Prices

October 17, 2019

Hot Rolled Futures: A Pickup in Futures Market Price Inquiries for Cal’20 Quarters

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

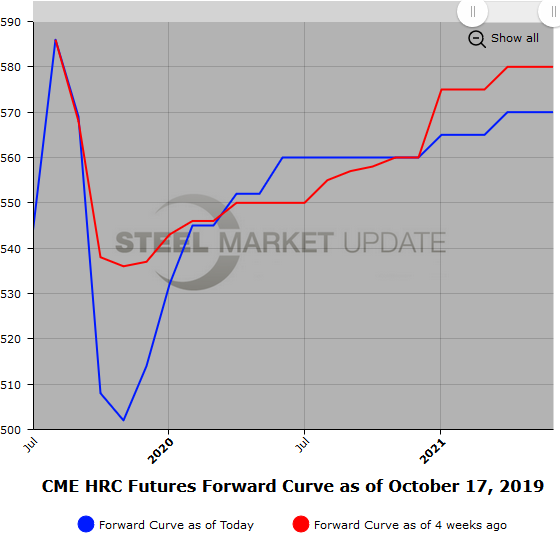

Near date HR futures month prices have been a bit choppy so far this month as the HR index has dropped nearer the $500/ST level. Good trading volumes have been going through in the near end of the curve, likely some profit taking and potentially some new short sellers for remaining 2019 months. However, we have seen a pickup in Q1’20 HR buying interest with limited selling interest. The curve pricing appears to be shifting since the beginning of October around the HR Mar’20 future with prices before Mar’20 declining and prices after Mar’20 moving higher. Mar’20 has been steadily valued around $535/ST since the beginning of the month. The contango spread between Nov’19 and Q4’20 has almost doubled as it increased from -27 to -49 since Oct. 1 as the HR Nov’19 future lost $22/ST and the HRQ4’20 futures gained $13/ST. Most of the outright activity has been in the near dates, and the longer date trades have been linked to calendar spread trades. However, we have seen a pickup in market inquiries for most Cal’20 quarters as end users check indicative offers available along the curve.

Market concern remains too much supply given current demand. Any sign of improving demand, (ie) longer mill lead times or an anchored HR index, will likely mean an increase in HR futures inquiries for offers in Q1 and Q2’20. Close to 130,000 ST of HR futures have traded so far this month. Also of note, a 535/600 Q1’20 HRO call spread was traded at $22/ST premium earlier in the month on 500 ST/mo.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

BUS: The sharp price decline for Oct’19 BUS to $216 and chatter that Nov’19 will likely be sideways is not putting much upward pricing pressure on HR. Given the low scrap prices, there appears to be further room for HR to trade lower. The Nov’19 BUS traded near $210/GT here this morning and Dec’19 traded between $225 and $230/GT. There is a steep contango going into Cal’20 with the Cal’20 offer coming in around $260/GT. We have had a good amount of buying interest in the BUS with the recent drop, which has pushed Q1’20 prices higher. Futures curve in Cal’20 is not as steep as the near date price rise.

USSQ: The October settle was less than $5 below BUS settle coming in at $211/GT for shred. Seems the spread between the BUS and the shred is fairly compressed. Q1’20 and Q2’20 offers have been around $230 and $250/GT reflecting the expectations that prices will rally going into the new year.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.