Market Segment

November 19, 2019

CRU: China’s Steel Capacity Probe May Need Timely Action to Prevent a Crisis

Written by Iris Speelmanns

By CRU Analysts Kevin Bai and Iris Speelmanns, from CRU’s Iron Ore Costs

China has launched a probe into steelmaking capacity to understand the true state of the industry. If the government views the current state as detrimental to its reform agenda, orders to curb supply could be forthcoming. If enough capacity is curbed, this would tighten the market and lift margins from current lows. That said, in CRU’s view, timely action on capacity may be needed to prevent another crisis developing as recent stimulus measures unwind and steel demand softens.

The Chinese government announced this week that it will investigate steel capacity and production in China. Recent production increases are of concern because in recent years China has eliminated a substantial amount of capacity to reform the industry. The probe has two main areas of focus: confirming capacity eliminations took place in 2016-2017 and evaluating the real capacity situation. The investigation is to be run by three government units: the National Development and Reform Commission (NDRC), the Ministry of Industry and Information Technology (MIIT) and the National Bureau of Statistics (NBS). These will engage with local provincial governments and the Assets Supervision and Administration Commission (SASAC) to check mills under their administration.

According to the announcement, the government seeks to identify real capacity levels in order to plan future policy amendments. This aims to avoid a return of excess capacity and weak industry conditions, such as in 2015. Structural reforms had eliminated outdated capacity, including induction furnaces, leading to a net reduction in steelmaking capacity of over 200 Mt since 2015. CRU’s view is that Chinese steel capacity has expanded in 2019, though the timing of this probe means there is a risk this has been more than we have estimated. Thus, while a crisis is not our basis forecast, this is now a greater risk without action on steel capacity. Thus, a probable outcome of the probe is that capacity output restrictions or closures will be forthcoming. While this could tighten the market and lift margins from current lows, timely action may be needed to prevent a crisis developing before the effects of recent stimulus measures unwind and demand softens.

Strong Steel Output Growth and Low Margins Drive Launch of Probe

The investigation comes at a time when total crude steel production has reached an all-time high. Chinese crude steel output was 842 Mt in the first 10 months of this year, on an annualized basis, growing by 7 percent compared to the same period last year. In order to achieve this high output, given registered capacity levels, steel mill utilization rates would have been very high. In some cases, reported production has exceeded registered capacity so much that utilization would have been 150 percent. CRU believes greater production has been enabled by capacity expansion and productivity gains, enabled by the strong profitability for Chinese mills between the end of 2017 and late-2018. Much of these investments realized capacity increases in late-2018 and 2019, which have weighed on the sector’s profitability and attracted the government’s attention.

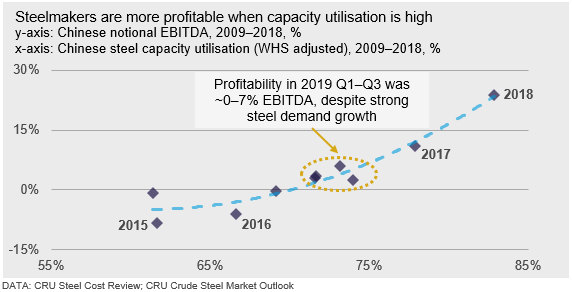

These capacity expansions could have been done via investment in new capacity or through incremental investment in existing assets (e.g. debottlenecking, technology improvements, process improvements, etc). The chart below shows the relationship between Chinese steel mill profitability (EBITDA) and capacity utilization. Surging profitability meant that steel mills had plenty of capital at hand to expand their businesses and produce more. Meanwhile, given high utilization, the only way to capture more of these profits was to expand capacity. See our past analysis on the relationship between capacity utilization and profitability in our recent Insight – “Chinese steel price uplift as industry health improves”.

Increased productivity has also been a key source of stronger steel output. We have noticed an increase of blast furnace productivity at Chinese steel mills, by as much as 12 percent over the past two years (see chart below). This may be achieved by relining to allow larger internal furnace volume, investing in increased pulverized coal injection (PCI) and oxygen injection, and/or allowing for higher scrap usage in the furnace. Beyond the blast furnace, mills would have been investing across their supply chains, such as increasing the volume of BOF vessels through refractory changes and better management, installation of ladle furnaces, and re-motoring of rolling mills.

Probe Targets Mills with Strong Output Growth and Production Exceeding Capacity

The investigation will focus on changes in steel and smelting (i.e. blast furnace) capacity since 2016. Local governments and the SASAC will investigate steel mills where there were capacity changes, where crude steel output rose by more than 10 percent y/y and where utilization rates have exceeded 100 percent.

There are two steps that will follow. First, local governments will audit steel operations, which will require mills to submit forms that detail equipment, capacity and production levels, as well as any capital investments from 2015 to September 2019. The SASAC will do the same for national steel companies. The submission deadline for the audit forms is Nov. 29. While the public announcement of the audit was only made this week, mills were informed as early as Nov. 4. Next, the NDRC, MIIT, the NBS and CISA will conduct spot checks to confirm the results of the audit. The timing of these spot checks has not yet been communicated.

Action on Capacity May be Needed to Prevent a New Crisis

Although the steel capacity probe focuses on confirming the historical and current real capacity in China, we expect it will also serve to progress steel industry reforms. We have discussed the transition in industry reforms in a previous Special Feature, ‘Where next for Chinese steel industry reforms?’ and we believe the government’s aim is to shift the focus of the industry from quantity to quality. The implementation of this agenda will ultimately be one of optimization over elimination. For example, steel plants have moved from inland to coastal regions. This probe will be aimed at ensuring the government has genuine and detailed data to progress the next steps in this industry reform.

In terms of the near-term dynamics, if the probe finds there have been capacity expansions beyond that expected and allowable by the reforms implemented to date, it is highly probable that orders to close or restrict output is an outcome. More restrictive controls on further capacity expansion would also be needed to ensure a repeat does not occur and to prevent the restart of any restrictions that may be put in place. While this is by no means certain, such orders would lift utilization of operating capacity and tighten the market from a loose position today. This would then be supportive of a recovery in domestic steel margins if sufficient supply was curbed by the orders. However, because the government is taking this action on a reasonably rapid timescale suggests that capacity may have expanded more than we have estimated. If this is the case, there is a risk that the Chinese steel market could be weaker in the near term than we have forecast. Depending on the significance of surplus supply, this could lead to a crisis developing as the effects of recent stimulus measures are already beginning to fade, leading to softer steel demand. Thus, timely measures by the government would be important to prevent this occurring. This not only has implications for the domestic market but would lead to greater steel exports from the country, particularly if recent cost disadvantages unwind.

We will continue to evaluate the outcome of the probe and assess how this impacts our forecasts for steel prices and margins.