Prices

September 17, 2019

Shipments and Supply of Sheet, Longs Through July

Written by Peter Wright

Demand for sheet products is declining due to the weakness in manufacturing. Construction expenditures are showing signs of softening and will reduce the demand for long products through the balance of 2019.

This analysis by Steel Market Update is based on steel mill shipment data from the American Iron and Steel Institute (AISI) and import/export data from the U.S. Department of Commerce (DoC). The analysis summarizes total steel supply by product from 2003 through July 2019 and year-on-year changes. The supply data is a proxy for market demand, which does not take into consideration inventory changes in the supply chain. Our analysis compares domestic mill shipments with total supply to the market. It quantifies market direction by product and enables a side-by-side comparison of the degree to which imports have absorbed demand.

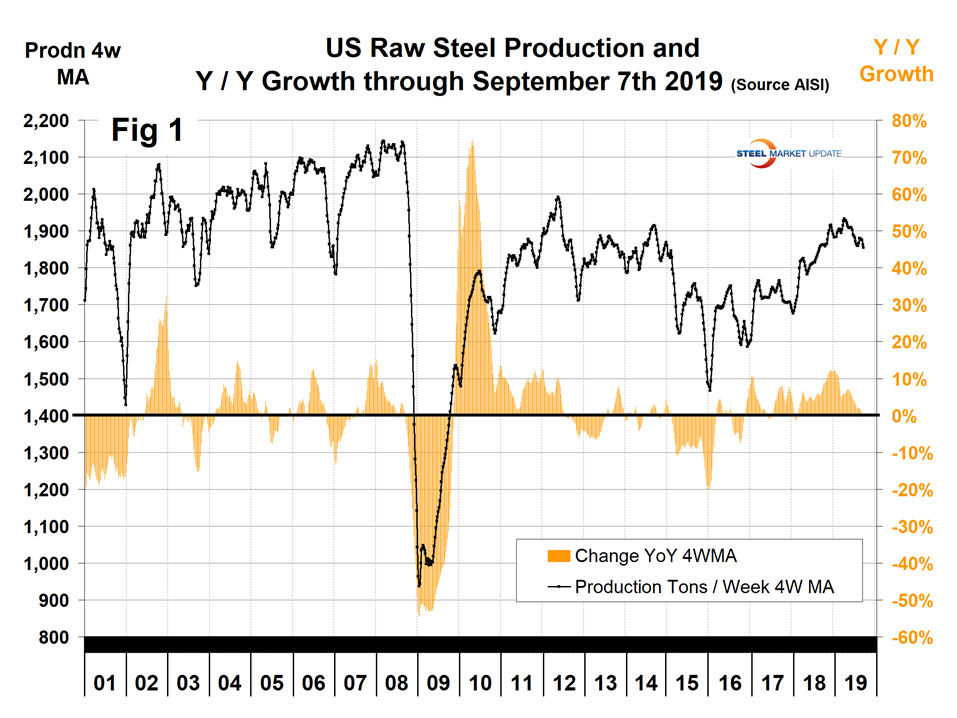

Figure 1 shows that the robust growth of U.S. raw steel production that occurred last year has reversed in 2019. Year over year through Sept. 7, production was down by 0.4 percent. This is a four-week moving average and is based on weekly data from the AISI.

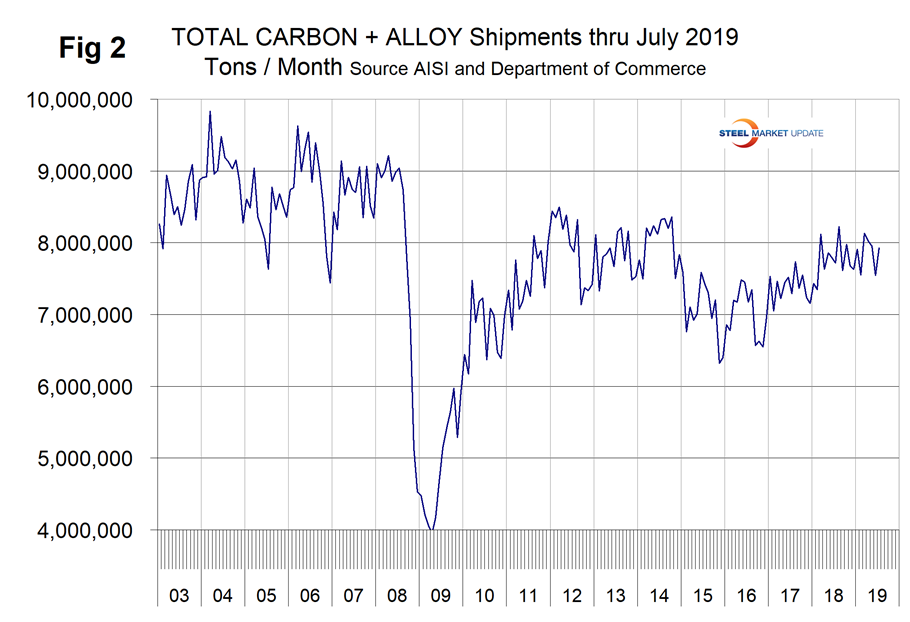

The shipments and supply report that you are reading now is based on monthly shipments by product as reported by the AISI, plus import and export data from the Department of Commerce. Figure 2 shows the monthly shipment data for all rolled steel products. In the long run, the trajectories of growth in Figures 1 and 2 are basically the same.

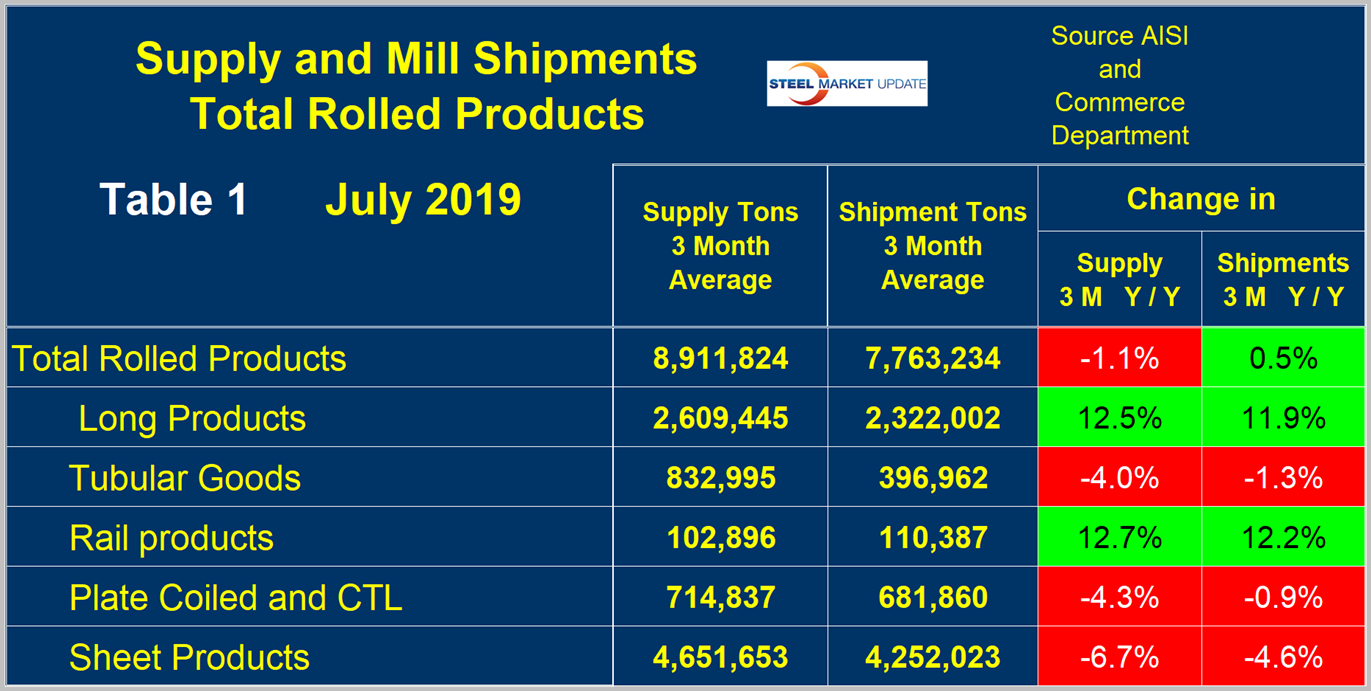

First, though, we will look at the shipment and supply situation for all product groups to see how much difference there is between them. Table 1 is this compilation. Total supply (proxy for market demand) as a three-month moving average (3MMA) was down by 1.1 percent year over year and mill shipments were up by 0.5 percent, meaning that imports took a smaller slice of the pie in the three months through July year over year. There is a big difference between products. Sheet, plate and tubular products had a year-over- year decline in both shipments and supply. Long products had double-digit growth in both shipments and supply.

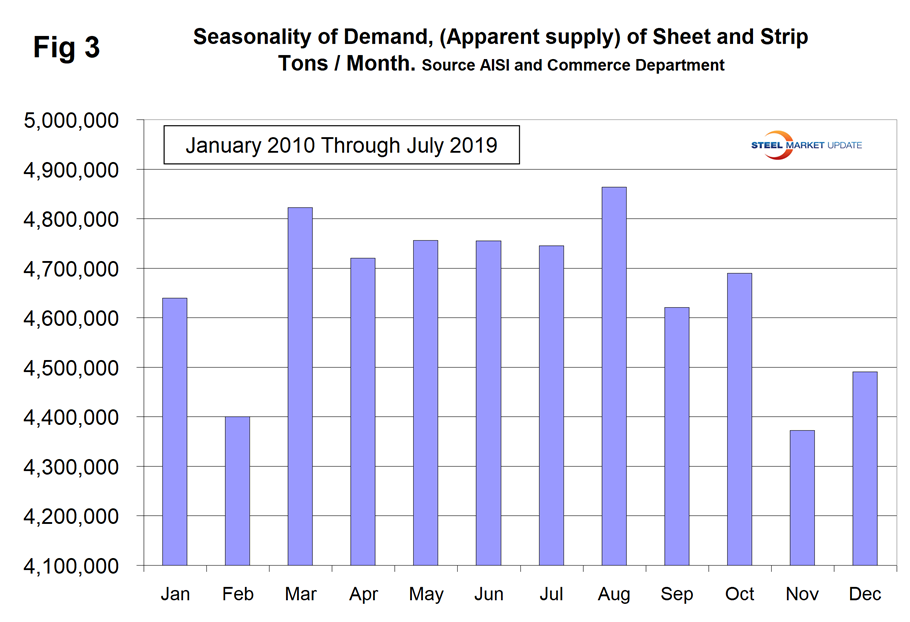

Now let’s look at sheet products in detail. One consideration is that seasonality of demand is significant with a 10-year historical average that varies by 11.4 percent between the high month of August and the low month of November. Over this 10-year period, May, June and July have been very consistent as shown in Figure 3, but this was not the case this year when July was up by 3.9 percent from June.

