Prices

September 10, 2019

License Data Shows Modest Steel Imports in September

Written by John Packard

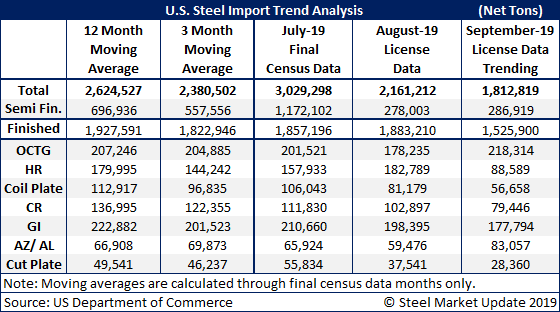

U.S. steel imports are trending well below average in September, based on Commerce Department license data. Extrapolating the current rate of import licenses out through the end of the month shows total imports on track to hit about 1.8 million tons–significantly below the 2.4 million ton average for the past three months and the 2.6 million ton average for the past 12 months.

Imports of semi-finished steel, mostly slabs purchased for rolling by domestic mills, remain modest at a projected 287,000 tons. The mills are still working off the 1.2 million ton spike in semi-finished they acquired in July, which was the first month of the third quarter. Some slab imports, notably from Brazil, are subject to quarterly quotas. Another big bump in semi-finished imports can be expected in October as the mills move to secure supplies at the beginning of the fourth quarter.

Compared with the preliminary license data for August, imports are trending down in every product category in September, except for oil country tubular goods and Galvalume.

See the chart below for more detail: