Market Data

January 27, 2020

BEA: Regional GDP Growth Through Q3 2019

Written by Peter Wright

U.S. gross domestic product had positive growth in every region of the country in each of the first three quarters of 2019, according to Bureau of Economic Analysis data.

![]() The BEA reports GDP by state and region on a quarterly basis. This data is released several weeks after the national report. The latest data was updated through Q3 2019. Even though this might be considered historically “old,” we think it’s worth reporting because it’s the foundation for where we are now. The data is reported in chained 2012 dollars seasonally adjusted. Steel Market Update analyzes the data and reports to subscribers quarterly by region. Table 1 shows the growth of regional GDP quarter on quarter. (These growth numbers are not annualized, as opposed to the headline number for the growth of national GDP. Annualized means multiplied by four.) Every region had positive growth in each of the first three quarters of 2019 with the South West having the highest growth year to date at 3.1 percent followed by the Rocky Mountains at 2.7 percent.

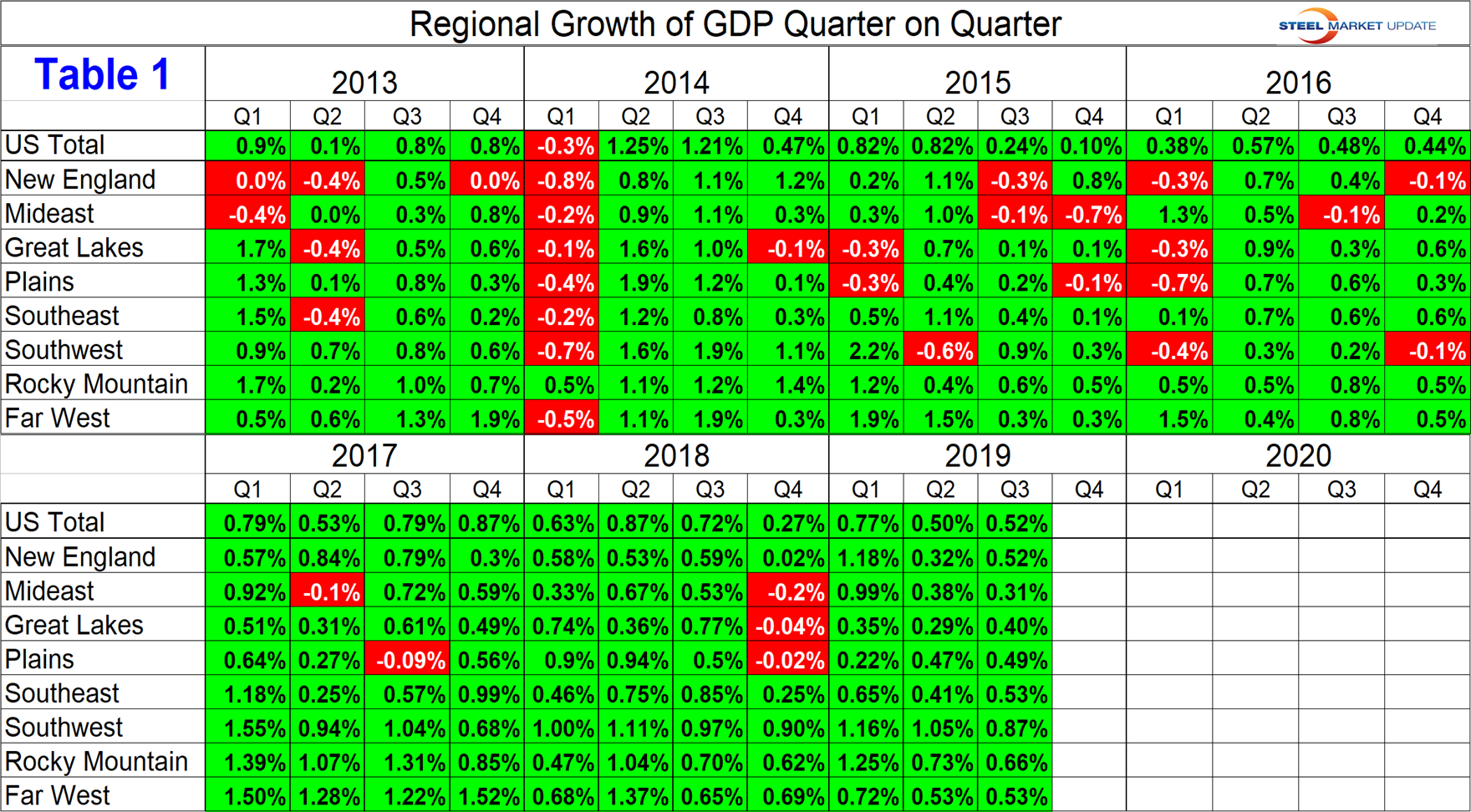

The BEA reports GDP by state and region on a quarterly basis. This data is released several weeks after the national report. The latest data was updated through Q3 2019. Even though this might be considered historically “old,” we think it’s worth reporting because it’s the foundation for where we are now. The data is reported in chained 2012 dollars seasonally adjusted. Steel Market Update analyzes the data and reports to subscribers quarterly by region. Table 1 shows the growth of regional GDP quarter on quarter. (These growth numbers are not annualized, as opposed to the headline number for the growth of national GDP. Annualized means multiplied by four.) Every region had positive growth in each of the first three quarters of 2019 with the South West having the highest growth year to date at 3.1 percent followed by the Rocky Mountains at 2.7 percent.

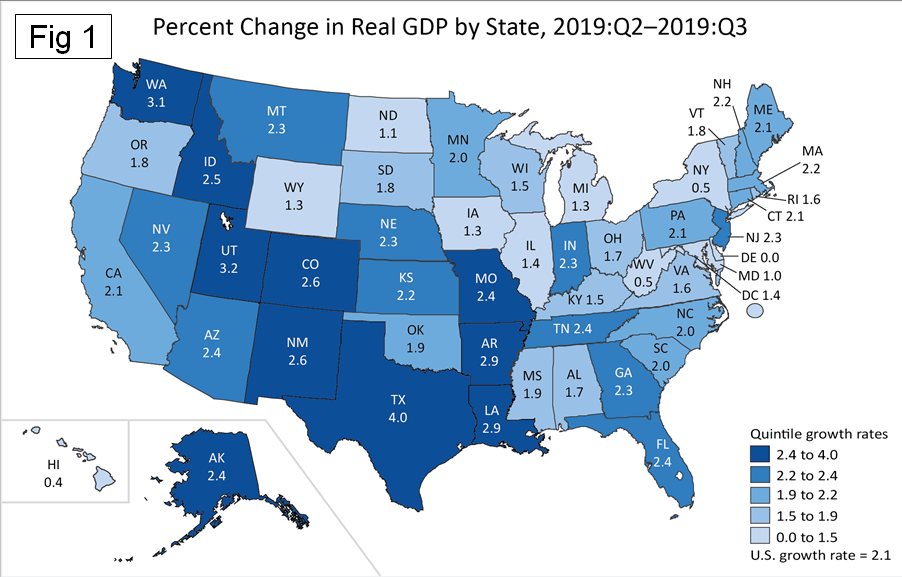

The BEA publishes a color-coded map of the United States showing annualized quarter-over-quarter growth of GDP by state within each region.

Regions as defined by the BEA are as follows:

New England: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont.

Mid East: Delaware, DC, Maryland, New Jersey, New York, Pennsylvania.

Great Lakes: Illinois, Indiana, Michigan, Ohio, Wisconsin.

Plains: Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota.

South East: Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, West Virginia.

South West: Arizona, New Mexico, Oklahoma, Texas.

Rocky Mountain: Colorado, Idaho, Montana, Utah, Wyoming.

Far West: Alaska, California, Hawaii, Nevada, Oregon, Washington.

