Prices

November 23, 2019

SMU Market Trends: Buyers Split on the Fortunes of Demand, Pricing and Cats

Written by Tim Triplett

Steel buyers are clearly split on whether demand is sufficient to support the recent mill price increases or whether the market can expect another dead cat bounce. Following are results from this week’s Steel Market Update market trends questionnaire.(Note that the following responses were gathered prior to the mill price increase announcements on Friday.)

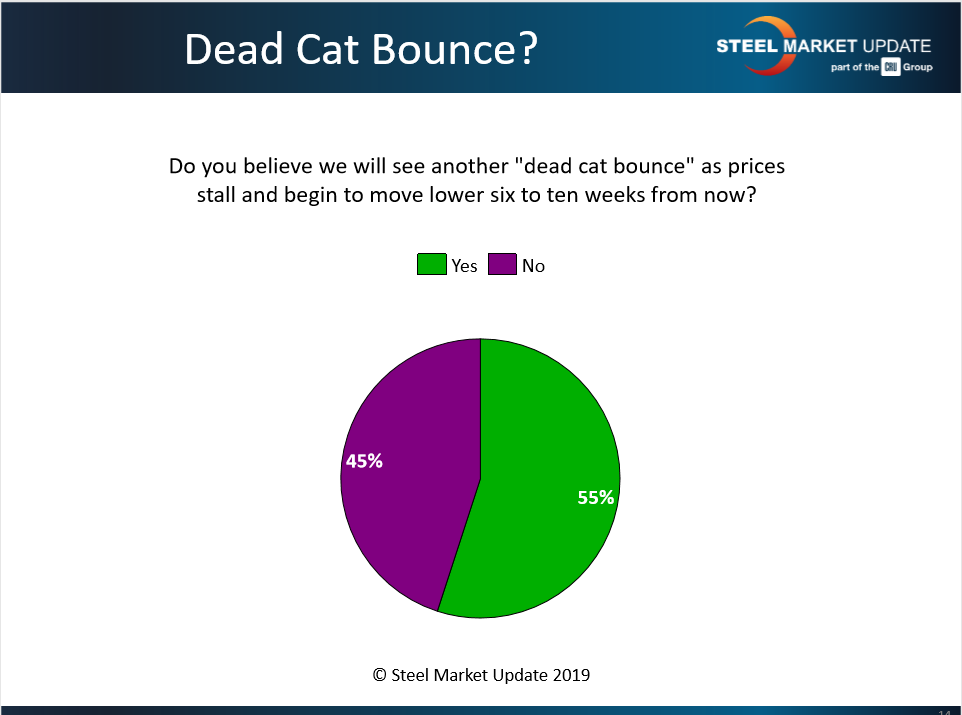

Dead Cat Bounce?

Steel Market Update asked: Do you believe we will see another “dead cat bounce” as prices stall and begin to move lower six to ten weeks from now? Slightly more than half (55 percent) said yes, slightly less than half (45 percent) said no.

Following are comments from a few respondents:

“Impossible to predict.” Service Center

“The oft-regaled Election Year Economy notwithstanding, the end of the year may see the price soften a bit, but expect to see movement generally sideways through January before it begins climbing.” Manufacturer

“Another bounce is possible. That beginning-of-a-new-year optimism will be in the mills’ favor for a little while. But then there is the additional capacity that is coming online. Who knows anymore?” Manufacturer

“We see a bounce, but not an appreciable amount lower afterward.” Manufacturer

“We’re more likely to see downward price adjustments if demand does not increase.” Trading Company

“Yes, unless demand picks up substantially.” Manufacturer

“I see prices stalling, (i.e.) I don’t think they will go as low as they have been.” Trading Company

“I believe Q1 will be a roller coaster ride, up a bit December to January, back down in February. Demand is the only cure. If they inflate lead times and push on pricing, they will pay dearly with orders being shipped early and buyers back to sitting on their hands.” Manufacturer

“Production cutbacks, lower inventories and lower import volumes will help the market stay together for 3-4 months.” Steel Mill

“Fundamentals are unchanged. Demand is not great, the economy is just okay and there’s an election year coming. There are no indications the first quarter will come out of the gates running, so far. We’re very conservative in inventory and expectations.” Manufacturer

“Prices got so low this time that we should see some of the increase stick from this recent bottom. How much is the question.” Service Center

“Not if the domestic mills play it cautiously and wait for demand to help support their increases.” Service Center

