Market Data

January 12, 2020

SMU Market Trends: Steel Buyers Split Over Staying Power of Prices

Written by Tim Triplett

As the laws of economics have proven time and again, supply and demand will determine whether steel prices continue to rise in 2020. Demand is set by the marketplace; supply can be controlled by producers.

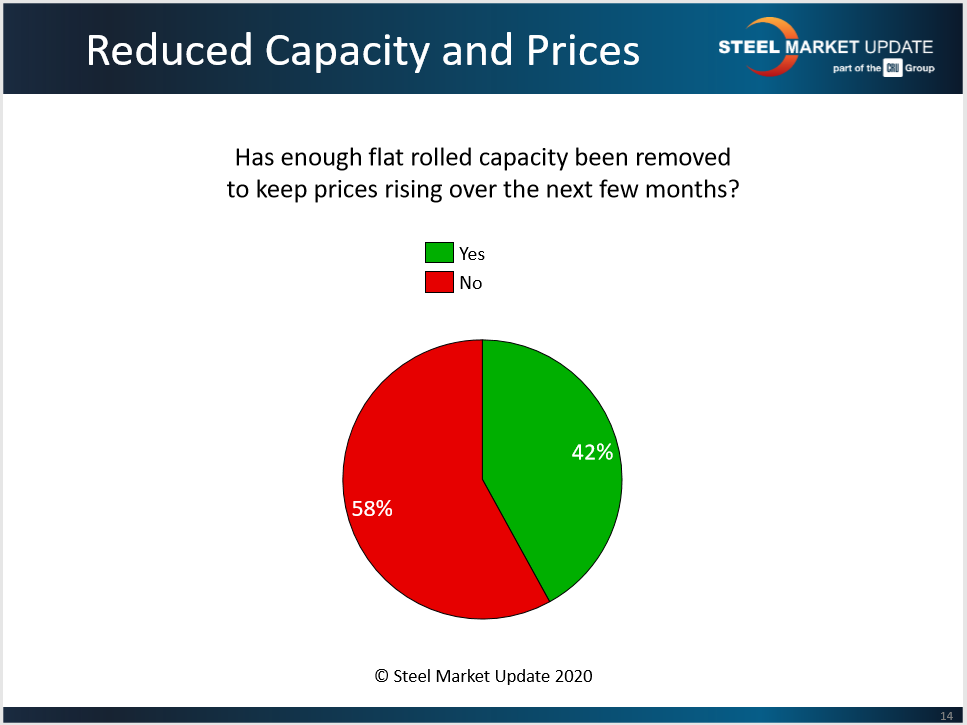

Steel Market Update canvassed the market this week, asking readers: Has enough flat rolled capacity been removed to keep prices rising over the next few months? Opinion was split. No, said 58 percent of respondents; yes, said the other 42 percent.

Comments from the service center and OEM execs show varying levels of hopefulness and skepticism:

“Hard to say. We also need to consider the import risk, trade tariffs and inventory. But it seems they all favor domestic supply for now.”

“We feel supply/demand are very balanced on coated products. The mills could probably afford to remove some HR capacity, but with imports being kept at bay, and OCTG/automotive really having nowhere to go but sideways or up, I think we are at healthy production levels domestically.”

“Yes, as long as prices don’t rise enough to support imports plus the 25 percent tariff.”

“It is really a function of demand. Price will not hold if demand continues its first-of-year sluggishness. Too early to tell.”

“Maybe enough to keep prices up, but not continuing to rise.”

“Imports will increase starting in the second quarter.”

“Too early to tell. Great Lakes is still running.”

“No, they have not [removed enough capacity]. With seasonal slowing and imports hitting in the first quarter, the mills will see holes in their March/April order books since everyone ordered heavy in October/November.”

“Right now, the mills are riding the crest of the wave, pushing fiction on lead times. The only thing factual is scrap. Reality will set in by the end of February. No true demand.”

“It all depends on import levels and demand. Time will tell.”

