Market Segment

January 7, 2020

CMC Optimistic Heading into 2020

Written by Sandy Williams

Commercial Metals Company is looking forward to a steady construction market in 2020 for its merchant bar and rebar products.

“We are positioned to continue benefiting from the positive trends in our core markets and remain optimistic about the construction market, as many of the macro indicators we monitor point to resilience ahead,” said President and CEO Barbara Smith.

Smith cited year-over-year growth in construction spending, particularly in public projects and state and local highway spending, as well as customer confidence in CMC’s core markets.

“Finally, our own bidding activity remains strong, offering encouragement that the pipeline of work is solid,” said Smith. “I would further add that our fabrication backlog sits at a healthy volume and pricing levels. The average price per ton in our backlog is up nearly $100 from one year ago, and we expect it to be profitable when shipped given current rebar prices.”

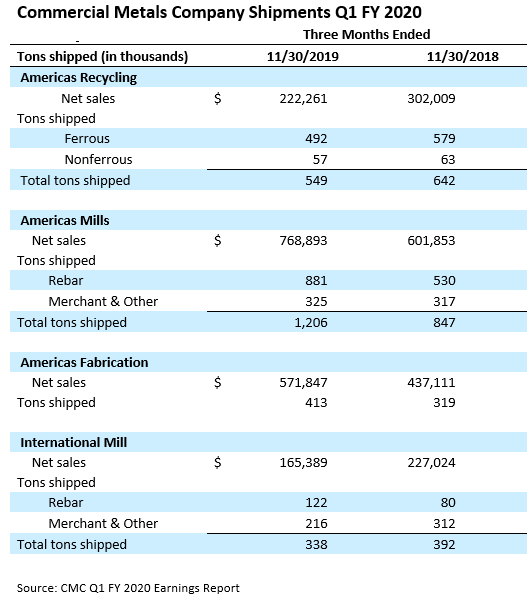

CMC reported earnings of $82.8 million in the first quarter of FY 2020, ending Nov. 30, 2019, compared to $19.4 million in Q1 FY 2019. Net sales increased 8 percent year-over year to $1.4 billion.

The acquired Gerdau fabrication assets were integrated flawlessly and were profitable in the first quarter, opening up opportunities due to a “much larger amount of available capacity,” commented Smith. CMC continues to optimize product mix with higher value-add products, including spooled rebar. Domestic mill shipments increased 14 percent in Q1 compared to the first quarter of 2019.

The closure of the melt operations at Rancho Cucamonga was a difficult decision driven by high energy and compliance costs in California. The measure is expected to lower the cost of finished rebar from the facility as well as support utilization rates at other CMC mills.

CMC’s Polish operations are performing well, and EU funding for infrastructure investment through 2023 will benefit rebar demand. A weaker manufacturing market in Germany, however, will negatively affect exports of wire rod and merchant products. The segment is also pressured by imports.

During the earnings call, Smith said European safeguard measures have not been effective and shifting to a quota system caused further disruption to the market.

“I think initially they were effective,” said Smith. “It was when the EU converted to the quota system that it started to disrupt that market more. And as you know, they have adjusted that quota system to take into account some of the abuses they were seeing.”

Quotas for the year were met in July and those products are currently working their way through the system. CMC is monitoring what effect it may have on the market.

“But certainly, one would expect, as that material flows through, that it would give the domestic producers more opportunity,” said Smith, “and we would look to take advantage of that.”

The America Mills segment reported adjusted EBITDA of $155 million in Q1 2020 compared to $113.9 million in Q1 2019. Shipment volumes increased due to contributions from the acquired Gerdau mills. Selling prices dropped $34 per ton in the fourth quarter, but were offset by a $20 per ton reduction in ferrous scrap that allowed the mills to maintain high metal margins of $385 per ton. Margins were $10 higher than a year ago, but down $14 per ton from the previous quarter.

“Average selling prices of $976 per ton increased by $108 compared to the first quarter of 2019. High-priced work booked more recently has replaced the lower-priced projects awarded prior to the Section 232 tariffs being implemented,” said CFO Paul Lawrence. “Our backlog is favorably priced, and we expect it to be profitable when shipped in future quarters.”

Manufacturing costs are expected to increase $10 to $15 per ton due to maintenance outages planned in the second quarter.

The flow of products increased from Mexico following the removal of Section 232 tariffs, but is not a concern at this stage, said Smith. CMC is looking forward to a favorable Commerce decision on a circumvention case regarding a fabricated product that was initiated before the elimination of the tariffs.

Smith said it is impossible to catch all abuses of the trade system, but good intelligence and acquired knowledge of the loopholes countries exploit has made a difference.

“But I think the good news is that we have an administration that is committed to stopping these abuses when they see them,” said Smith. “And I think that the actions, thus far, have been pretty effective.”

“And I should also point out, there have been some changes to the existing trade, I don’t want to say, laws, but the rules associated with administering those laws, that are more helpful when we do find situations of abuse. And it will be helpful in future trade cases on a go-forward basis. So, it’s just a process of being extremely diligent and working together with our peer companies and the SMA and our trade attorneys to share all of that good intelligence.”