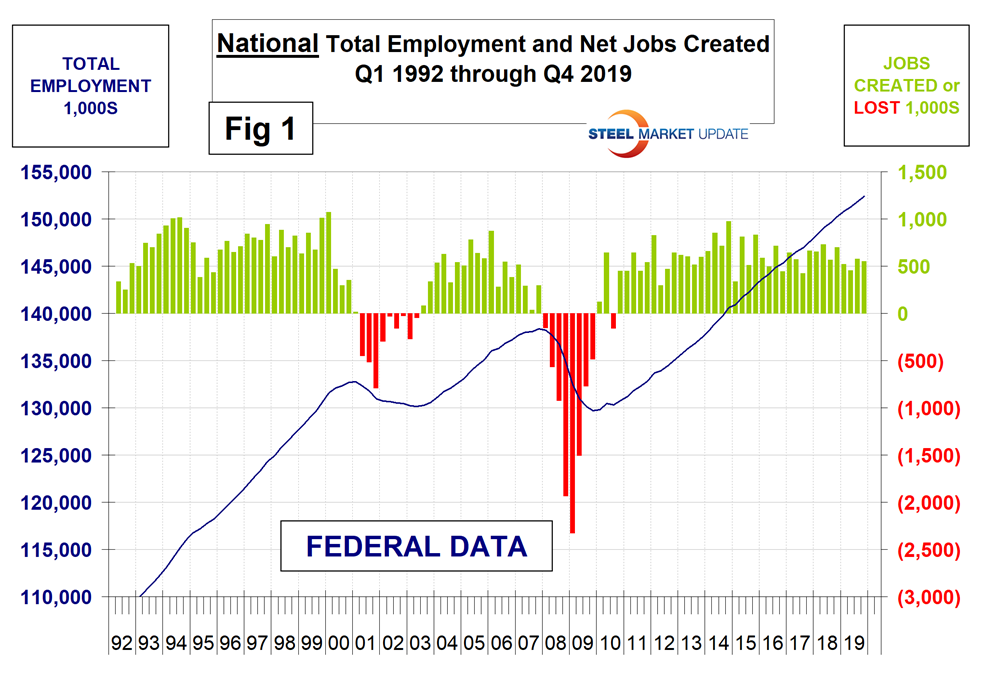

The states compile their employment numbers independently of the Feds, and then both are reported by the BLS. In the seven years since and including Q1 2013, the Feds reported total job creation of 17,319,000 and the states reported 16,556,000. Our report covers only the lower 48 states, and the state numbers don’t include individuals such as those in the military who are employed overseas. Therefore, the federal and state totals are close. Figure 1 shows the history of federal data totals since 1992 and Figure 2 shows the same format for the state data.

