Government/Policy

December 5, 2019

CAMMU: Tariffs on Brazil and Argentina? It’s Complicated

Written by Sandy Williams

Editor’s note: President Trump’s surprise decision to impose 25 percent tariffs on steel and aluminum imports from Argentina and Brazil stunned the industry and leaves many questions unanswered. Paul Nathanson, executive director of the Coalition of American Metal Manufacturers and Users (CAMMU), addressed the issue in the following op-ed:

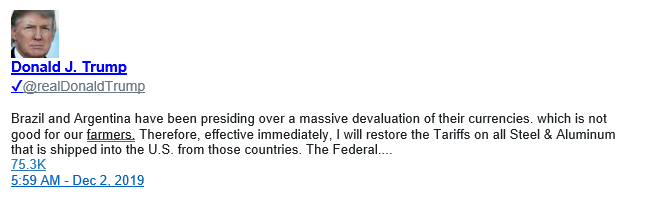

President Trump announced via tweet on Monday that he was imposing tariffs on steel and aluminum imports from Brazil and Argentina due to both governments devaluating their currencies. These two countries previously had reached a deal with the Trump administration to avoid Section 232 steel and aluminum tariffs by agreeing to quotas. The president tweeted:

The announcement caught everyone (including the governments of Argentina and Brazil) by surprise. It has also created some confusion and raises many questions.

Steel Tariffs as a Weapon in a Trade War

Both Argentina and Brazil were exempted from the S232 steel and aluminum tariffs in May 2018. The tariffs can’t be “restored” because the two countries were not subject to tariffs in the first place. The exemptions for both countries required Presidential Proclamations. To change the quotas to tariffs would require new Presidential Proclamations as tariffs can’t be re-imposed by a tweet. At this writing, we are still awaiting these proclamations.

If the president does move forward with these tariffs, it would likely lead to an immediate legal challenge. A current U.S. Court of International Trade case (Transpacific Steel v U.S.) is focused on this exact issue of whether the president can modify Section 232 import restrictions. The case involves an earlier decision by President Trump to raise the Section 232 steel tariff on Turkey to 50 percent.

In a preliminary opinion that was issued to deny the U.S. government’s motion to dismiss the case, the court ruled against the president’s actions against Turkey because (1) he did not give a reason for raising the tariff only on Turkish steel imports that was related to the S232 statute; and (2), the president did not follow proper procedures in issuing the Proclamation.

The court held the president had to take action to change the tariffs within 90 days following the Commerce submission of the report the White House on Jan. 11, 2018, as required by the statute. While this wasn’t the court’s final decision in the case, there are many similarities with the issue involving Argentina and Brazil. Neither Argentina nor Brazil was found by the U.S. Treasury Department to be a “currency manipulator.” Nor is it apparent that currency manipulation is a basis for “national security” tariffs as defined by Section 232.

How Trump’s Steel Tariffs are Doing More Harm Than Good

There is growing evidence that the Section 232 steel tariffs are damaging U.S. manufacturers and not helping the domestic steel industry. It’s important to note that, while Brazil is the second largest exporter of steel to the U.S., most of these exports are semifinished products (slabs) used by the domestic steel industry to make other steel products. In other words, domestic steel producers are the ones importing the steel from Brazil. This is one reason why President Trump had agreed to a quota instead of tariffs for Brazil, and why in 2002 President George W. Bush decide to impose a tariff-rate quota on Brazil instead of Section 201 tariffs (Brazil was able to export 5.4 million tons of steel tariff-free during the S201 tariffs).

Finally, the president’s actions may give impetus to efforts in Congress to reform the Section 232 national security statute. Senate Finance Committee Chairman Charles Grassley (R-IA) has been trying to reconcile two competing bills to place checks on the ability of the president to impose Section 232 tariffs. The compromise bill is delayed due to differences between committee members on whether to give Congress the ability to approve Section 232 tariffs proposed by the president, or to only have the ability to invalidate them though a resolution of disapproval, and whether the provisions would apply to current Section 232 tariffs or only those imposed in the future.

The president’s continued use of tariffs to punish trading partners for reasons beyond national security grounds may motivate senators to reach a compromise to move the legislation forward.