“No! Dead cat bounce assumes companies have not passed through profitability and are now losing money. Third-quarter results from publicly traded service centers and domestic mills shows results at or below breakeven. Fourth quarter will be even worse. Any business that continues to sell at a loss will soon be out of business by either market conditions or their lending partners. Service centers and mills need to stand firm to OEMs and end users with regard to reasonable and responsible selling values that result in a reasonable net profit. Flatter and faster organizations realize this fact sooner rather than later. We had better all realize it sooner or there won’t be a later for some in this business.” Service Center

Demand

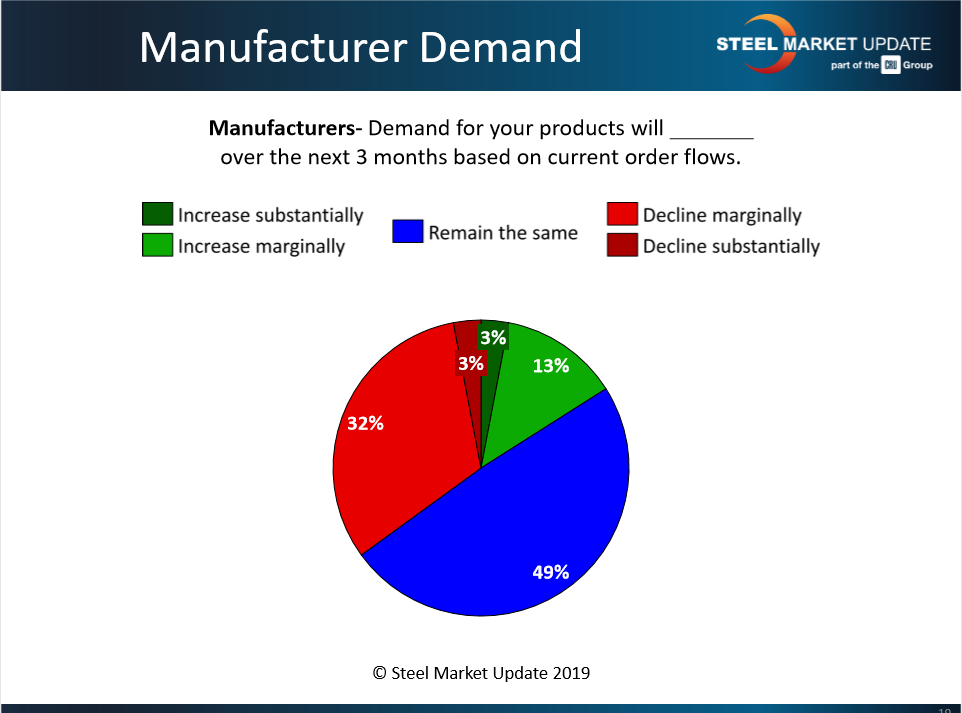

Steel Market Update asked: Do you see demand increasing, declining or staying the same?

Nearly half of the manufacturers responding to Steel Market Update’s market trends questionnaire this week reported demand from their customers as about the same. Only 16 percent said demand is improving. Thirty-five percent said they see declining demand in their market.

The mills have managed to collect at least a portion of the increases on flat rolled steel, but with 85 percent of end-users reporting flat or declining demand, their ability to sustain that momentum is uncertain.

Following are comments from a few respondents:

“Demand is declining, which isn’t good.” Service Center

“Demand is declining slightly as we are in our slower season.” Manufacturer

“It depends on how you define demand. If you count inquiries and price checking, then yes there’s more. But actual confirmed new business is steady to down, with many traditional imports still noncompetitive versus domestics.” Trading Company

Paying the Price?

Steel Market Update asked: Is your company paying the $80 in price increases on flat rolled steel?

None of the respondents to SMU’s questionnaire this week said they are paying the full increase. About 56 percent said they are paying some of the increase—half of that group less than $40, half $40 or more. Another 22 percent aren’t paying higher prices yet, but expect to soon. About 16 percent said they are not paying any of the increase and do not expect to in the future.

Following are comments from a few respondents:

“The percentage of the increase we pay will be reflected in monthly CRU programs, but we expect to see some movement upward in pricing.” Service Center

“I have seen increases of $20/ton on some items we booked recently.” Trading Company

“We are and we aren’t. We’re on an index-minus deal, so prices are rising, but we aren’t paying spot. On the spot business we’ve done, we’re probably up around $40.” Manufacturer

“We buy monthly and have not settled January yet.” Manufacturer

“We have fixed pricing for the year.” Manufacturer