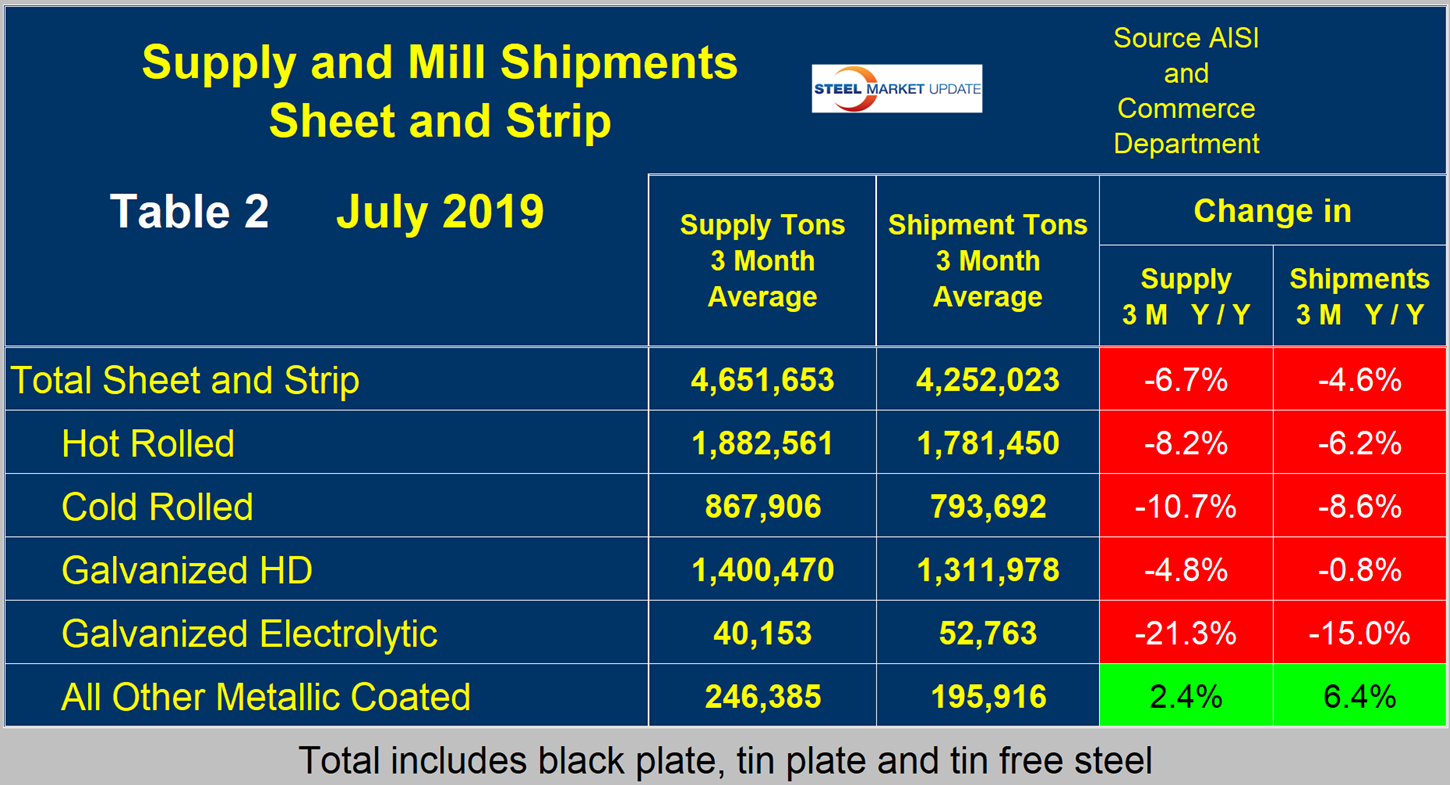

Table 2 describes both apparent supply and mill shipments of sheet products (shipments includes exports) side by side as three-month averages through July with year-over-year growth rates for each. Comparing the year-over-year time periods, total supply of sheet products to the market decreased by 6.7 percent and mill shipments decreased by 4.6 percent. Table 2 breaks down the total into product detail and shows that both shipments and supply were down for all sheet products considered in this report except for other metallic coated (mainly Galvalume). Apparent supply is defined as domestic mill shipments to domestic locations plus imports. In the three months through July 2019, the average monthly supply of sheet and strip was 4.652 million tons. There is no seasonal manipulation of any of these numbers. By definition, year-over-year comparisons have seasonality removed.

