Prices

November 14, 2019

CRU: Supply Recovery Pushing Iron Ore Prices Lower

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Crude Steel Market Outlook

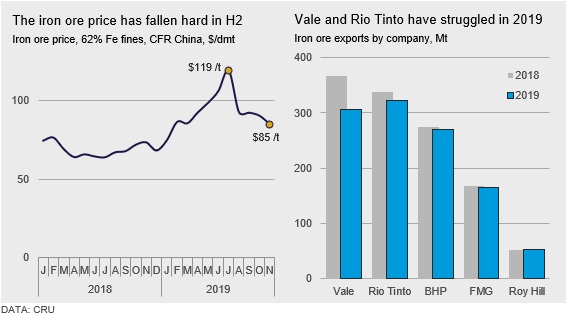

The iron ore market in 2019 has been dominated by supply disruptions. The Vale accident in January was followed by cyclones in Australia and, more recently, quality issues affecting Rio Tinto, the second largest iron ore producer in the world. The company has made the decision to reduce output in order to maintain the quality of its two flagship products, Pilbara Blend Fines (PBF) and Pilbara Blend Lump (PBL). These two products make up around 75 percent of the company’s total sales and are the most common medium-grade and lump products in the market.

Rio Tinto revised production guidance to 320-330 Mt in 2019, substantially below its initial guidance of 338-350 Mt at the start of the year. The lower production is a consequence of the cyclones, two fires at ports earlier in the year and quality issues, which also forced the company to sell more low-grade products than in previous years. Rio Tinto has just completed major rail maintenance and is expected to ship at a high rate for the rest of 2019 to meet its annual guidance. CRU’s analysis shows that the quality issues will persist into 2020, but the grade of the ore will be recovering gradually throughout the year.

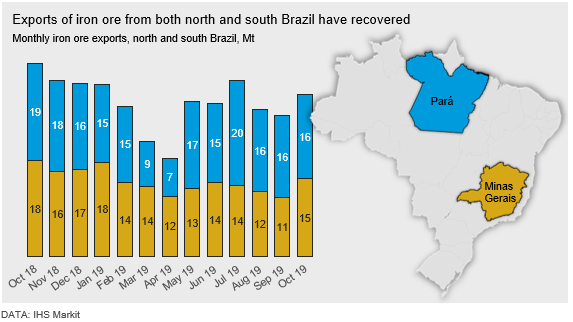

Vale has had a very difficult year following the tragic dam accident in January, followed by exceptionally heavy rain in northern Brazil a few months later. Initially, around 90 Mt/y of capacity was suspended, but we have since then seen restarts of important mines and complexes such as Brucutu (30 Mt/y), Vargem Grande (12 Mt/y) and Alegria (8 Mt/y). Production is still ramping up and Vale is replenishing working inventory levels throughout the country, which is why the restarts have yet to impact sales figures. Going forward, we expect production in Minas Gerais to continue its recovery while production in north Brazil will rise as the giant S11D mine completes its ramp up to 90 Mt/y next year.

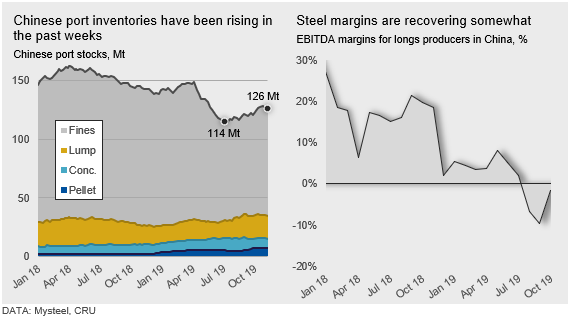

Iron Ore Availability Has Improved

Our sources in China have highlighted that they are currently less concerned about iron ore supply availability. Domestic production in China has increased this year, India has been exporting iron ore at very high levels and Chinese steelmakers are being offered higher volumes of Australian and Brazilian iron ore on the spot market. In addition, inventories at ports have rebounded from the very low levels in July when prices peaked. This has spread confidence in the steel industry, which now views the future of iron ore supply with more optimism. However, Chinese steelmakers still maintain relatively low inventories at hand, as a result of the weak margin environment.

Supply Risks Still Prevail

Although iron ore supply in the near future looks promising, there are still risks in the market that could result in another supply shock. Currently, there are a number of tailings dams concerns in both Brazil and Australia that may put some mines at risk. In addition, weather conditions are becoming more of a concern in the market. Poor weather affects both Australian and Brazilian iron ore supply in Q1 each year and the impact on supply was particularly hard in 2019. Although it is still early, our initial indications point towards a calmer start to 2020, at least in Australia.