Prices

January 8, 2020

CRU: What’s Happening with Vale’s Northern System Expansions?

Written by Erik Hedborg

By CRU Research Analyst Eduardo Tinti and Senior Analyst Erik Hedborg, from CRU’s Iron Ore Costs

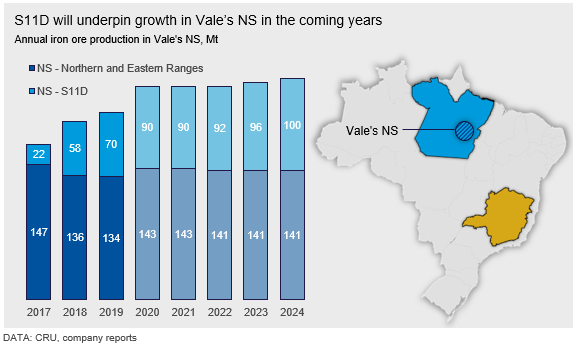

Following suspensions of iron ore production in Minas Gerais, Vale’s Northern System located in the Pará state will account for a growing share of the company’s total production. Despite some supply issues in 2019, production is ramping up and Vale’s S11D is scheduled to reach close to its full capacity of 90 Mt/y in 2020. Vale is also investing in infrastructure to expand S11D’s capacity to 100 Mt/y by 2023. However, there is still plenty of uncertainty regarding Vale’s additional 50 Mt/y expansion project proposal that was announced in May 2019.

Vale’s Northern System Yet to Reach Full Capacity

Vale’s Northern System (NS), located in the Brazilian State of Pará, has over 50 percent of the company’s total capacity and accounted for half (194 Mt) of its 2018 production. After the tragic dam accident at Corrego do Feijão in January 2019, production in the Southeastern System (SES) has been severely affected and, as a consequence, the NS represented 62 percent of Vale’s total production in the first three quarters of the year.

Production in the NS is divided into the older Northern and Eastern Ranges (Serra Norte and Serra Leste) and the newer S11D mine, the latter having one of the largest and the lowest production costs among all of Vale’s mines. S11D’s nominal capacity is currently 90 Mt/y, but the ramp up to full capacity is not yet complete. Earlier last year, Vale guided for ~75 Mt from S11D but, due to poor weather conditions and recent problems related to higher-than-expected phosphorus content in the ore, its 2019 production is estimated to be only ~70 Mt.

Regarding the future of the NS output, Vale has the potential to increase production in three major steps:

- Ramping up S11D production to its current nameplate capacity of 90 Mt/y.

- Expanding S11D’s capacity to 100 Mt/y by 2023, which brings total NS capacity to 240 Mt/y

- Through building new port and rail infrastructure, expanding NS capacity by another 50 Mt/y over the long term.

CRU holds the view that S11D will come close to achieving the first step in 2020 and the 10 Mt/y expansion in step 2 is likely be completed within three to four years. However, there are numerous challenges facing Vale in pushing the total NS capacity beyond 240 Mt/y.

S11D Ramp-Up to Add 15-20 Mt in 2020

Production at S11D started in 2016 and has been steadily increasing ever since. The mine’s output was particularly strong in 2019 Q3, reaching 20 Mt. Production fell slightly in Q4, mostly due to a high concentration of phosphorus in the ore that forced Vale to reduce output and sell more material outside of the normal Carajás fines specification. The company expects to ramp up production at the mine to full capacity of 90 Mt/y in 2020. This is possible, although disruptions linked to heavy rains in Q1 or complications similar to the ones faced in Q4 may jeopardize this goal. Therefore, CRU expects S11D production to be slightly below the 90 Mt target for 2020. In addition, Vale is also planning to regrind more Carajás fines and market this material as GF88 pellet feed, and expects production to increase to 30 Mt/y over the medium term.

Bank Loans to Finance 10 Mt/y Expansion

In 2018, Vale announced a 10 Mt/y increase in S11D’s productive capacity, bringing it to 100 Mt/y by 2022, thereby bringing total NS mine capacity to 240 Mt/y. With this expansion, complementary investments will also be required to align its transport infrastructure, currently at 230 Mt/y, with the higher production levels.

On Nov. 13, the New Development Bank (NDB) announced a $300 million loan to Vale, which will be used mainly to augment the transport capacity of the Carajás Railway. This upgrade is expected to become operational in 2023 and will tie in with the higher S11D capacity.

The NDB is a financial institution formed, funded and managed by the BRICS countries to mobilize resources for infrastructure and sustainable development projects in emerging and developing countries. NDB’s loan represents an important new source of funding for Vale’s capex investments in the future. The Brazilian Development Bank (BNDES), which has been a key source of funding for Vale in the past, has been reducing its balance sheet drastically since 2014 and, at the same time, focusing its resources in areas other than mining. BNDES has been the main funder of greenfield investments in Brazil in the past decades and, with over BRL23 bn in loans contracted since 2004, Vale is one of the bank’s four largest clients. However, due to BNDES’s new directives, the company has not signed any new contracts since 2014.

The investment plans to bring S11D’s capacity up to 100 Mt/y, and overall NS from 230 Mt/y to 240 Mt/y, have a clear and feasible schedule and, therefore, we expect this additional 10 Mt/y to begin to enter the market in 2023.

50 Mt/y Expansion Appears Far-Fetched

In May 2019, Vale’s new CEO, Eduardo Bartolomeo, announced a long-term plan to increase the NS by a further 50 Mt/y.

During the Vale Day presentations held in New York and London in early-December, the company’s executives described a more cautious, staged approach. The company stated that the 50 Mt/y expansion is “on the horizon” and having within it a 20 Mt/y expansion plan already under study. Increasing capacity in the Carajás Southern Ranges, where S11D is located, above 100 Mt/y should be considered an “engineering flexibility plan,” which means the company will have the project plans ready for approval in case market fundamentals indicate there is scope for increasing production without oversupplying the market. However, there is no concrete schedule nor funding in place to indicate that the project will start any time soon. CRU holds the view that any such expansion is unlikely to happen before 2024 and is, therefore, not included in our medium-term base case.

A more in-depth analysis on Vale’s NS expansion beyond 240 Mt/y will be available to CRU Long Term Iron Ore Market Outlook subscribers at end-January.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com