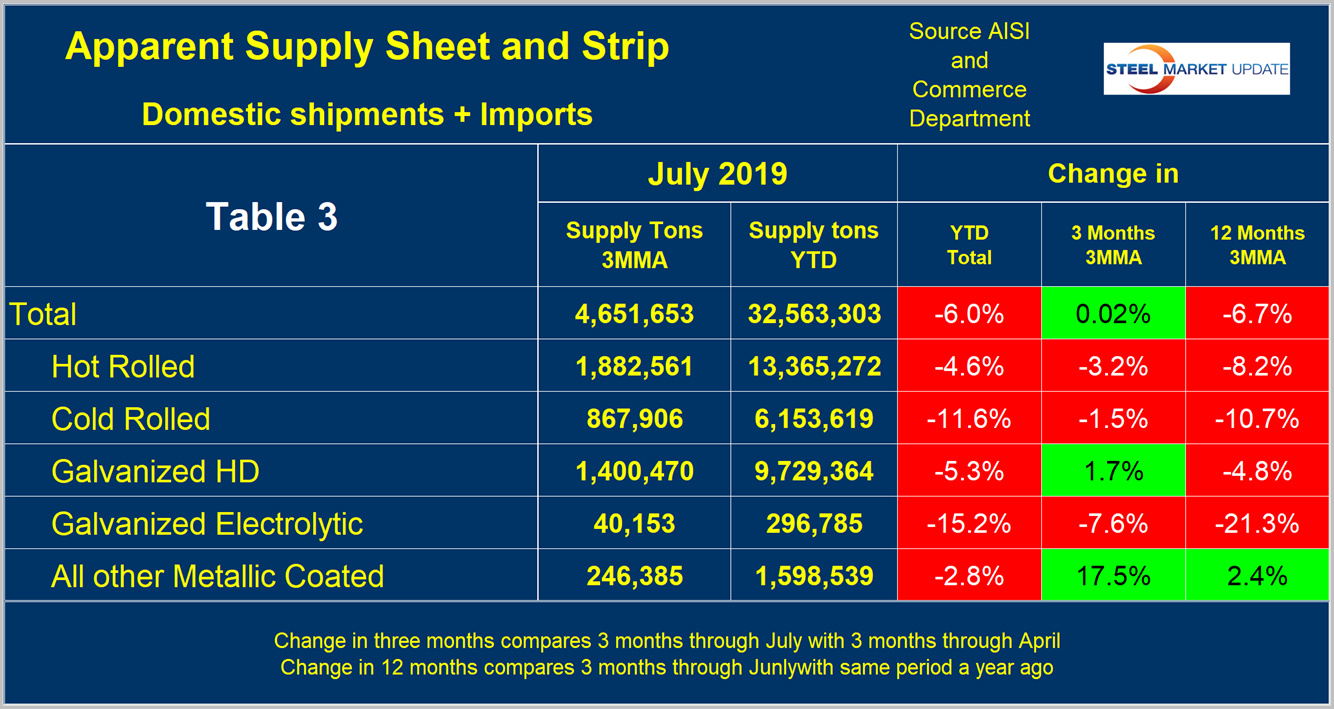

Table 3 shows that total supply of sheet and strip products including hot rolled, cold rolled and all coated products decreased by 6.0 percent year-to-date and increased by 0.02 percent comparing three months through July with three months through April. This latter increase is a seasonal effect as shown in Figure 3.

