Prices

October 6, 2019

U.S. Raw Steel Production Steady in August

Written by Brett Linton

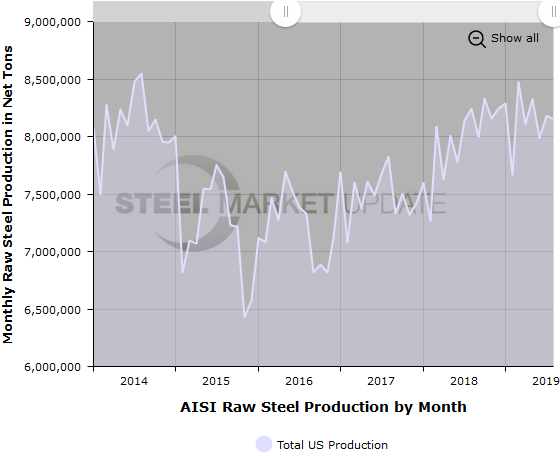

U.S. raw steel production in August fell 0.3 percent to 8,152,796 net tons, reports the American Iron and Steel Institute in Washington. August production is in line with the 2019 average of 8,147,242 tons and down 1.1 percent compared to the same month last year.

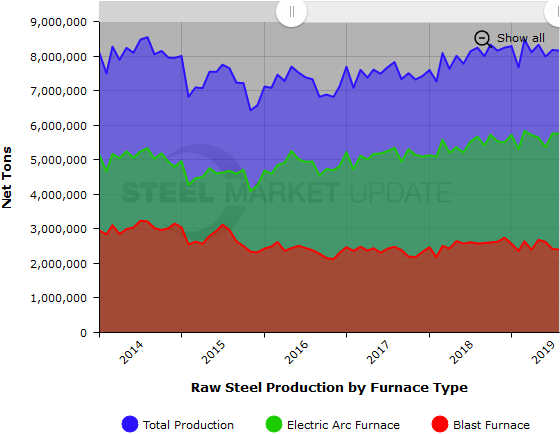

Broken down by production method, 5,752,849 tons (70.6 percent) were produced by electric arc furnaces (EAFs) and 2,399,947 tons (29.4 percent) were produced by blast furnaces in August. The EAF share of total production was at the second highest level seen in Steel Market Update’s 10-year history (behind October 2017 at 70.7 percent).

August production was 25,767 tons lower than July, and 88,647 tons lower than the same month last year. AISI’s monthly estimates are different than the weekly estimates SMU reports each Tuesday; the monthly estimates are based on over 75 percent of the domestic mills reporting versus only 50 percent reporting for the weekly estimates.

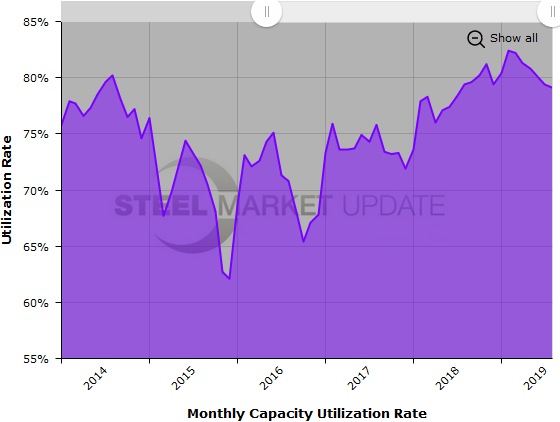

The mill capacity utilization rate for August averaged 79.1 percent, down from 79.4 percent in July, and down from 79.4 percent one year ago. The yearly capacity utilization rate has been adjusted down to 80.7 percent, up from 77.3 percent compared to the same period last year.

The chart below shows total monthly steel production (blue) broken down by electric arc furnace production (green) and blast furnace production (red).

SMU Note: Interactive versions of the raw steel production graphics above can be seen in the Analysis section of our website here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.