Prices

December 10, 2019

CRU: Raw Materials Prices Continue to Decline

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

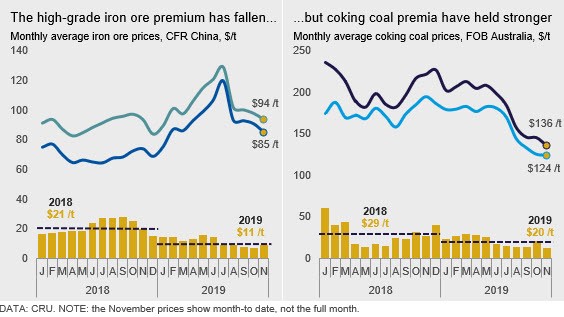

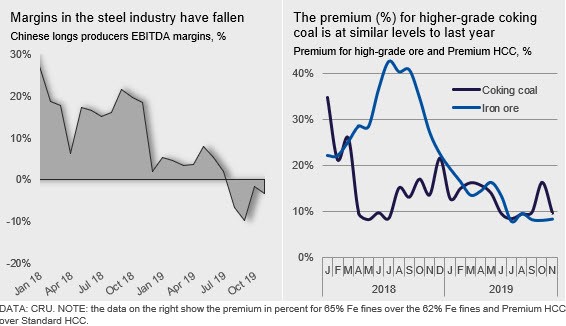

Throughout 2019, steelmakers’ willingness to pay higher prices for premium quality steelmaking raw materials has diminished. For iron ore, the spread between 65% and 62% Fe fines has fallen to $8 /t in Q4, well below the $28 /t peak in 2018 Q3. The quality premium for coking coal has also declined, although to a lesser extent. Premium hard coking coal (HCC) is currently trading at $12 /t above the standard HCC price. Although this is the lowest level in years, recent price falls across all coking coal products mean the relative premium, expressed in percent above the standard price rather than U.S. dollar spreads, has been relatively steady. In fact, the relative premium for higher quality coking coal is at similar levels to those in mid-2018, a time when steel industry profitability peaked.

Quality Premia—More Than Just Steel Profitability

One common misconception is that the quality of the steel is impacted by the input materials. This might be true in some cases, as lower-grade materials have higher impurity levels that, in some instances, feed into the finished steel product. However, the main reason for preferring higher-quality material, especially for iron ore, has to do with blast furnace (BF) productivity. When the steel industry is profitable, steelmakers will strive to maximize output and “speed up” their BFs. This typically means that steelmakers value higher-grade material more in a profitable environment and are willing to pay a premium to maintain the share of higher-grade material. However, steel margins alone do not fully explain why demand for quality materials changes over time.

In addition to other demand factors, the supply side must also be considered. For iron ore, the elevated premium since 2017 has resulted in a large number of new high-grade projects in the pipeline, including assets that were producing during the 2010–2014 price boom. In coking coal, most of the projects in the pipeline are standard HCC and not premium HCC.

Coking Coal: Multiple Factors Drive Premia

As highlighted in our recent Insight on this topic, there are many other factors, barring steel margins, that affect the high-grade HCC premium. Of relevance, there are a number of ways to lift BF productivity, for example, by extending heating times in coke ovens, which results in harder coke that will improve the structure of the BF burden mix. This will impact on the required coal blend used in coke making and, therefore, demand for premium HCC. An alternative is to use higher rates of pellet, which allows the steelmakers to reduce coke consumption (n.b. and, therefore, also coking coal consumption) and raise PCI rates, but this impacts on coke quality requirements.

Iron Ore: Profitability and Coking Coal Prices Play a Role

The premium for higher-grade iron ore over the 62% Fe index shows a strong correlation with steel industry profitability, much more so than in its impact on the premium for higher-quality coking coal. Besides supply of high-grade iron ore, another important factor is the coking coal price in China. The incentive to use higher-grade iron ore increases as coking coal prices rise, as higher rates of premium ore reduce coking coal consumption. However, it is important to remember that Chinese steel mills have a relatively low exposure to seaborne coking coal prices as over 90 percent of the country’s demand is met by domestic supply. In the second half of 2019, we have observed how the Chinese coking coal price has not fallen as much as seaborne prices, which means that Chinese mills are currently more incentivized than steelmakers in other regions to use high-grade ore as a way to offset high coking coal prices.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com