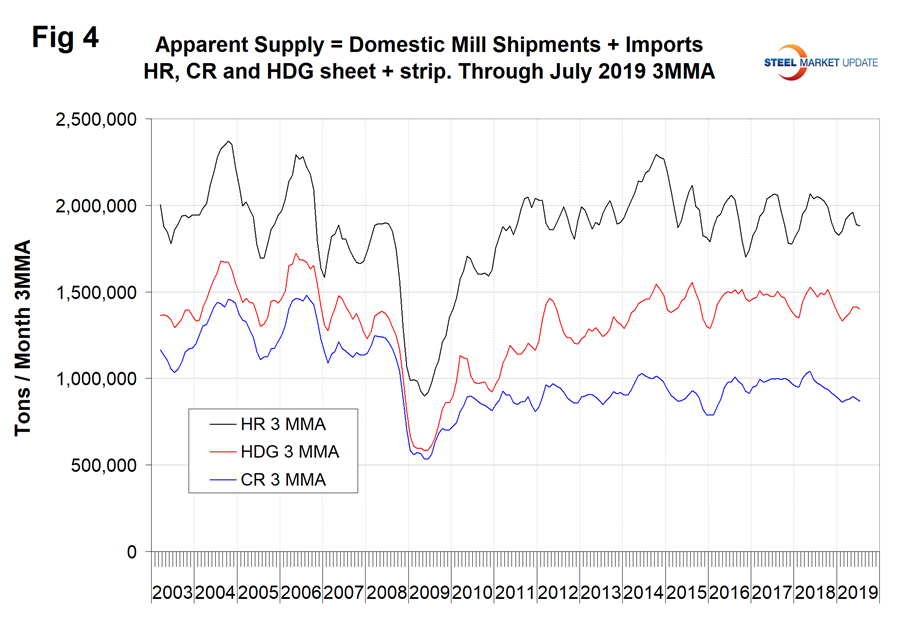

Figure 4 shows the long-term supply picture for the three major sheet and strip products—HRC, CRC and HDG—since January 2003 as three-month moving averages.

