Long Products

January 21, 2020

CRU: European Longs Producers Brace for Scrap Price Fall

Written by Chris Bandmann

By CRU Analyst Chris Bandmann, from CRU’s Steel Long Products Monitor

Europe: Germany has not seen any significant snowfall yet this winter, and these mild conditions had the potential to support the continuation of construction activities. Construction companies entered their holidays regardless, however, and steel demand has settled into a seasonal low point. Even so, service centers are broadly optimistic about a quick return to business.

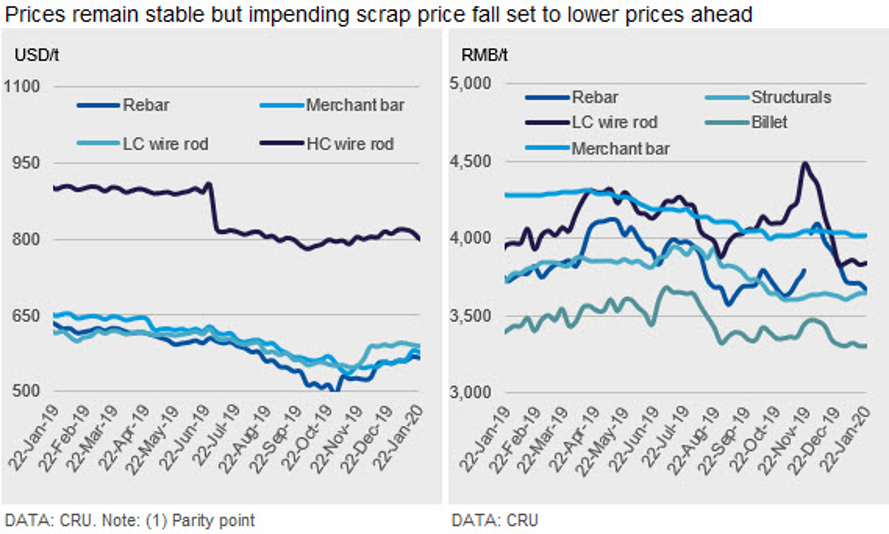

German longs prices were assessed as stable compared to last week, aside from a €10 /t drop in the delivered price of high carbon wire rod. Cheaper offers for the product from Italian and British mills are pushing down prices in the region, despite the recent increases in scrap prices, which have propped up other longs prices.

With a potential scrap price fall on the horizon in February, some producers are concerned that this may prompt longs buyers to push for prices to fall again. To pre-empt this, some mills are offering prices well above the market price for rebar—as they hope this will leave them better off after customers negotiate prices down again.

Turkey

Rebar was assessed at $435 /t FOB Turkey, a decrease of $5 /t w/w, while wire rod remained flat at $465 /t FOB Turkey. As anticipated, pressure from Turkish mills has contributed to the recent decline in Turkish scrap prices. Despite this decrease, mills are yet to adjust their offers accordingly—as it remains unclear as to whether the current scrap price will be maintained.

China

Chinese longs prices remained stable this week, as the New Year holidays meant that there were only a couple of days for business to be done. The markets are currently quiet, as most participants have left for the New Year.

Looking forward, there is some uncertainty about the speed of demand recovery after the holidays. The holidays are being celebrated early this year and the weather is expected to still be cold when the markets restart—which would be unfavorable for construction activities.

There has been an unexpected national virus outbreak, and the Chinese government has called for its citizens to stay at home. It is currently difficult to estimate when this situation will pass, but it may delay the restart of business and in turn affect the steel markets.

While we expect longs prices to remain stable during the New Year holidays, we anticipate some downward pressure in the aftermath as inventories are currently growing.

Far East Imports

Asian imported long products saw a fall in prices last week as rebar offers from Turkey declined following a decrease in ferrous scrap costs.

One Turkish rebar deal was heard to have been concluded at $475-480 /t CFR Hong Kong on actual weight basis. Another shipment was heard to have been sold to Singapore—probably for less than $465 /t CFR Singapore, according to market sources—as a previous offer at this level had been rejected by the market.

CRU assessed rebar at $462 /t, CFR Far East Asia, a decrease of $3 /t w/w. Metric sized heavy sections were assessed at $535 /t, CFR Far East Asia, unchanged w/w.

All quoted prices are on theoretical weight basis unless stated otherwise.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com