Prices

January 2, 2020

CRU: 2020 Multi Commodity Outlook

Written by CRU Americas

By Peter Ghilchik, Head of CRU Multi Commodity Analysis and Production, from CRU’s Global Steel Trade Service

CRU expects a return to commodity demand growth in 2020, albeit a weak recovery, as industrial production growth recovers to 2.2 percent; however, risk is heavily weighted to the downside. Economic uncertainty, weak demand and an increasing focus on the costs of environmental policies played on the market in 2019. There is no end in sight for the U.S.-China trade war and further monetary policy easing is expected. Could we be at the bottom of the commodity price cycle? It depends on where you look.

Here is a brief run through CRU’s 2020 outlook for some key commodities.

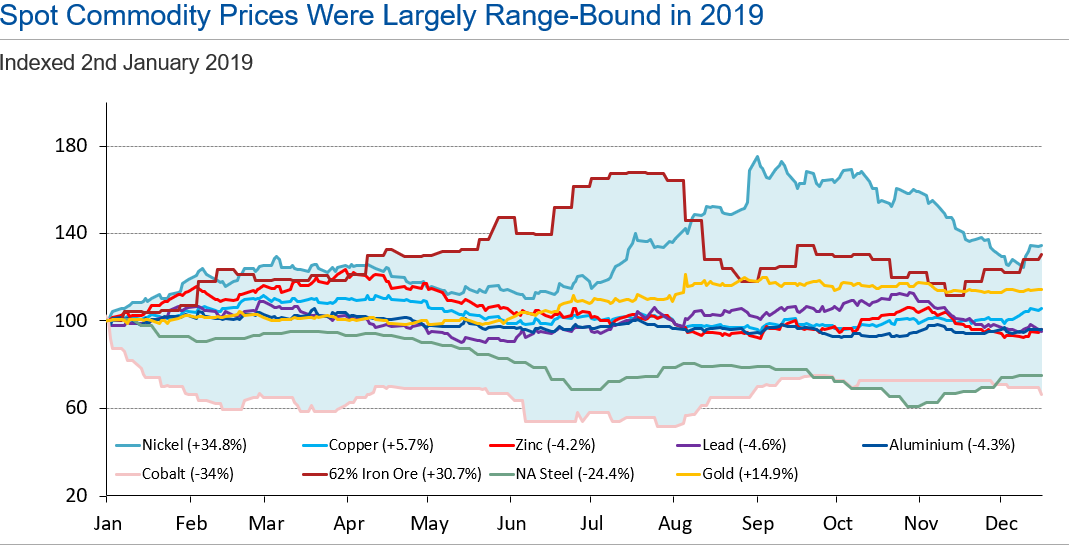

Metals prices were largely rangebound over 2019, the exceptions to this being iron ore and nickel, which rallied on the back of supply issues. For iron ore it was the Brumadinho dam disaster in January at Vale’s Córrego do Feijão iron ore mine that initially sent the price flying, and nickel has been held up by the Indonesian government’s ore export ban. The big fallers were cobalt, which fell precipitously as the higher prices that were fueled by investor overexuberance couldn’t hold as artisanal mining supplied the market; and steel…

Steel – Bottom of the Cycle or Worse to Come?

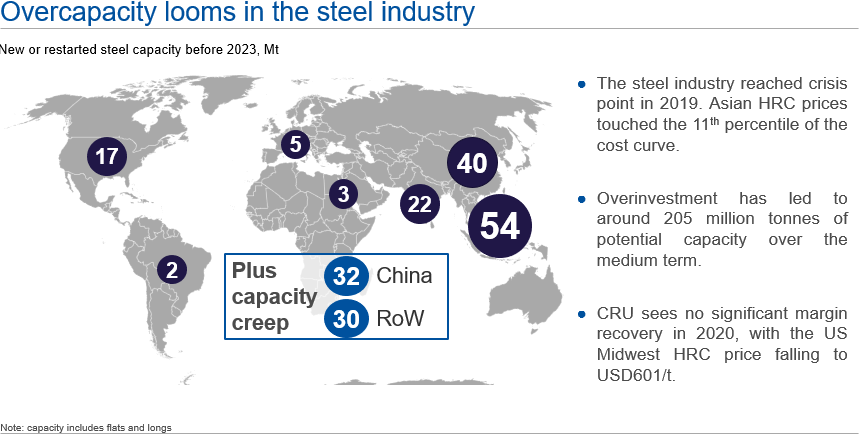

The steel industry reached crisis point in 2019, with Asian HRC prices at the 11th percentile of the steel cost curve. Although steel output fell, production cuts were too little, too late, and producers attempted to ride out the storm. High profits made in 2017-18 provided impetus for investment and there is around 205 million tonnes of potential capacity. Some of this new capacity will inevitably be delayed, but CRU sees no significant margin recovery in 2020, with U.S. Midwest HRC prices falling to USD601/t.

Flat Demand Will Pressure Metallurgical Coal Prices

The period of extreme profitability in the coal industry has come to an end and capital is still being spent to develop additional metallurgical coal supply. CRU expects global demand will remain flat and, in combination with improved supply, CRU forecasts prices will fall by 13 percent in 2020 to average USD160/t.

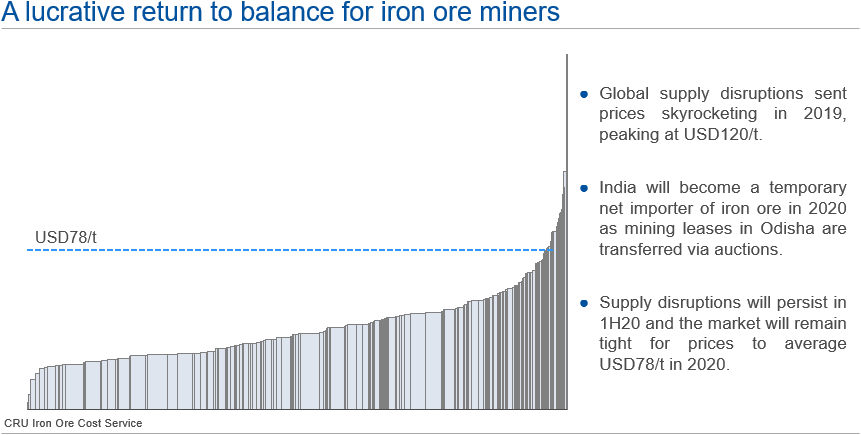

A Highly Profitable Return to Normality for Iron Ore

The tragic events of the Brumadinho dam disaster, along with a series of global supply disruptions from flooding, fires and cyclones, drove the iron ore price to a high of USD120/t in July 2019. Prices soon fell as a weak steel industry and macro concerns coincided with improved supply. CRU expects prices will continue to fall into 2020, but Rio Tinto’s and BHP’s operational issues will persist, and India will become a net importer of iron ore as mining leases are transferred via auctions. Although CRU sees improving supply and demand fundamentals in 2020, the market will remain relatively tight and the 62% CFR China prices will fall from a high base to average USD78/t in 2020.

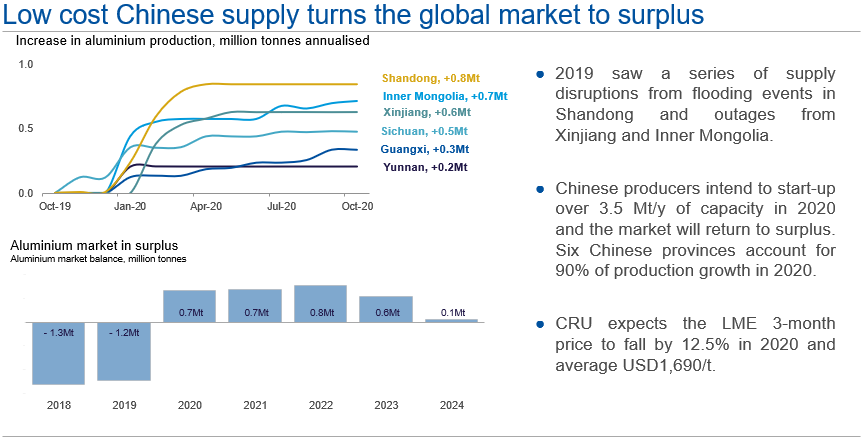

Profitable Chinese Aluminum Producers Supply Export Markets in 2020

The Chinese aluminum industry experienced a series of disruptions from flooding events in Shandong and unexpected outages from Xinjiang and Inner Mongolia in 2019. As a result, Chinese producers intend to start up over 3.5 Mt/y of capacity in 2020, and China’s market balance will be shifted into surplus putting pressure on global prices. The combination of weak demand and resurgent Chinese supply growth will return the aluminum market to surplus in 2020. Prices will fall by 6.2 percent to average USD1,690/t in 2020.

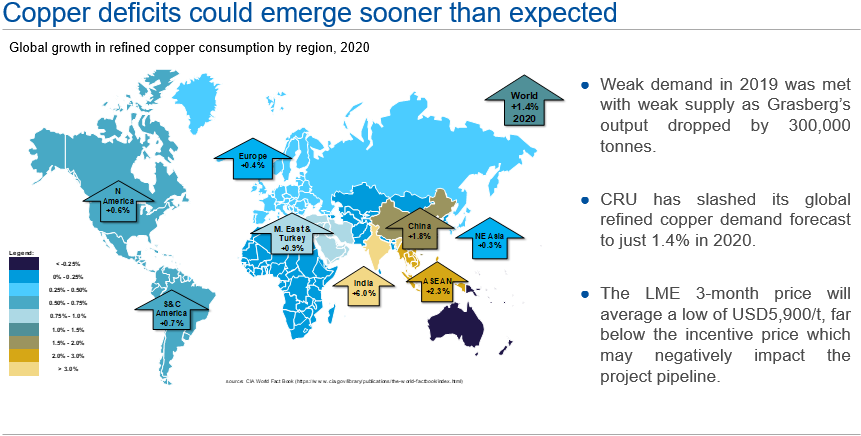

Copper Below Incentive Price to Keep Project Pipeline Thin

Weak demand in 2019 was met with weak supply, following a 300 kt loss in Grasberg’s production as it transitions underground. Mine supply will rebound in 2020, but disruptions will continue to be high. CRU slashed its global refined copper demand forecast for 2020; however, although we expect a mathematical surplus, the market will remain essentially balanced in 2020 and the LME 3-month copper price will hit a low of USD5,900/t. With the copper price below that needed to incentivize new investment, the project pipeline will remain weak over the medium term.

Nickel Prices Up and Onwards into 2020

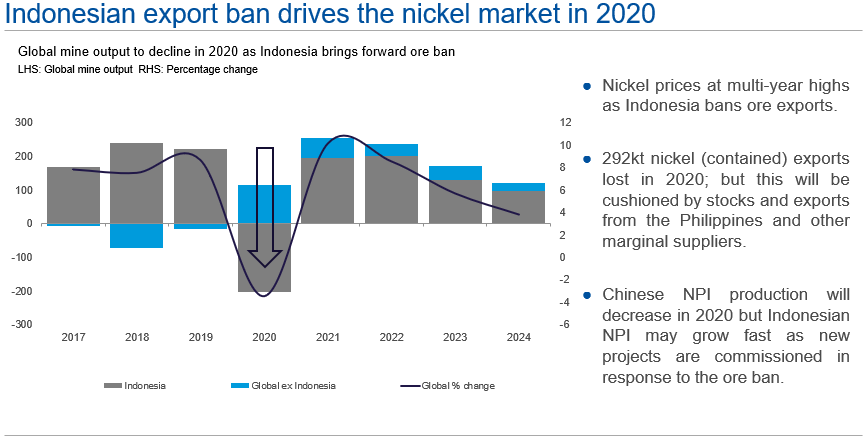

The early onset of the Indonesian ore exports ban led nickel prices to trade at multi-year highs on fears this will impact Chinese nickel pig iron (NPI) production and potentially result in a larger deficit in 2020. CRU believes the loss of around 292kt of contained nickel export volume will be cushioned by a stock drawdown and increased exports from the Philippines and other marginal suppliers. Indonesian NPI production may grow faster than expected in 2020 as new projects are commissioned in response to the ore ban. Lower stainless production will impact nickel demand in 2020, reflecting the bleak global macroeconomic outlook and an expectation of a marginal scrap usage increase. Prices will continue to rise to average USD15,520/t in 2020.

