Prices

December 7, 2019

CRU: Longs Prices on the Rise as Buyers Restock

Written by James Campbell

By CRU Principal Analyst James Campbell, from CRU’s Long Products Monitor

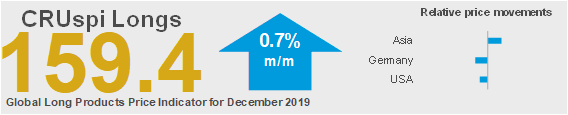

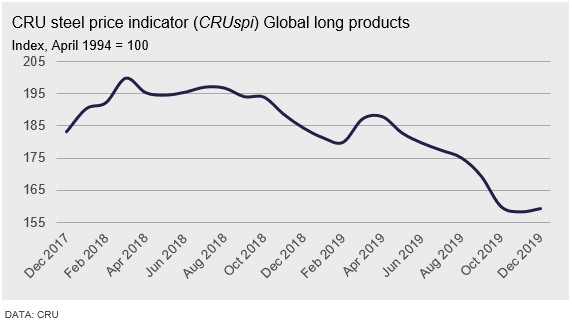

Steel longs prices have changed direction this month with rises now observed in many markets. Although underlying demand has improved in some regions it is still weak elsewhere. Buyers in many regions have restocked in the last month while producers exposed to scrap and billet have started to pass on higher costs, aided by tighter supply. Overall, the Global Long Products Price Indicator (CRUspi Longs) increased by +0.7 percent m/m to 159.4 in December 2019.

Demand Fast-tracked Before Year End in Some Regions…

Buying activity in the long products market has strengthened this month. In some regions this is driven by restocking, but in others there are now signs of improving underlying demand. The real demand success story is in India. The Indian market is experiencing a revival in demand following government stimulus measures to ease liquidity issues and kickstart previously announced infrastructure projects. This is now happening: government spending has increased, and construction projects are being fast-tracked for completion before the end of the fiscal year in March. These factors have combined to boost sentiment, and with it, price. There are also positive signs in Brazil where demand continues to improve. Along with a depreciating real, this has allowed producers to push prices 2 percent higher m/m, with further rises targeted for January.

The Chinese domestic market is experiencing stronger buying activity as projects are fast-tracked. Developers are taking advantage of milder than expected weather to speed up construction projects ahead of the year end. Projects face additional time pressure compared to last year as Chinese New Year is 10 days earlier this year.

… in Other Regions Restocking and Higher Costs Pushed Prices Higher

In other regions, restocking has been the key driver. In Europe, buyers restocked heavily at the price floor at the end of October for projects due to start in early 2020. With orderbooks now strong, domestic mills were able to raise prices and sustain this level throughout November. However, there has been little purchasing activity at this level as restocking is complete and activity is seasonally lower in the winter.

Restocking ahead of the holiday season has also pushed prices higher in Southeast Asia, although here higher costs were the main driver. Scrap and billet have both trended higher and this has in turn pushed finished steel prices higher. However, in the absence of any improvement in underlying demand, the rebar price rise has stalled following the completion of the restocking cycle. Buyers there now have enough inventory until January.

Supply More Balanced as China Pulls in Imports

Prices for other products have found support from China. Southeast Asian producers have started to export billet and wire rod to China. Producers in the region have now exported 900kt of billet to China in 2019 YTD, enough to ease supply competition in the region.

Lower than expected demand in 2019 has resulted in producers in many regions facing weak orderbooks. This has led to steelmakers cutting production. These production cuts are now starting to affect market supply. Although the effects are most pronounced in regions where demand is improving, such as India, it has also tightened supply in the Middle East, where demand remains weak.

Outlook: Further Improvement in Demand Still Needed

Last month we asked if prices were near the turning point. A month further on and that turning point has been reached in most markets, although as explained above the reasons are different region by region. In the Northern Hemisphere, we are now in the seasonally weak winter period. With the exception of the U.S. and India, the current restocking cycle has finished so it is unlikely to provide further support in December.

Scrap prices look set to increase further in the U.S. this month, and if replicated elsewhere could provide further support to steel prices in the short-term. However, underlying demand remains the problem and for price rises to stick, or increase further in 2020, we need to see underlying demand improve.

China is a wild card. Although demand is strong right now, it is expected to weaken over the winter, meaning less support for price and potentially a short-term refocus on export markets. However, supply may still be restricted. The government has recently started an investigation into the increase in steel capacity (see our recent – China’s steel capacity probe may need timely action to prevent a crisis ). The result of this investigation may be to restrict or close down unneeded or unapproved capacity. All eyes are on China this winter.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com