Prices

January 14, 2020

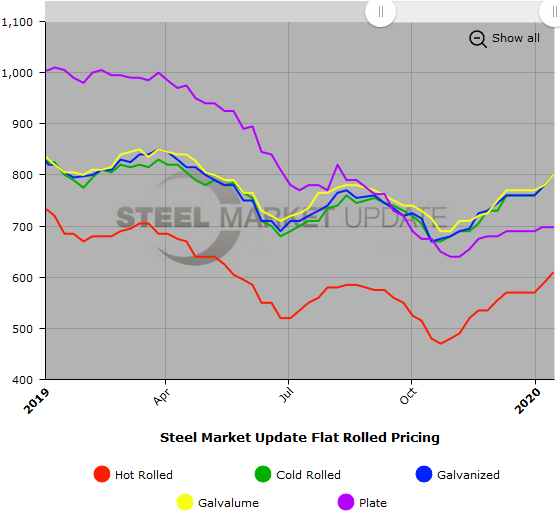

SMU Price Ranges & Indices: Flat Rolled Up Another $20

Written by Brett Linton

The price of hot rolled steel topped the $600 per ton mark this week, cresting a psychological barrier that many saw as unreachable two months ago. Opinions are split on how much higher HR can go, and how long it can stay above the $600 level. Prices for all flat rolled products increased by another $20 per ton on the strength of yet another round of mill price increases last week. SMU’s Price Momentum Indicators will continue to point Higher until we see signs the market has peaked.

As we collected pricing, we did see that the “offers” out of the domestic steel mills are tracking at, or above, $600 per ton. We did collect prices as high as $640 per ton. The trend is for prices to move higher, although we are watching the market carefully as there is some skepticism amongst the steel buyers. We need to remember, prices have gone from below $500 per ton to over $600 per ton in a little less than three months.

Steel buyers reported cold rolled as the weakest product. There is a difference between the spot prices out of the large integrated mills and the smaller conversion and EAF mills. This is a market where one should shop around and look for holes in order books before committing major tonnage (of course, maintaining relationships is also very important).

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $580-$640 per ton ($29.00-$32.00/cwt) with an average of $610 per ton ($30.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago, while the upper end increased $40 per ton. Our overall average is up $20 per ton over last week. Our price momentum on hot rolled steel is Higher, meaning we expect prices to increase over the next 30 days.

Hot Rolled Lead Times: 3-7 weeks

Cold Rolled Coil: SMU price range is $760-$840 per ton ($38.00-$42.00/cwt) with an average of $800 per ton ($40.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week, while the upper end increased $40 per ton. Our overall average is up $20 per ton over one week ago. Our price momentum on cold rolled steel is Higher, meaning we expect prices to increase over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $38.00-$42.00/cwt ($760-$840 per ton) with an average of $40.00/cwt ($800 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago, while the upper end increased $40 per ton. Our overall average is up $20 per ton over last week. Our price momentum on galvanized steel is Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $829-$909 per net ton with an average of $869 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-10 weeks

Galvalume Coil: SMU base price range is $38.00-$42.00/cwt ($760-$840 per ton) with an average of $40.00/cwt ($800 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week, while the upper end increased $40 per ton. Our overall average is up $20 per ton over one week ago. Our price momentum on Galvalume steel is Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,051-$1,131 per net ton with an average of $1,091 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-8 weeks

Plate: SMU price range is $680-$720 per ton ($34.00-$36.00/cwt) with an average of $700 per ton ($35.00/cwt) FOB delivered to the customer’s facility. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged over last week. Our price momentum on plate steel is Higher, meaning we expect prices to increase over the next 30 days.

Plate Lead Times: 4-6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.