Market Data

January 4, 2020

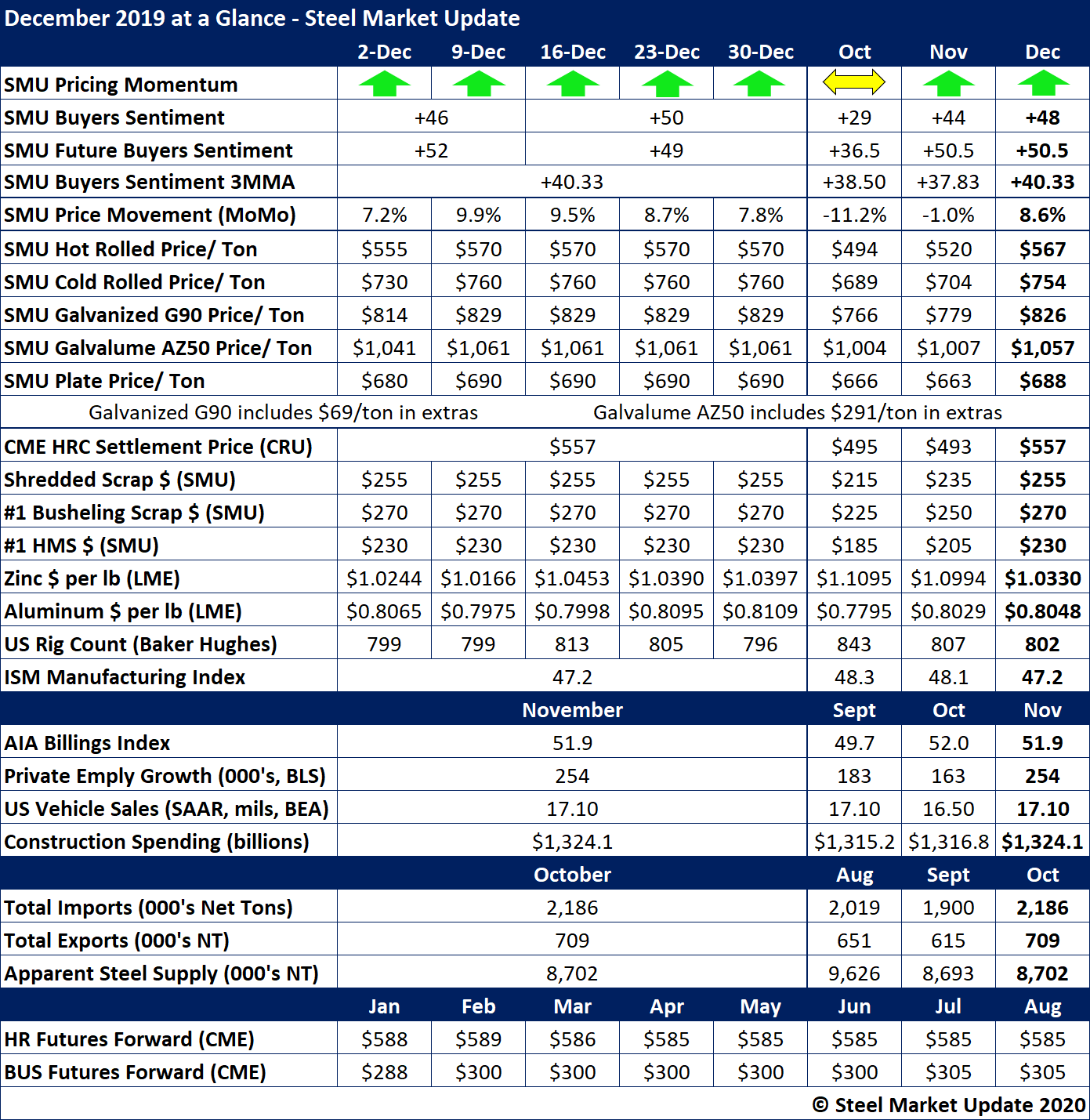

SMU's December At-a-Glance

Written by Brett Linton

The industry finished 2019 with steel prices on the rebound. Steel Market Update’s Steel Pricing Momentum Indicator pointed upward in December as the mills worked to collect higher prices announced in four waves beginning in late October. The benchmark price for hot rolled steel rose to more than $570 per ton by the end of December from less than $500 at the beginning of the fourth quarter, supported by rising scrap prices. Producers and distributors are hopeful the trend will continue into January.

Higher prices and prospects for better margins improved steel buyers’ sentiment in the fourth quarter, but readings in the 40-50 range in December remained well short of the more optimistic levels of a year ago. Concerns about steel demand weighed on market sentiment last month. Key indicators, such as the ISM Manufacturing Index, which was in contraction at less than 50.0, and the U.S. rig count, which continued to trend downward in December, raise questions about the health of steel consumption in 2020.

See the chart below for other key metrics in the month of December: