Government/Policy

December 14, 2019

Global Trade Restrictions at Historical High

Written by Sandy Williams

A new report by the World Trade Organization shows trade restrictions by WTO members are at historically high levels.

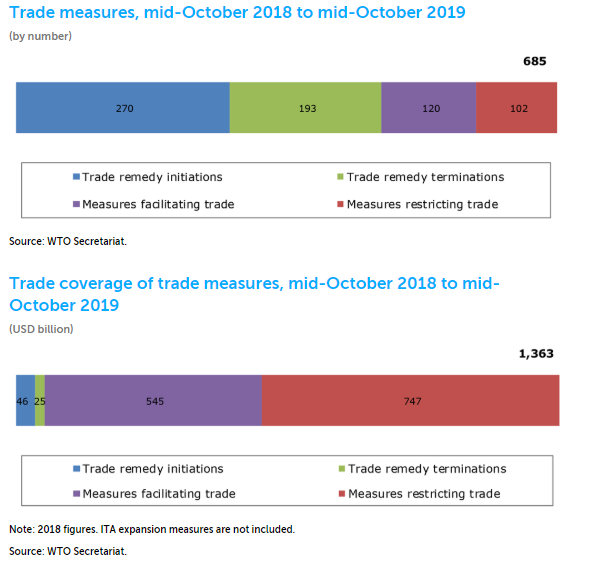

Between mid-October 2018 and mid-October 2019, the trade coverage of import-restrictive measures implemented by members was estimated at $747 billion, an increase of 27 percent from the prior year and the highest level since October 2012. Trade measures increased in the second half of the year as a result of anti-dumping investigations. WTO members implemented 102 new trade-restrictive measures during the review period, adding to those already in place.

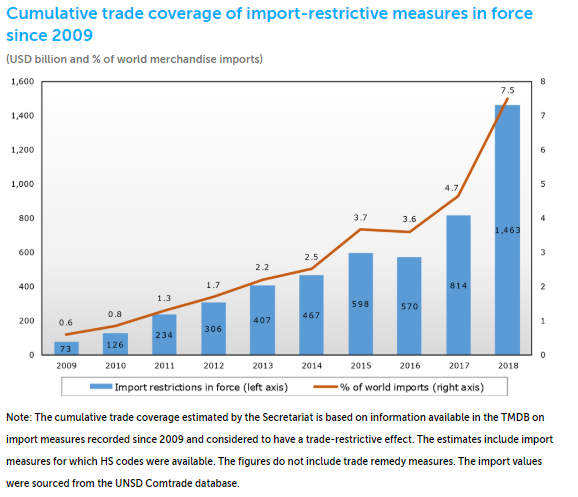

The WTO estimates that 7.5 percent of the world’s imports are affected by import restrictions that have been implemented since 2009–an estimated $1.7 trillion by mid-October 2019 compared to $1.5 trillion at the end of 2018.

“The report’s findings should be of serious concern for WTO members and the broader international community,” said WTO Director-General Roberto Azevêdo. “Historically high levels of trade-restrictive measures are hurting growth, job creation and purchasing power around the world. Strong collective leadership from the membership would make an important contribution to increasing certainty, encouraging investment and bolstering trade and economic growth. Without such action, however, unfavorable trends could become worse.”

WTO members also implemented 120 new measures aimed at facilitating trade. The trade coverage of the import-facilitating measures introduced by WTO members during the review period was estimated at $544.7 billion, the second highest level since October 2012.

Steel Trade

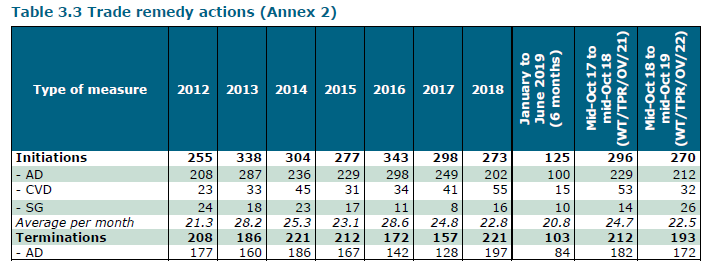

During the review period, the WTO recorded 463 trade remedy actions by WTO members. Initiation of antidumping investigations decreased 23 percent during the last review period to a total of 179 compared to 233 in the 2018 period. AD investigations were led by metal products. In each of the last three review periods, at least 65 initiations targeted metals, with 75-92 percent focused on steel products. The number of AD initiations on metal products accelerated during the last review period.

Initiation of countervailing investigations decreased significantly in the most recent period, dropping from 42 to 37 with 90 percent of the investigations conducted concurrently with antidumping investigations. The U.S. initiated 63, or 50 percent, of CVD investigations over the last three reporting periods, including 18 in the most recent period. Of the 45 investigations specifically targeting steel products during the past three periods, the U.S. initiated 24.

It was also noted that during the last review period, the United States applied global safeguard measures on solar cell products and large residential washing machines, enacted steel and aluminum tariffs under Section 232 of the Trade Expansion Act of 1962 related to U.S. national security, and took action against China under Section 301 of the Trade Act of 1974. WTO members raised concerns regarding the introduction of new “Buy American” provisions with respect to government procurement legislation.

“The low uptake of international standards in the United States, which may result in unnecessary trade barriers, was noted,” said the report, “as well as the level of protection of geographical indications that some considered insufficient.”

World Trade Growth Slowing

World trade growth stalled during the first half of 2019, said the WTO in its report. Volume of merchandise traded year-over-year fell to 0.6 percent from 2.4 percent in the second half of 2018 as trade tensions continued to escalate.

On Oct. 1, 2019, the WTO downgraded its forecast for world trade growth in 2019 to 1.2 percent and 2.7 percent for 2020. “World real GDP at market exchange rates is projected to increase by 2.3 percent in both 2019 and 2020,” noted the WTO. “If these estimates are realized, trade volumes will only grow half as fast as world GDP in 2019.”

Note: all charts sourced from WTO Secretariat