Prices

October 29, 2019

CRU: Iron Ore Rising on Weak Australian Supply

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg

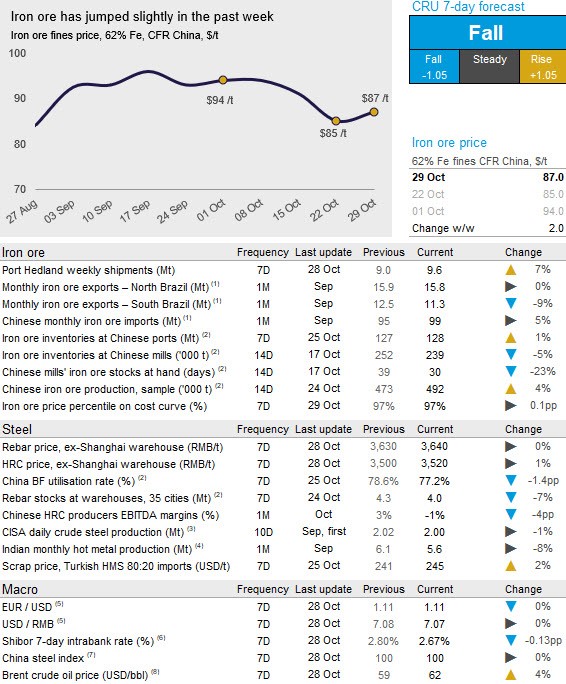

Iron ore prices have increased slightly overall in the past week despite early gains being met with falling prices at the start of this trading week. On Tuesday, Oct. 29, CRU assessed the 62% Fe fines price at $87.0 /t, a $2.0 /t increase w/w.

Australian supply has continued to struggle in October. Rio Tinto supply has been affected by its rail maintenance and BHP’s shipments have been below expectations for most of the month. In the past week, however, BHP has managed to lift its shipments to higher levels. Despite recent strong performance, the company’s October shipments will be below the September levels. Another company that is struggling is Roy Hill. End-October is the time for the quarterly shiploader maintenance, which means the company will not ship any iron ore for about a week. Roy Hill also struggled at the start of the month and there were speculations that the maintenance period was brought forward, which is not the case. The company’s supply in October will be one of the weakest months in recent years. In Brazil, shipments have remained at a high level, despite recent announcements of further suspensions of tailings dams.

In China, poor air quality is resulting in production cuts affecting BFs and sinter plants in Hebei and Shandong provinces. The Chinese market has been quiet with steady steel prices, and iron ore demand has remained weak. Port stocks have increased again and are now at 128 Mt, 14 Mt above the lowest point in July.

Iron ore supply will continue to improve in the coming weeks as Australian supply will recover and Brazilian shipments, which have been increasing recently, will result in increased arrivals at Chinese ports. With a weak steel market and improving iron ore supply, we expect prices to decline further in the coming week.