Prices

October 20, 2019

CRU: Why Steelmakers Should Make Rather Than Buy Metallurgical Coke

Written by Jordan Permain

By CRU Analyst Jordan Permain

It is imperative for carbon steel producers to have secure supply of metallurgical coke to ensure stable and efficient operation of their blast furnaces (BF). Steelmakers also benefit from using coke with consistent technical specifications, namely CSR and ash content in their BFs. For these reasons alone it is prudent for steelmakers to fully control their coke supply by building their own coke ovens, but there are other factors that may impact their coke supply strategy.

This article explores the patterns of coke plant investment and the financial factors that steelmakers must consider when deciding to invest in making their own coke or sourcing it from the third-party market.

Integrated Steelmakers Striving to be Self-Sufficient in Coke

CRU has conducted significant primary research on investment into the construction of both brand new and remediated coke capacity over this decade. This includes coke capacity as part of greenfield integrated steel plants and also existing or previously idled coke capacity that has been fully rebuilt and returned to an operating state. Our research identified coke plants were built throughout major steelmaking countries and regions, such as Europe, USA, Japan, South East Asia and Russia, and by large steel companies, such as ArcelorMittal, JSW, JFE, U.S. Steel and MMK. The average size of the coke plants identified was ~1.4 Mt/y – enough coke to support a ~3 Mt/y BF operation – but build capacities increased over the course of the decade.

In terms of capital expenditure, the average capital cost of the coke batteries specifically was ~$270 per tonne of annual coke making capacity (/tACC). We have standardized this figure to include all essential parts and construction costs associated with a typical heat-recovery coke battery, including coke dry quenching (CDQ), as well as auxiliary facilities such as coal storage yards, screening stations and handling systems. In addition to this cost, investments also need to be made in associated facilities, such as by-product recovery plants, which our research suggests costs ~$70 /tACC. This helps to reduce emissions by capturing the gas produced by the coke oven, extracting valuable byproducts (such as benzol, coal tar and ammonium sulphate) for sale in the third-party market and purifying the gas for use elsewhere in the steelworks, such as in the sinter plant or BFs.

The addition of stamp charging is another key component of many modern coke plants. The stamp charging process compacts the coal outside the coke oven and enables coke makers to maintain CSR levels using 15–20 percent less HCC in the blend, lowering raw material costs. Based on research as part of CRU’s Metallurgical Coal Long Term Market Outlook, an annually published report that analyses all facets of the global metallurgical coal markets and provides a price forecast out to 2035, we found that the use of stamp charging has increased during the decade and will continue to do so in the future, particularly in India. We estimate that the installation of a stamp-charging system costs ~$60 /tACC. However, as we have modelled the analysis in this article on the construction of a European coke plant, where operating costs are high, we have not included stamp-charging in our base case. Thus, when adding the cost of the byproduct recovery plant to the initial CAPEX for the coke batteries, our total base-case estimation for a new coke plant is $340 /tACC.

Strong Coke Margins Have Made the “Buy” Decision Financially Unviable

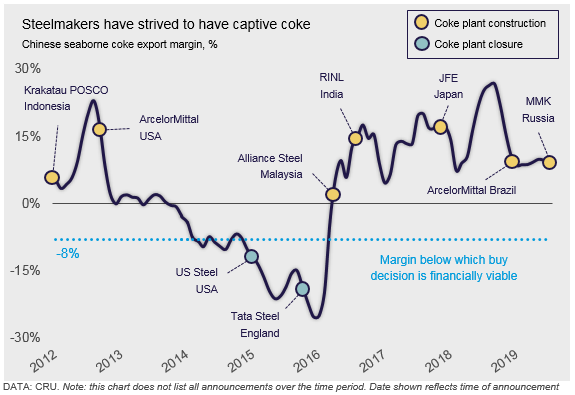

By building a coke plant, steelmakers are taking the strategic decision to make their own coke rather than buy it. Our research shows many examples of steelmakers deciding to build their own coke plants when seaborne coke margins have been positive and closing plants without building a replacement when margins have been negative. Despite this trend, our analysis into monthly movements in seaborne coke margins suggests that margins have not been consistently low enough to justify favoring the “buy” decision from a purely financial perspective.

Our assumptions in this analysis include the above CAPEX figures to model the construction of a typical, 2 Mt/y heat-recovery coke plant without stamp-charging in Europe with an operating life of 40 years that consumes coal, ostensibly from Australia, at market-related prices. Based on this analysis, we found that seaborne margins would have to be lower than -8 percent (i.e. negative) over the life of the intended coke plant for the “buy” decision to be considered favorable. In the past decade, margins first fell below -8 percent in early-2014 and remained lower than this for around two years.

Our analysis shows that two major integrated steelmakers closed coke plants without building a replacement during this period, namely U.S. Steel and Tata Steel (Scunthorpe); the latter’s assets were since sold to Greybull in 2016 to be renamed British Steel. This was done when margins had been below -8 percent for some time and the “buy” decision looked far more favorable. At the time, margins in the steel sector were also negative and, as steel companies globally had reduced steel production, requirements for coke in the short term were reduced. In addition, depressed conditions in the coke market meant that steelmakers would have made losses if they were to sell their excess coke on the third-party market, making the closure of old capacity a more viable proposition. However, margins began to recover in 2016 and, as both companies now purchase coke from the third-party, they will be exposed to higher overall costs.

Integrated Steelmakers Will Continue to Build Coke Plants, But May Face New Challenges

As explained in more detail in CRU’s Metallurgical Coke Market Outlook, we expect seaborne coke margins to be between 5-10 percent up to 2023, underpinned by Chinese supply-side reform of their coke sector and its impact on effective utilization rates. As such, from just the financial perspective, we expect that integrated steelmakers will continue to favor the “make” decision. As an example, in India, currently the largest importer of seaborne coke, integrated steel producers are investing in coke plants to reduce their reliance on expensive imports and all new capacity has associated captive coke supply. Having said this, it is expected that the operational benefits of captive coke supply will certainly have been the major factor in these decisions, but higher margins in the seaborne coke market make these decisions much more favorable. As such, we expect that India will add ~13 Mt of coke supply in the next five years and will see imports decrease by ~25 percent.

Despite making financial and technical sense, steelmakers may face new challenges in building and maintaining coke plants in the future due to environmental factors. For example, U.S. Steel recently stated that the rising price of CO2 emissions allowances within the EU Emissions Trading System (EU ETS) was partly to blame for its decision to idle a BF in Europe. During the period 2013-2016, permit prices were stable at ~€5 /tCO2. However, the EU reduced the number of allowances in 2017 and this caused prices to jump to above €25 /tCO2 by early-2019, the highest prices since the system was introduced in 2008. ArcelorMittal is attempting to mitigate such charges by investing €200 M to reduce emissions from the coke plant at its newly-acquired steelworks in Taranto, Italy.

Irrespective of whether steelmakers choose to pay the rising price for CO2 or invest in technology that reduces emissions, additional costs will be incurred and further consideration will need to be made when facing the coke “make or buy” decision in the future. Steelmakers may also find it difficult to secure funding and governmental approval for any projects that have an adverse impact on the environment, as has been seen in the coal mining industry recently. Nonetheless, we expect that integrated steelmakers will, and should, continue to favor the “make” decision, as building their own coke plants remains the financially and technically prudent decision for the long-term viability of a steelworks.