Prices

November 7, 2019

Hot Rolled Futures: Unclear Market Sentiment Leaves Conviction on Price Direction Muted

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

HR futures markets have been range-trading the last few weeks as participants have been focusing on what appears to be a technical near-term bottom. Volumes have been somewhat uneven, even as we have seen some longer-term end-users coming into the HR futures markets to buy and lock in financial hedges against some of their exposures.

On the other hand, there has been steady interest to offer the latter half of Cal’20 and the 1H’21, which has kept the slope of the forward curve relatively contained even as they periodically get paid. We saw $580/ST trade in Jan’21 to Sep’21 HR last week as part of a metal margin spread. In Cal’20, the HR futures for market Q1’20 has been actively pinned to the $550 to $555/ST level recently, and the Q2’20 HR and Q3’20 HR have been trading in the $560-$565 area.

The latest index values for HR physical are fairly wide as they range from $460 to $500/ST depending on the index. Even with the latest mill price announcement, some squaring up of physical positions going into yearend might account for the lagging rise in prices. The markets will be very focused on the upcoming weekly print for further clues as to price. There has been some anticipation of a pickup in spot prices as the market waits for all mill deliveries to fully cross over into January 2020.

While the HR futures curve prices have risen about $20/ST when compared to Oct. 1 settles for the Cal’20 period, we have seen the slope of the HR forward curve start to push higher in the last month or so only to retrace. For comparison of settles in HR: Back on Oct. 1, the Jan’20 HR versus Dec’20 HR was $530/ST versus $540/ST, a $10 contango. As of Nov. 6, Jan’20 HR settle was $547/ST versus Dec’20 HR settle at $570/ST, a $23 contango. However, today we are again seeing some compression in the slope of the futures curve as Q1’20 HR traded $555/ST versus Q4’20 HR, which traded at $560/ST (only a $5 contango for the beginning and ending quarters of ’20 as compared to Oct. 1 settles of $532/ST Q1’20 versus $540/ST Q4’20, or an $8 contango).

This market will be focusing on whether another announcement of a mill price increase in HR will be enough to offset concerns that current demand is still underperforming available supply.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

Some tightness in East Coast scrap export markets with 80/20 trading around $260/GT has helped give rise to Midwest BUS prices. Early prices for Detroit suggest up $20/GT for November’20, which could see Midwest BUS up at least $15/GT. Recent interest in 1H’20 BUS futures has helped push prices up to $275/GT. Last week a metal margin trade spanning Jan’21 to Sep’21 saw BUS trade at $290/GT. Trading in Dec’19 BUS has been limited as Dec’19 bid offer spreads have been wide ($235/$255). Steep contango in BUS futures curve.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

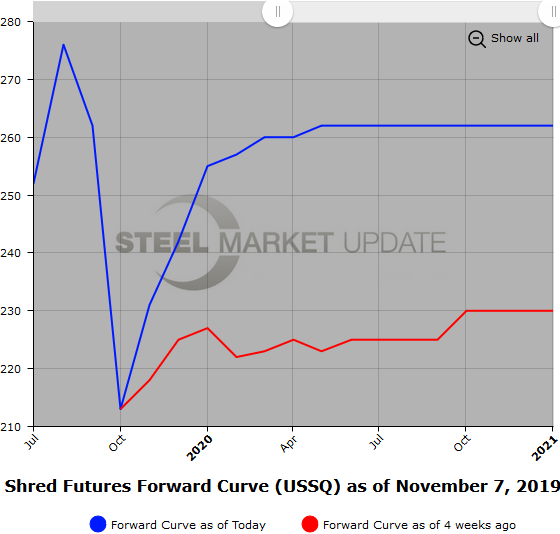

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.