Prices

September 14, 2019

CRU: Scrap Prices Collapse Amid Weak Steel Markets

Written by Tim Triplett

By CRU Principal Analyst Chris Asgill

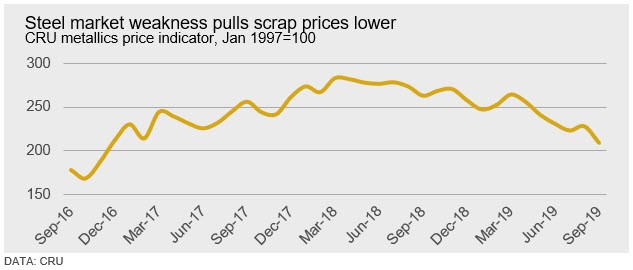

The pervasiveness of steel market weakness came to the fore this month, particularly for steel long products, leading to a sharp drop in scrap prices in almost every market we assess. Consequently, the CRU metallics price indicator (CRUmpi) dropped by 8.3 percent m/m to 209.4 (see chart), the lowest level since November 2016.

Following standout gains in August, U.S. scrap prices were some of the hardest hit in September as oversupply amid weak demand from mills saw prices drop by up to $40 /lt m/m. That said, virtually every other scrap market we assess suffered falls of $10-35 /t m/m. While still falling, ore-based metallics prices fared better and cost support remains, as weakness in flat-rolled steel markets has been less severe.

Although scrap prices fall more often than they rise in September, price movements this month have been dramatic in a number of markets. The last time prices fell nearly to this degree was in 2015, as the steel industry approached what many would consider near enough to rock-bottom; at least aside from the global financial crisis over a decade ago.

U.S. scrap prices have fallen by $30 /lt or more m/m, with prime grades fairing worse than obsolete. A supply overhang was apparent in both markets, compounded by mill outages that have reduced buy programs. The September recovery that European steel markets were hoping for has not materialized as yet. Faced with weak conditions, mills there have reduced buying activity and put pressure on scrap prices, with these falling by €20-30 /t m/m. In Japan, steel production remains weak, limiting scrap demand, which has been compounded by demand weakness and bearish sentiment more broadly throughout Asia.

The only market that has experienced a slight uptick in prices has been China. Scrap prices there weakened throughout the month as EAFs cut output and BOFs cut scrap rates. Prices would have fallen further had it not been for restricted scrap supply due to environmental inspections and merchants withholding material. Once steel prices in Chinese edged up to be broadly stable with a month ago, mills started to demand more scrap and this helped lift prices to a similar extent.

Ore-based metallics markets have proved more resilient than scrap prices, despite still weak conditions in flat-rolled steel markets. That said, long products market have been weaker month-to-month, with price falls being around $20-30 /t deeper for longs than flats. Meanwhile, iron ore prices rose in September, following sharp falls throughout August. This will ease downwards cost pressure, albeit briefly. Overall, buyers have largely stayed on the sidelines in anticipation of falls ahead, while exporters have resisted reducing prices so far.

Outlook: Few Signs for Optimism

Steel markets have soured markedly in recent months. Demand remains soft in many markets and there are no substantial indications this will improve in the near-term. Markets in the northern hemisphere typically see a seasonal boost in construction demand as hot weather from the summer months abates and construction projects get underway. This has not been very strong so far this year and there is little that points to improvement. Meanwhile, the steel industry remains oversupplied as recent and pending capacity expansions look to increase their order books and ramp up production, particularly those that are BF/BOF-based, which have little operational flexibility.

Consequently, scrap prices are unlikely to gain significant ground either. With steel prices and margins remaining weak and iron ore prices expected to fall, significant increases are unlikely. While some scrap prices are below where they should be in relation to steel and iron ore prices, prices are also suppressed by weak sentiment in major markets with buyers holding off purchases and pushing for lower prices. Although a return of buyers to the market would lift scrap demand, we do not see this as a likely outcome in the near-term.

For ore-based metallics, production costs will decline in the coming month with falls in iron ore prices. Furthermore, there is mounting pressure for HR coil prices to fall in the U.S., while prices in Europe are unlikely to find significant support. With weakness continuing in two major demand centers for pig iron, there is little to support prices at current levels once costs fall. HBI prices did not fall as significantly as scrap prices in September. This has opened an atypical price premium for HBI over HMS/E3 scrap. As pellet markets are looser currently, we do not see any significant support for HBI prices in the month ahead.