Overseas

October 7, 2019

CRU: Quiet Markets After China Returns from Holiday

Written by Tim Triplett

By CRU Steel Prices Lead Anh Nghiem

China returned to the market on Tuesday from their national holidays, but the market remained stable with mixed signals from the China Futures market, i.e. a 1 percent increase in the iron ore futures market while the steel futures market showed a 2 percent decline on the first trading day after the holidays.

In India, steel demand is expected to improve, but Indian steel mills have yet to start raw materials procurement. In addition, market participants heard several unusual transactions of semifinished products, such as Japanese coke sold to China and China importing billet, slab and pig iron from different origins. According to market sources, these trades happened due to arbitrage opportunities.

Iron Ore Prices Stable with Absence of Chinese Market

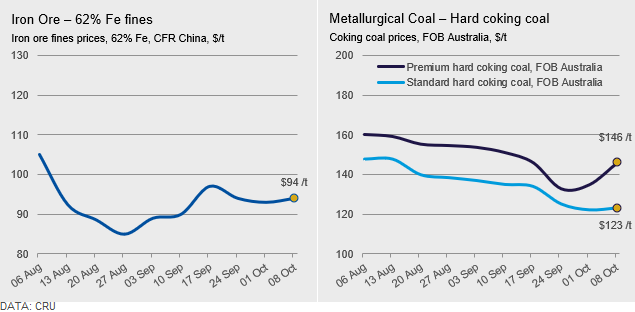

Iron ore prices moved up slightly just before the long holidays in China and then remained flat for the whole week. Nothing much was heard on the demand side. On the supply side, shipments from Port Hedland decreased by 13 percent w/w to 8.9 Mt last week. Shipment from Rio Tinto is expected to be lower in October due to rail maintenance.

Due to low profit margins, steel mills in general have become more concerned about cost and therefore have less appetite for premium iron ore products. The CRU weekly iron ore 62% Fe fines price was assessed at $94.0 /t, up by $1.0 /t w/w.

Coking Coal Prices Hiked Just Before the Holidays

Seaborne coking coal prices were pushed up by a few transactions of Premium Low Vol. HCC just before Chinese buyers went off for the long holidays last week. Deals were heard to have been concluded at $147-148 /t FOB Australia for Premium Low Vol. HCC. Offers for Premium Mid Vol. HCC were stable at $140 /t FOB Australia, but buying interest from Indian steelmakers is still subdued. According to a trader, the price spread between Premium Low Vol. HCC and Premium Mid Vol. HCC, usually in the $6-10 /t range, is currently at $15 /t, On the supply side, shipments from Hay Point moved up slightly last week to 2.7 Mt, up 0.4 Mt w/w. There should be more buying interest from India in the coming weeks due to seasonal demand improvement. Indian buyers will also look to book additional cargoes before December, as supply is often disrupted due to wet weather conditions in Queensland in Q1.

CRU assessed the weekly average price for Premium HCC, FOB Australia, at $146 /t, up by $11/t w/w, while Standard HCC, FOB Australia, was assessed at $123 /t, up by $1 /t w/w.