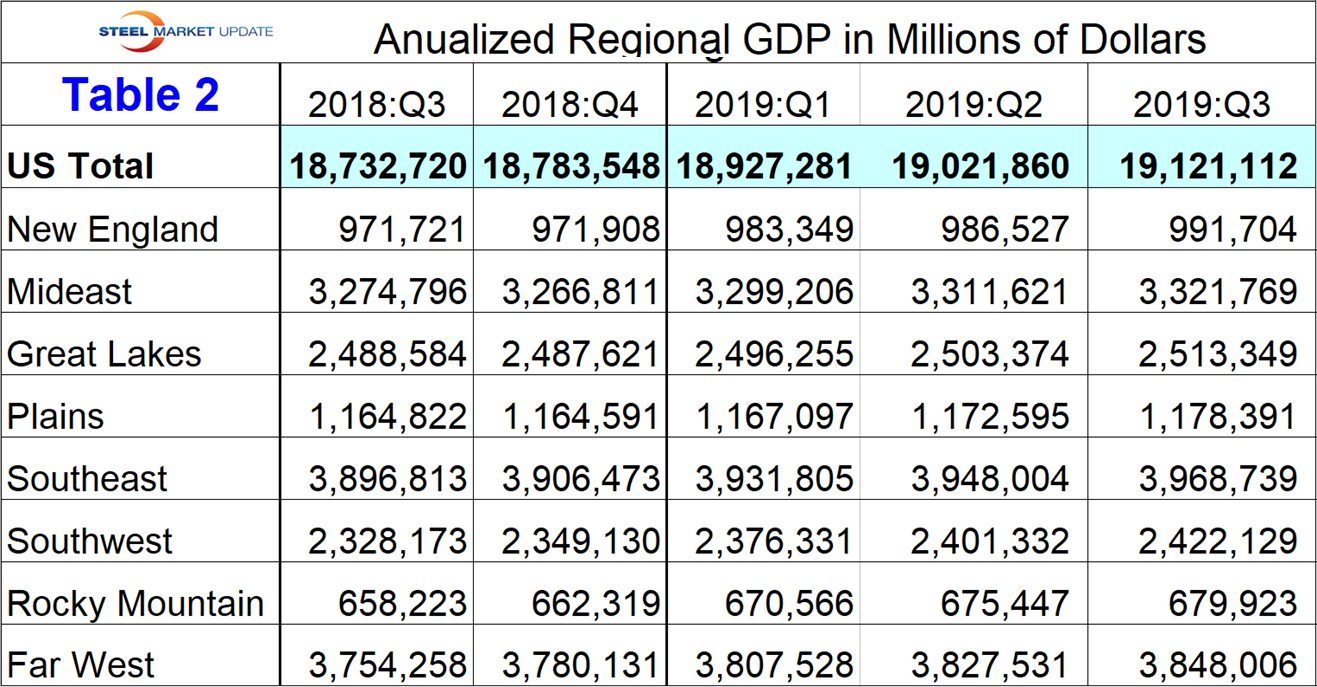

Table 2 shows the GDP in millions of dollars annualized for the U.S. in total and for each of the eight regions as defined by the BEA. GDP is the value of the goods and services produced less the value of the goods and services consumed in each period. The South East region has the highest total GDP and the Rocky Mountains the lowest. This ranking is not qualitative; it is a function of how the BEA defines regions, which unfortunately does not correspond to how the Bureau of Labor Statistics defines regions for employment purposes.

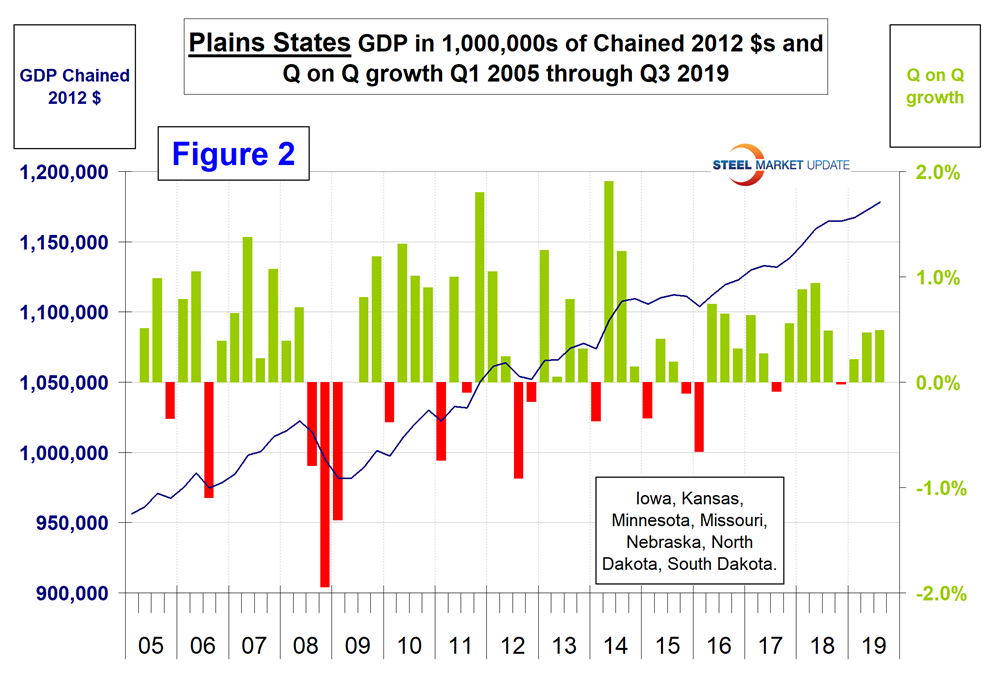

Figure 2 gives subscribers an example of the GDP graphs available on request for all regions and individual states. This example shows the results for the Plains states, which have an annual economic output of $1.178 trillion.

In addition to this report of regional GDP, we publish quarterly reports of regional job creation and regional imports. Our intention with these three reports is to help subscribers determine whether their business is subject to headwinds or tailwinds in the regions where they operate.

The U.S. total GDP values are slightly higher than the sum of the regional totals in this report because the GDP-by-state numbers exclude federal military and civilian activity located overseas (because it cannot be attributed to a particular state). In addition, the official headline quarterly report of national GDP is annualized, which increases the value by a factor of four.