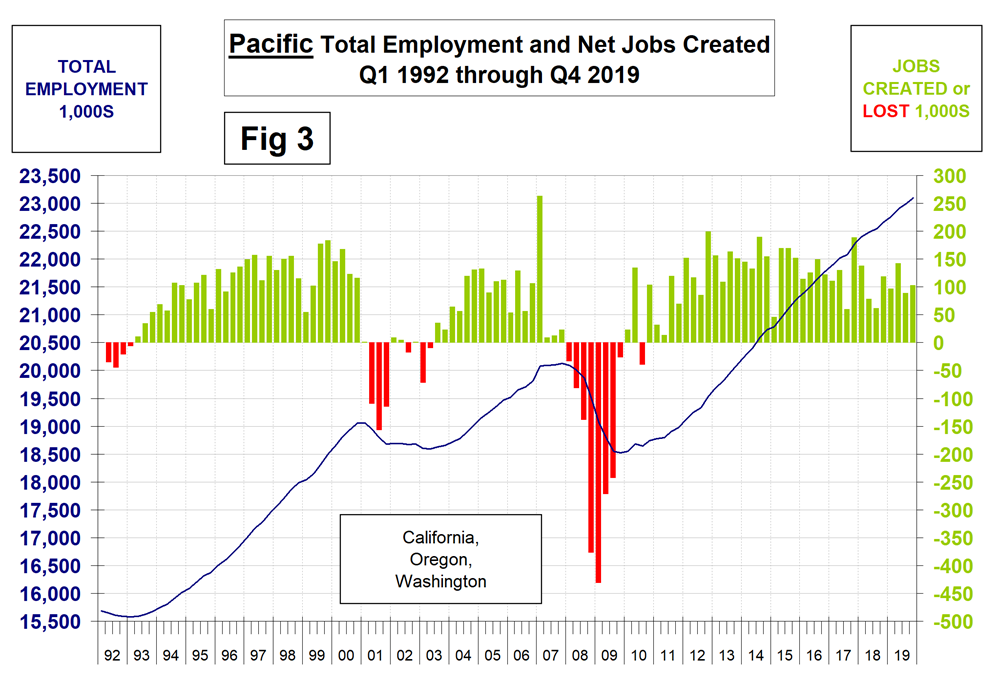

SMU has graphs in the same format for 10 geographic regions and can produce them for individual states on request. Figure 3 shows the history of the Pacific region.

The 10 geographic regions described in this report are:

New England (CT, ME, MA, NH, RI, VT)

North East (NY, PA, NJ)

Mid Atlantic (DE, DC, MD, NC, SC, VA, WV)

North Central (IA, KS, MN, MO, NE, ND, SD)

East North Central (IL, IN, MI, OH, WI)

East South Central (AL, KY, MS, TN)

South Central (TX, OK, LA, AR)

Mountain (AZ, CO, ID, MT, NV, NM, UT, WY)

Pacific (CA, OR, WA)

South East (FL, GA)

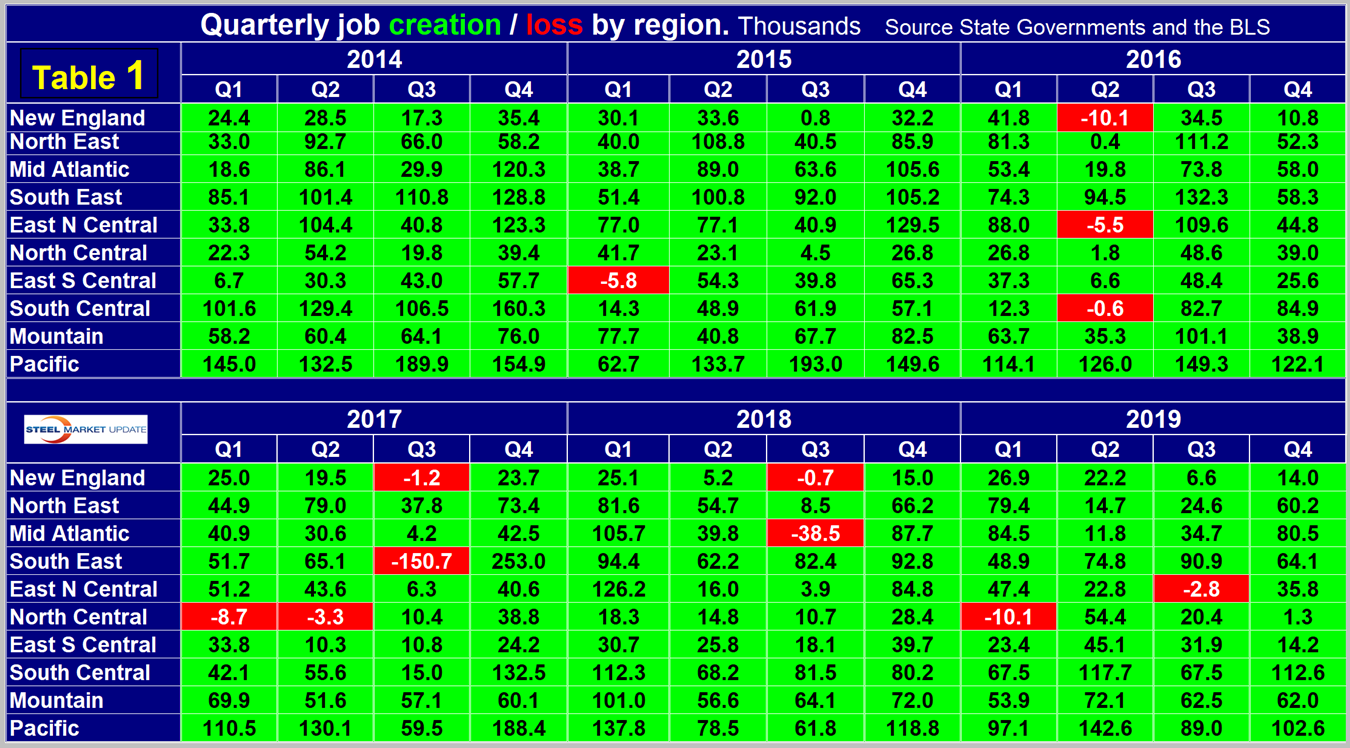

Table 1 shows the history of quarterly job creation by region since Q1 2014. In 2019 the Pacific region created the most jobs with a four quarter total of 431,300, followed by the South Central where 365,300 jobs were created. The numbers are seasonally adjusted and all regions had a positive net gain in the fourth quarter of 2019.