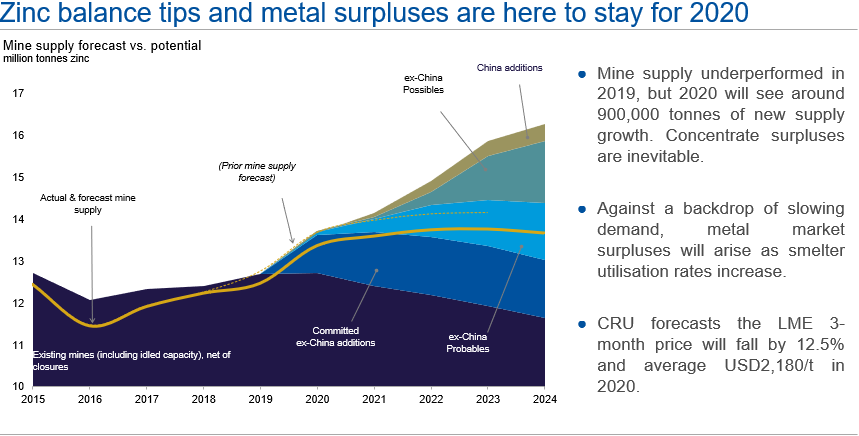

Zinc Metal Market Surplus is Here to Stay

Mine supply underperformed expectations in 2019, with many large operations increasing production far slower than guidance. 2020 is set to see around 900,000 tonnes of mine supply growth and, although there is a risk of higher disruption, further concentrate surpluses are inevitable in 2020. Against a backdrop of slowing demand, metal market surpluses will arise as smelter utilization rates increase. CRU expects price-related cuts will accelerate from the early 2020s to bring the market back to balance. CRU forecasts the LME 3-month price will fall by 12.5 percent to average USD2,180/t in 2020.

Peaks and Troughs – Where Will Cobalt Settle in 2020?

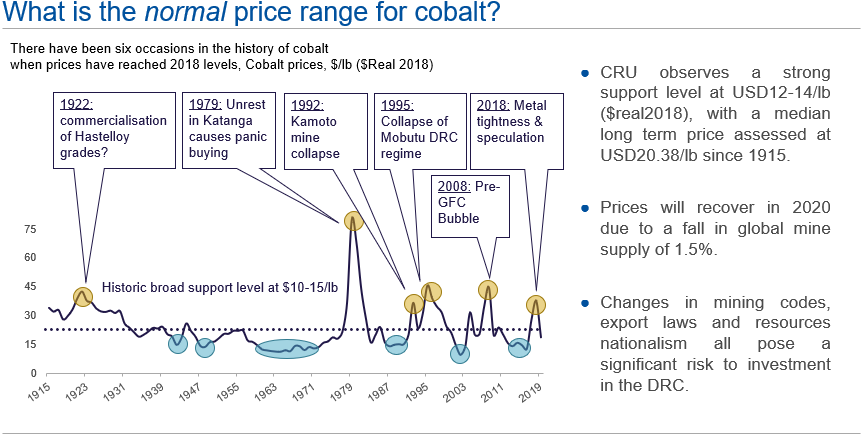

The most frequently asked question in 2019. CRU observes a strong support level at USD12-15/lb ($real2018), with a median long-term price assessed at USD20.38/lb since 1915. CRU expects prices will recover to average USD19/lb in 2020. This is due to a fall in global mine supply of 1.5 percent. Mutanda, the largest cobalt mine in the world, will close in 2020. However, this comes as several other mining operations ramp-up capacity. Changes to mining codes, export laws and even resource nationalism all pose a significant risk to investment appetite in the DRC.

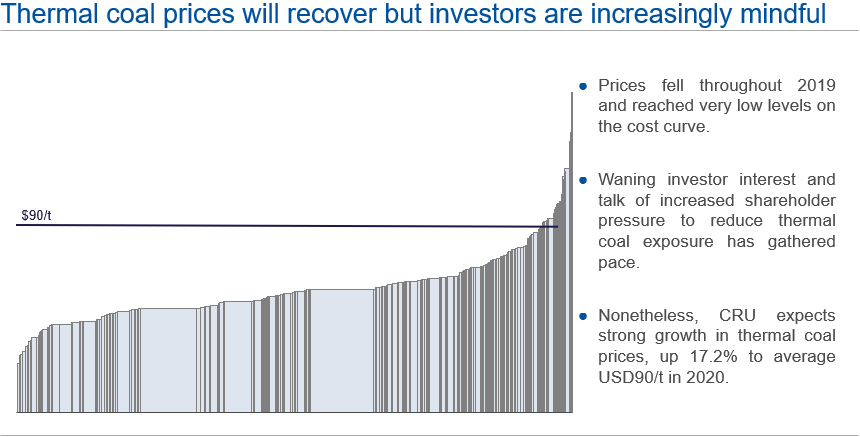

Thermal Coal – Prices Recover as Investors Depart

Prices fell throughout 2019 and reached very low levels on the cost curve. Waning investor interest and the talk of increased shareholder pressure on mining majors to reduce their coal exposure has gathered pace. Nonetheless, CRU expects strong growth in thermal coal prices, up 17.2 percent in 2020 to average USD90/t FOB Newcastle 6,000.

