Market Data

January 3, 2020

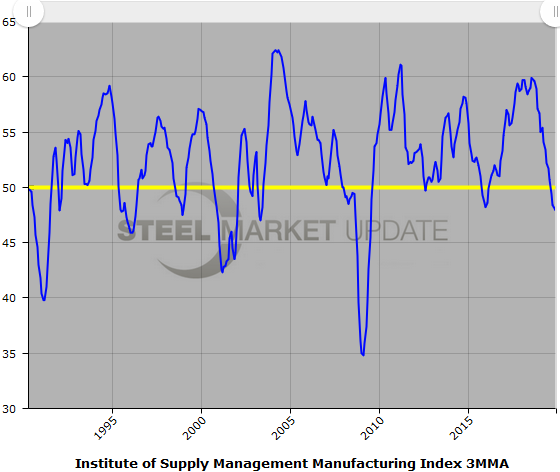

ISM Manufacturing PMI Contracts Again in December

Written by Sandy Williams

The December Manufacturing ISM Report on Business showed economic activity contracting in the U.S. last month. The PMI fell 0.9 points to 47.2 percent and its lowest reading since July 2009. A PMI below 50 indicates business is contracting and a reading above 50 indicates expansion. The December PMI marks the fifth consecutive month of contraction.

“Global trade remains the most significant cross-industry issue, but there are signs that several industry sectors will improve as a result of the phase-one trade agreement between the U.S. and China,” said Timothy Fiore, chairman of the ISM Manufacturing Business Survey Committee.

The subcomponents of the PMI mostly fell in December. New Orders, Production and Employment contracted at faster rates.

Production, at a reading of 43.2 in December, was at its lowest reading since April 2009. Only three of 17 industries surveyed reported production growth in December: food, beverage and tobacco, and machinery.

The new export orders index dipped 0.5 points to 47.3. Transportation equipment was noted as the weakest among the six big industries. Imports were also in contraction at 48.8, but rose 0.5 points in response to shipping before the Lunar New Year in Asia. “This dynamic is offset by the impacts associated with matching inventory and new-order inputs, as well as the overall effects of reshoring activity that began in 2019,” said Fiore.

Supplier deliveries continued to become more difficult in December, registering 2.5 points higher at 54.6 percent.

Raw material inventories contracted for a seventh month but at a slower rate. Customer inventories were considered too low for the 39th month.

“Prices increased in December supported by steel, copper and aluminum price growth, as manufacturers placed orders for 2020 demand,” said Fiore. “Prices registered their highest level since May 2019 when the index recorded 53.2 percent.”

Comments by survey respondents included:

- “Down month-to-month, but up over last year.” (Miscellaneous Manufacturing)

- “Anticipated large export orders did not materialize. As a result, expected U.S. production has decreased.” (Fabricated Metal Products)

- “Dealer inventories have rebounded, and overall customer market has softened, resulting in corrections to near-term production schedules and a tentative forecast outlook.” (Machinery)

- “Backlog of orders is shrinking due to new order pace continuing to fall.” (Computer & Electronic Products)

- “Cautiously optimistic is the rule these days. Sales are decent, but we’re wondering what 2020 will bring. Still hedging that it will be successful — but maybe not as much as this year.” (Transportation Equipment)

- “Export markets continue to weaken for plastic resins — Mexican producers are actually trying to sell product back into the U.S. due to weak in-country demand.” (Plastics & Rubber Products)

- “The construction market seems to have slowed for end of year. Overall, it’s marginally up.” (Nonmetallic Mineral Products)

Below is a graph showing the history of the ISM Manufacturing Index on a three-month moving average. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.