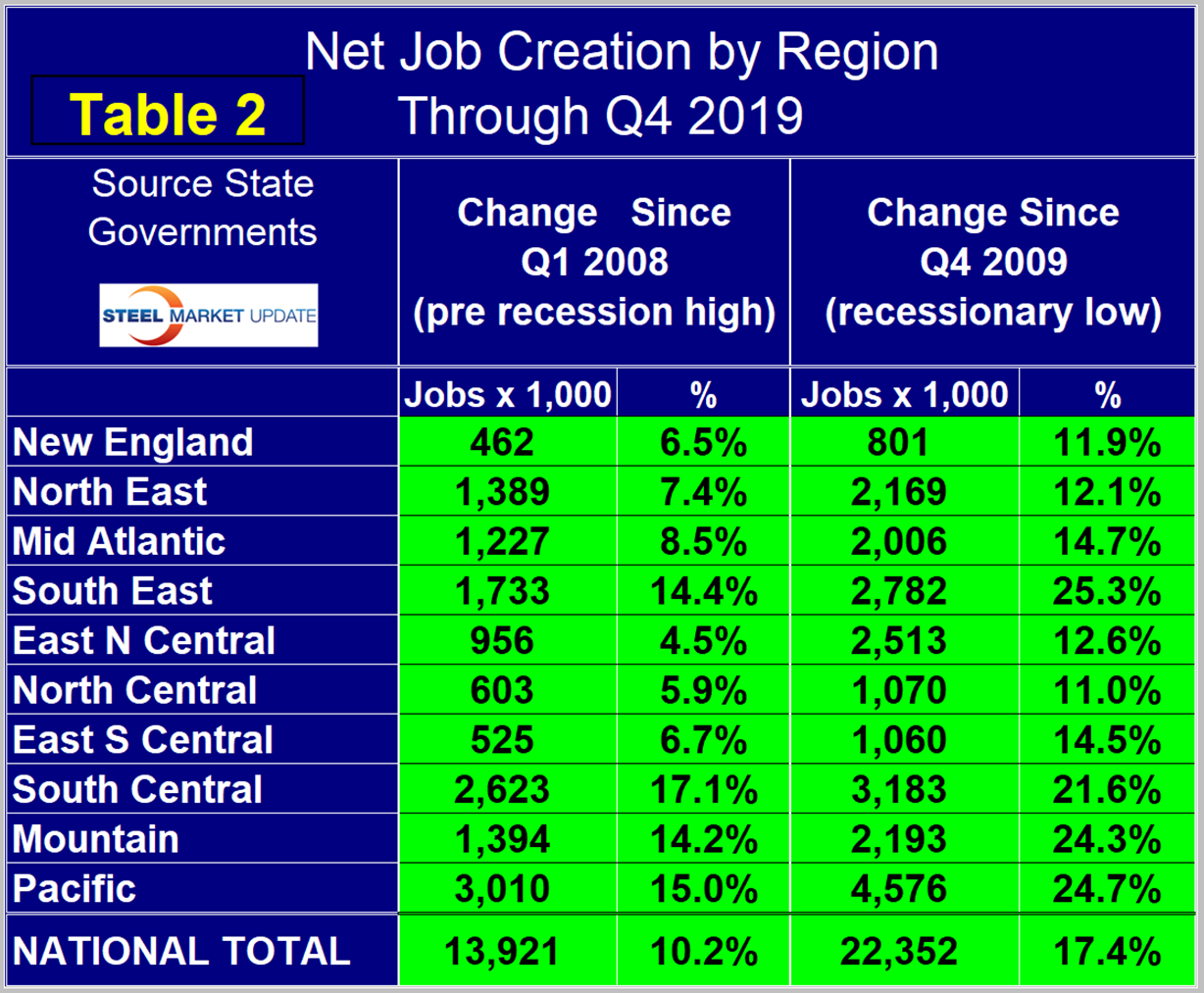

The regions have fared very differently since the pre-recession high of first-quarter 2008 and since the low point of fourth-quarter 2009. By the states’ calculations, there are now 13,921,000 more people employed than there were immediately before the recession. But of that number, more than 40 percent of the jobs were created in the South Central and the Pacific regions (Table 2).

