Market Data

December 3, 2019

ISM Manufacturing PMI Contracts for Fourth Straight Month

Written by Sandy Williams

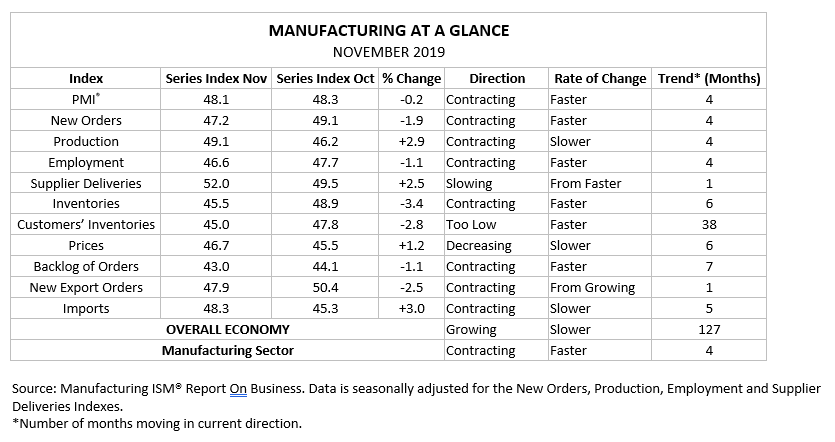

Manufacturing activity in the U.S. contracted at a faster rate in November, according to the latest Manufacturing ISM Report on Business. The PMI registered a 0.2 point decline for a reading of 48.1 percent and its fourth straight month in contraction.

Most of the components of the PMI remained in contraction last month. Production, at 49.1 percent gained 2.9 points from October. The backlog index fell another point to 43 percent. New orders dropped 1.9 points to 47.2 for its lowest level since April 2009.

Both import and export orders contracted in November, but imports at a slower rate. Customer inventories were at a 42-month low.

Supplier deliveries was the only component above the 50 neutral point, gaining 2.5 points for a posting of 52 percent.

“Prices contracted in November, at a slower rate compared to October. Generally, prices continued to decline. Price stability remains elusive,” says Timothy Fiore, chairman of the Institute for Supply Management Manufacturing Business Survey Committee.

Sentiment improved somewhat in November, but global trade remained the most significant issue for manufacturers, said Fiore.

Only five of 18 manufacturing industries in the survey reported growth in November with the rest reporting contraction.

“In short, this is a soft report, and the fall in orders, if sustained, suggests the headline index could dip a bit further in December. A charitable interpretation—and one consistent with the recent improvement in China’s PMIs—is that the ISM is bouncing along the bottom. We’d be surprised to see a further significant decline, but the sector is stuck in a mild recession with little prospect of a real near-term revival,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

Survey participants had the following comments:

- “Slowdown in business has us revising our 2020-21 capital spend.” (Petroleum & Coal Products)

- “The order book continues to shrink below our forecast levels. We’re unsure at this point how much of the slowdown is tied to certain events [like the General Motors strike], year-end inventory reductions by customers, or a worsening economy. We don’t expect clarity on this until early 2020, when we expect to either see restocking orders [a good sign] or not [a bad sign].” (Fabricated Metal Products)

- “Demand has stabilized for the last half of [the fourth quarter], and production will be stable for the rest of this year.” (Machinery)

- “Heading into the holiday season, we are seeing the backlog decrease as new orders for 2020 seem lighter than in past years.” (Plastics & Rubber Products)

- “Business level is similar to October.” (Computer & Electronic Products)

- “Chemical industry has been slow globally, but the curve seems to be flattening.” (Chemical Products)

- “Economic uncertainty continues. Our outlook on future business is cautious, yet positive.” (Transportation Equipment)

- “Markets have downshifted further. The continued confusion surrounding China trade has kept export markets on edge. Profits are elusive. Cash-flow planning is paramount. The general economy is slowing down.” (Wood Products)

- “Economy is holding up. Business is staying constant. The same challenges persist—foreign exchange, trade uncertainty and trend changes [for example, sugar reduction].” (Food, Beverage & Tobacco Products)

- “Incoming orders and production have ticked back up. Tariffs are still a question.” (Furniture & Related Products)

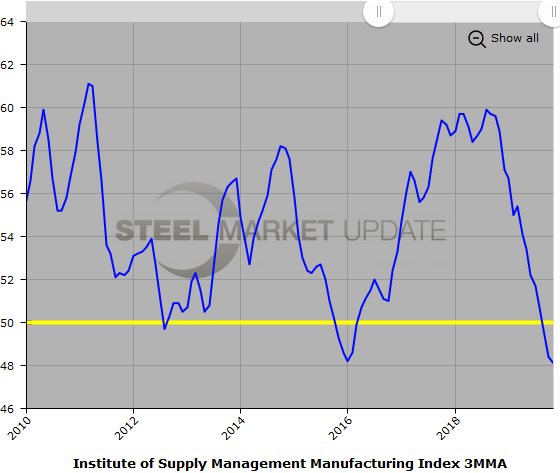

Below is a graph showing the history of the ISM Manufacturing Index as a three-month moving average. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.