Prices

October 15, 2019

CRU: Turkish Scrap Import Price Rebound

Written by Tim Triplett

By CRU Analyst Alexander Ordosch

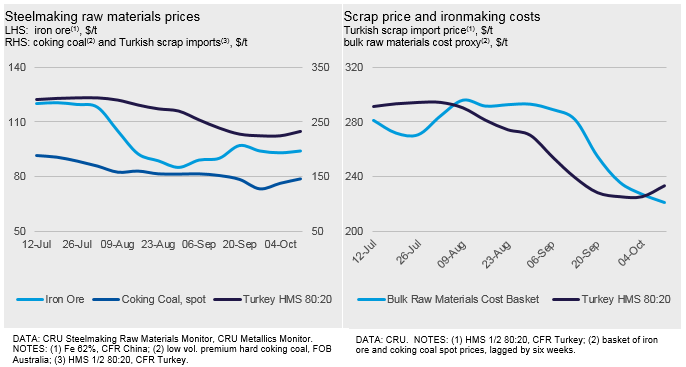

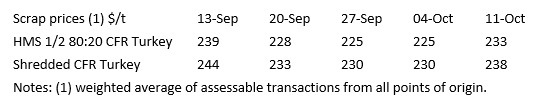

Last week, Turkish scrap import prices increased by $8 /t to $233 /t CFR for HMS 80:20, based on one 40 kt deal from the U.S. Following a number of weeks of sizable deal volumes, the market quietened. This increase comes despite sharp falls in the U.S. domestic market again for October buys.

The recent buying spree has helped to replenish scrap inventories at some mills, while others remain in need of material. High prices have come about despite a drop in deal volumes and a number of mills in Iskendrun idling capacity due to a lack of steel demand. This suggests there is resistance from exporters in both the U.S. and Europe to sell at the low prices of recent weeks.

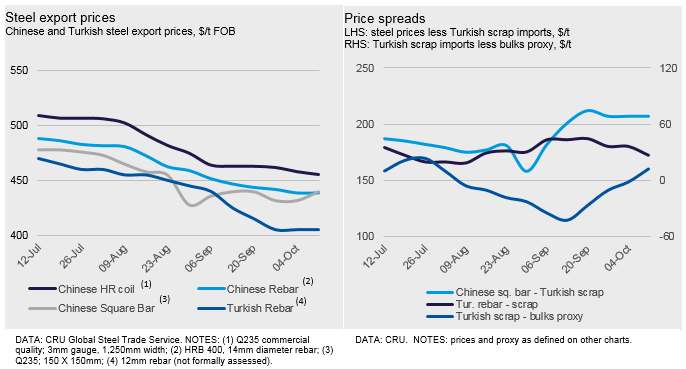

There was an increase in Chinese billet export prices last week, following gains in the domestic market there driven by expectations of the impact of winter heating season restrictions. However, there are also reports of Chinese mills importing billet from Russia, Iran and Malaysia due to imports being lower cost. While billet offer prices in Asia have fallen from some suppliers, most notably Iran, buying in the region is hand-to-mouth.

Further Gains, But for How Long?

Early indications are that scrap prices will rise again slightly this week. There is talk that a bottom has been reached for the U.S. scrap market, though a lot hinges on how the steel market there performs. We expect slight further weakness with the November buys. In Europe, the southern markets are particularly weak and demand overall is not expected to improve before the end of the year. That said, prices in the U.S. and parts of Europe are at a level where supply has historically dried up quickly. This indicates that a floor is near there.

Overall, while there may be increases in the near-term, we do not believe there is anything significant to get excited about currently. While prices are not expected to fall sharply again, there is little to suggest that gains will be significant either.