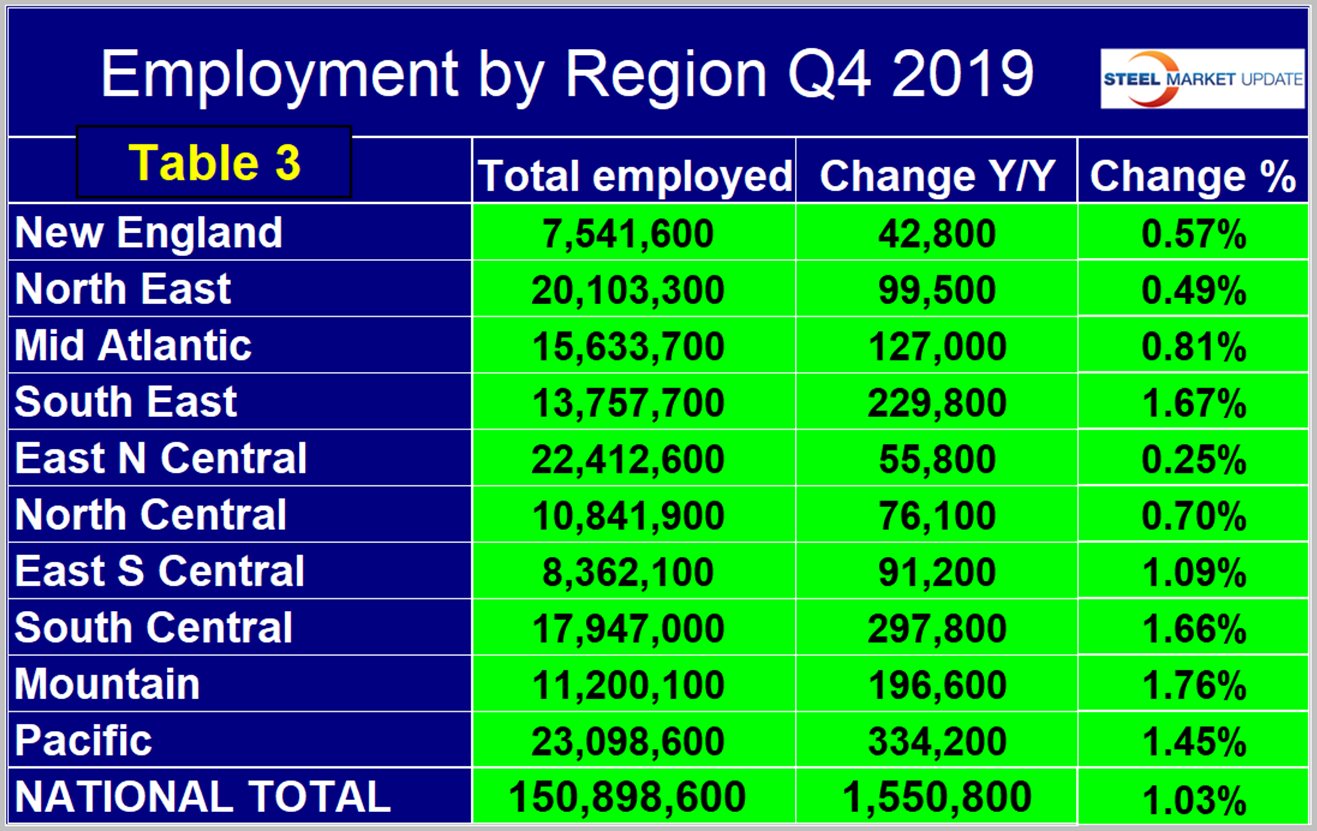

The Pacific region continues to have the highest number of people employed followed by East North Central, but on a percentage basis the ENC had by far the worst performance as a job creator in 2019. The South East and the South Central had the highest percentage gain in 2019 (Table 3).

SMU Comment: In 2019, the East North Central region had by far the worst rate of job creation on a percentage basis of all nine regions. This is a measure of the weakness of manufacturing. We believe it’s important for those subscribers whose businesses are substantially regional to have as much data as possible to compare their own results with those of their locality. This report, along with our quarterly reports on regional GDP and regional imports, are intended to help in that respect.