Views on Demand Also Divided

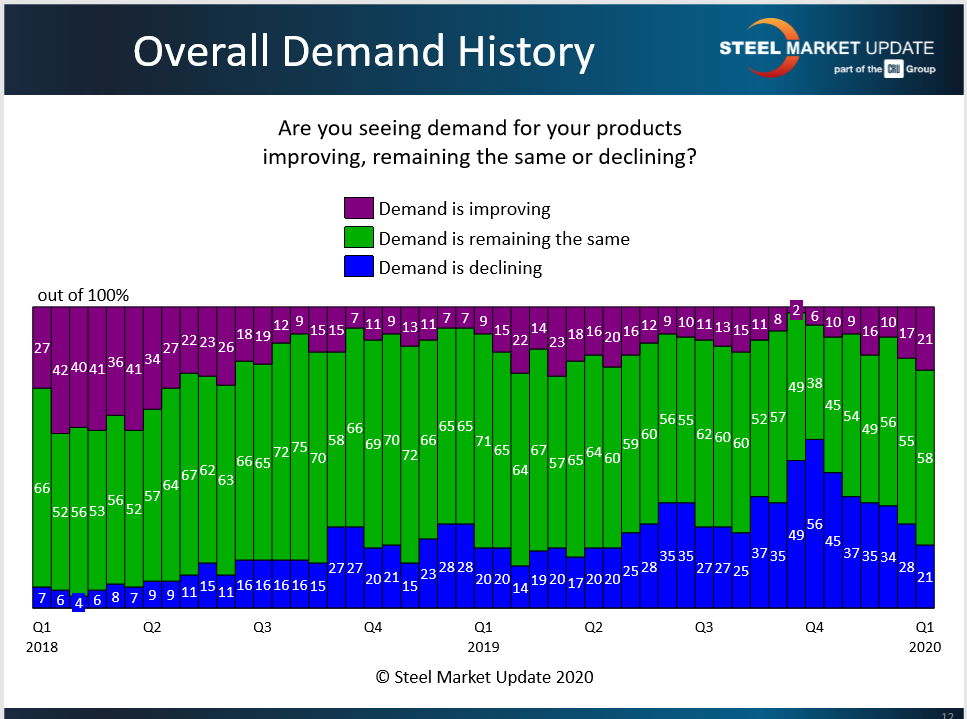

SMU asked: At this time are you seeing demand for your products improving, remaining the same or declining? Fifty-eight percent of respondents said they see demand remaining about the same, while an equal number (21 percent) each reported demand either improving or declining.

Comments show a wait-and-see attitude toward demand as the new year begins:

“Our seasonal slowdown is beginning.”

“Demand for Galvalume seems to be steady and rising slightly in our markets.”

“I am seeing less and less interest in imports or any steel buys for that matter. But its early in the year, so maybe things will improve soon.”

“There’s a seasonal slowdown for first two months of the year. Plus, everyone ended 2019 pretty heavy in inventory or with lots of orders to deliver in January or February from the mills.”

“This is the first full week of 2020, so I expect to see things improve as we get into it and projects start moving again.”

How Much Are the Mills Collecting?

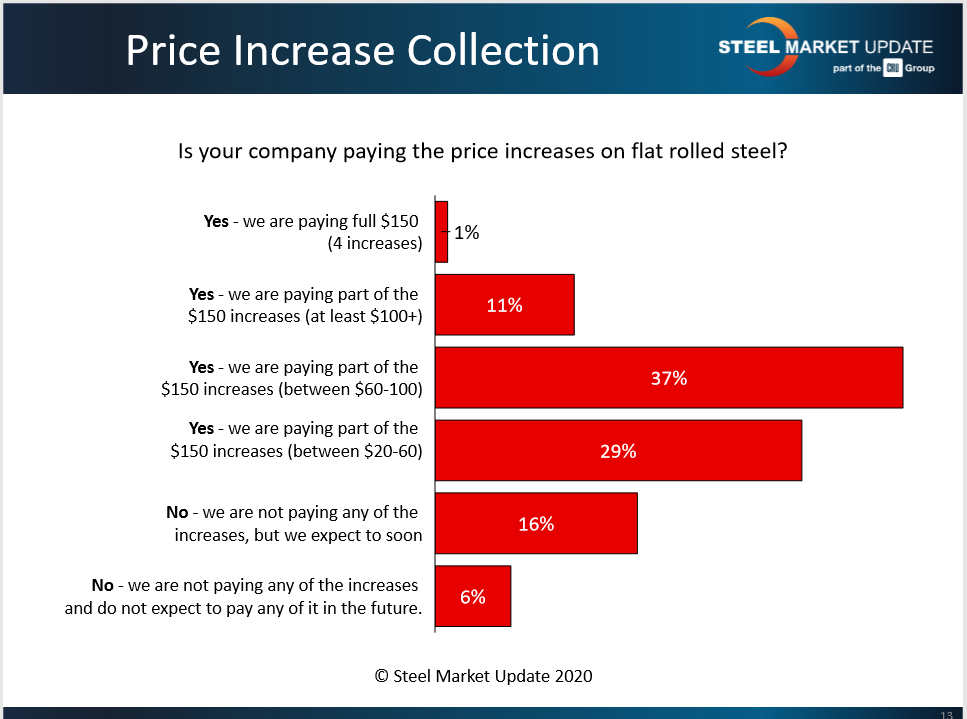

Flat rolled steelmakers have raised prices five times since late October by a total of $190 per ton. But how much have they actually collected? Roughly half the buyers polled by Steel Market Update this week say they are paying an additional $60 or less. Those in the other half are paying anywhere from $60+ to well over $100 more. More than 20 percent say they are not yet paying any upcharge for steel at all. Calculated as a weighted average, the typical increase is approximately $75 a ton.

Following are some buyers’ comments:

“It depends on the product, but for coated it seems to be $40-60 so far.”

“February material is the first increase we will pay and it is up $40 a ton.”

“Most contracts are index-based and lagging. We will ultimately pay what the indexes report for a given month, it’ll just be delayed.”

“We have fixed annual pricing,” which is lower for 2020 versus 2019.

“There was another round of increases announced shortly after this survey. I think the mills have gained more than half of the published increases, which is probably what they hoped. Scrap pricing over the next three months will be a very good indicator of how high the mills will try to move pricing.”