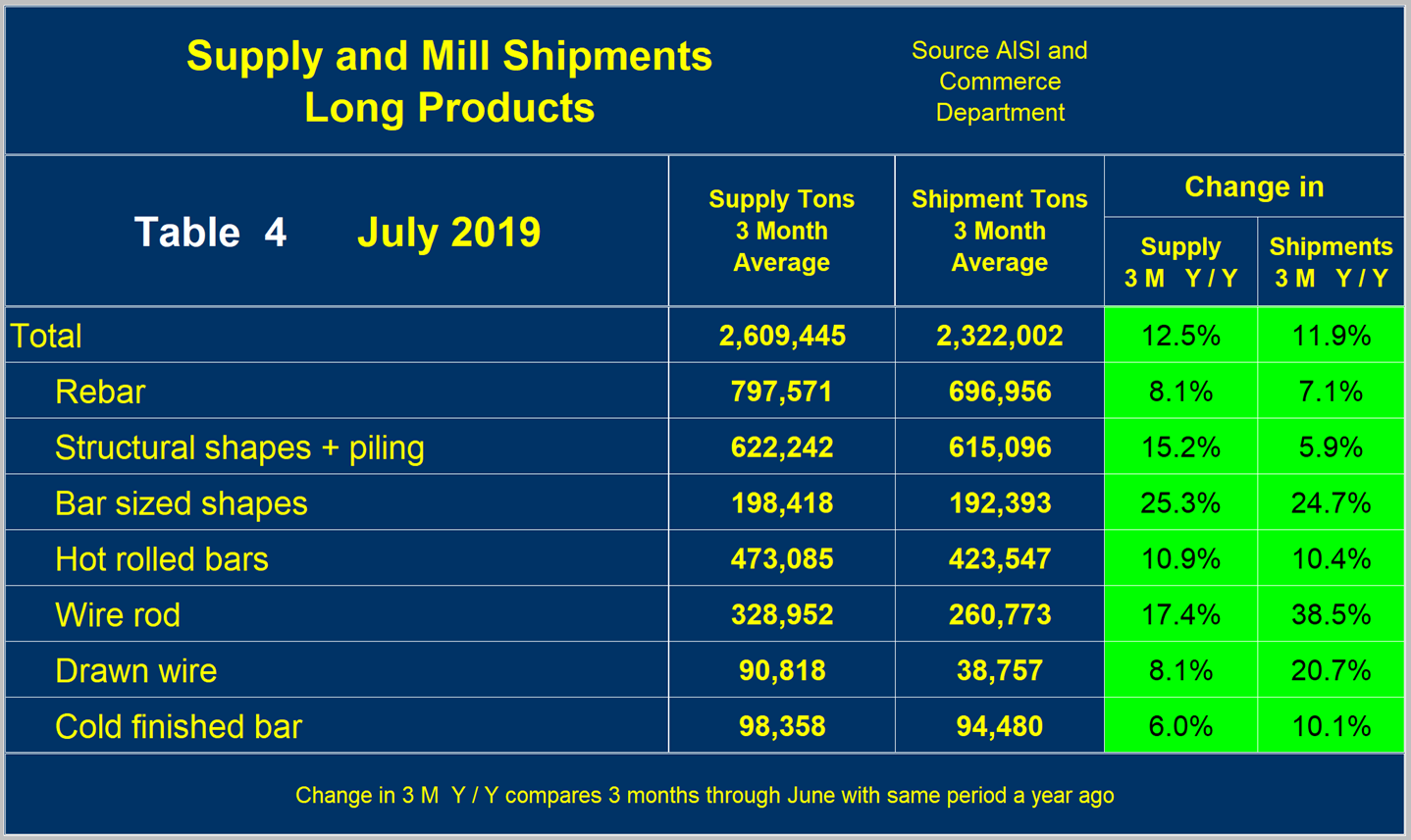

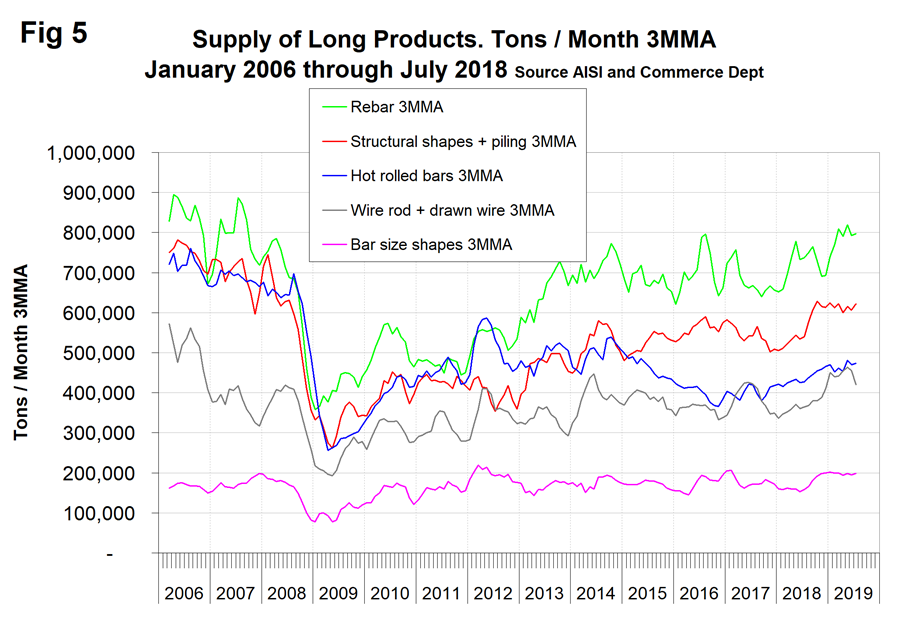

The dramatic difference between long and sheet products is shown in a comparison between Table 2 and Table 4. Long products are driven more by construction and less by manufacturing. Sheet products have the reverse drivers. Figure 5 shows the same result for longs on a graphical basis.

Figure 6 shows the long-term comparison between flat and long products. These are monthly numbers (not 3MMA), and clearly show the trend difference between longs and flat products including plate.

SMU Comment: The June and July construction reports showed negative growth for the first time since November 2011. If this deteriorating trend continues, it will negatively affect long product demand in the next few months. Sheet product demand is being adversely affected by the weakness of manufacturing industries, which has been intensifying since April this year. Since last November, the long product mills have had higher capacity utilization than the flat rolled mills for the first time since October 2012.