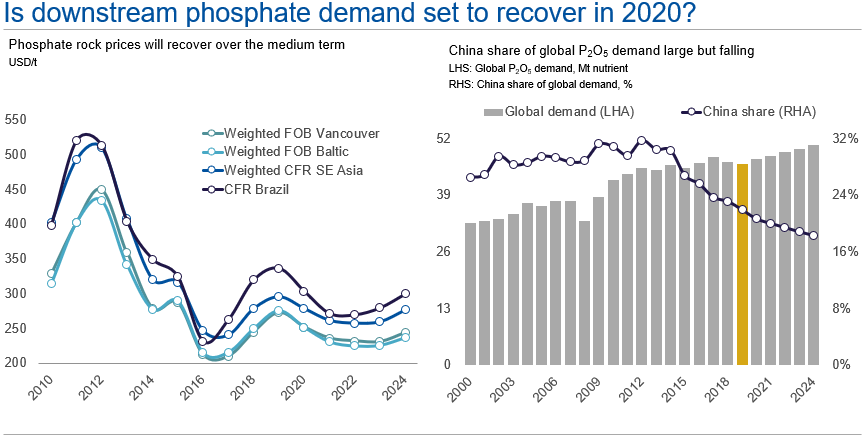

Phosphates – Is Downstream Demand Set to Recover?

Phosphate rock demand was weak in 2019 due to unfavorable weather, oversupply and plentiful downstream phosphate inventories. Rock inventories are near a two-decade high and so prices will fall to $90/t FOB Morocco in 2020. Phosphate fertilizer production cuts and rising demand should start to erode global inventories, and so we expect prices to stabilize in 1Q20 and then rise to average $318/t DAP FOB China in 2020.

Potash – Slowdown in 2019 But Strong Growth for 2020?

In 2019 the potash market experienced slower than expected demand in H1 and a decline in global spot prices. Strong growth in global MOP demand is expected in 2020, 2.7 percent higher year-on-year, driven by increases in all major markets. Global spot prices are set to decline until 2022 as supply increases but slower demand growth flattens the market balance. CFR Brazil spot price is expected to reach USD304/t in 2020.

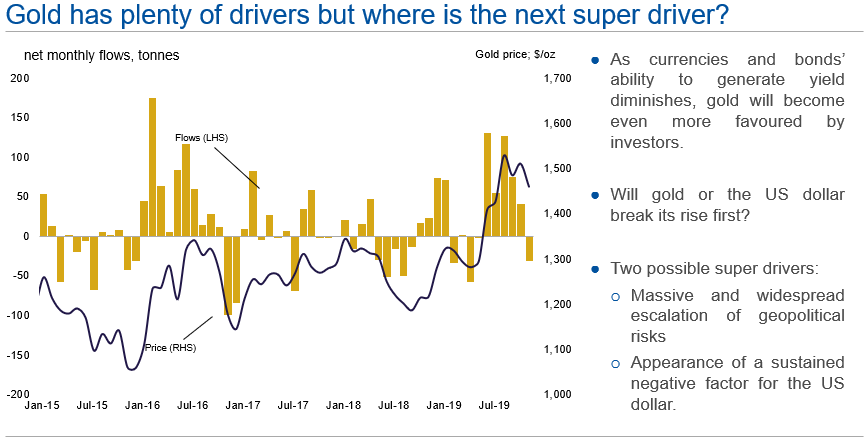

“Who Stole My Super Driver?” – Gold

As currencies and bonds’ ability to generate yield diminishes, zero-yielding assets such as gold will become even more popular with investors. In order to sustain a bull market, gold requires a super driver. There are two potential candidates for this: a massive and widespread escalation of geopolitical risks or the appearance of a sustained negative factor for the U.S. dollar. CRU forecasts prices to rise by 13.2 percent and average USD1,579/oz in 2020.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com