Prices

September 15, 2019

CRU: Oversupply and Outages Push U.S. Scrap Prices Lower Than Expected

Written by Tim Triplett

By CRU Analyst Ryan McKinley

Domestic scrap prices in the U.S. fell by $30-40 /l.ton in September depending on region and grade—by about $20 /l.ton lower than was generally expected by the market. The steeper-than-expected decline was caused by a confluence of factors including ample supply, mill outages and a weakening export market. Obsolete prices were mostly under less pressure than primes, although this varied regionally. This month’s decrease puts shredded scrap prices at their lowest level in nearly three years.

While inbound flows tapered off over summer as dealers cut scale prices, the large volume of scrap offered mid-month to mills in August was an indicator that obsoletes were still in plentiful supply for September trade. For primes, the return of manufacturers from outages put more prime material on the market compared to a month ago. Dealers, seeking to lock in positions for large volumes of primes prior to the trade week, agreed to deals on a to-be-determined price basis. With much of their scrap needs locked in ahead of time, mills were then able to push the market down by $40 /l.ton.

A weakening export market also pressured domestic U.S. scrap prices. The roughly $30 /t m/m decline in prices for HMS 1/2 (80:20) CFR Turkey meant there was no viable outlet for dealers seeking to get rid of excess material. Consequently, material on the East Coast turned inland to help compound an already oversupplied market there.

Coinciding with September’s oversupply were a few mill outages, which led to lower demand m/m. In areas like the South, these outages resulted in reduced buying programs and weaker demand for both prime and obsolete grades, pulling prices down by $40 /l.ton across the board. Overall, August capacity utilization rates struggled to stay above the 80 percent mark, especially in the back half of the month. A sharp decrease in scrap prices is often indicative of weaker capacity utilization rates given the correlation between the two. Running the data back five years, September’s shredded scrap price would indicate that capacity utilization should fall to around 72 percent. Although such a sharp decline is unlikely over the course of one month, we expect capacity utilization to remain under 80 percent for most of September.

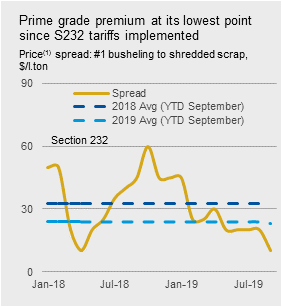

Shredded scrap prices are now at their lowest level since November 2016. The relative abundance of shredded scrap has meant mills are sourcing more of this material compared to prime grades. This weakened demand for prime grades and reduced the premium for #1 busheling to an average of $24 /l.ton year-to-date 2019 compared to $33 /l.ton a year earlier (see chart). The spread now sits at $10 /l.ton for the first time since the implementation of Section 232 tariffs on steel imports in April 2018.

Outlook: Little Upside for Scrap Prices in October

Prices are unlikely to recover in October following September’s decline. Even if obsolete flows into dealers’ yards are slowed by lower prices, multiple mill outages will keep a ceiling on demand. Mills will likely shift focus to buying more prime scrap given its narrow spread to obsolete grades.

We expect prices to remain under downward pressure for October and possibly November. December presents the strongest possibility for a price increase (driven by seasonal factors), although this will be weather dependent.