Prices

September 5, 2019

Hot Rolled Futures & BUS Futures Continue Their Descent

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

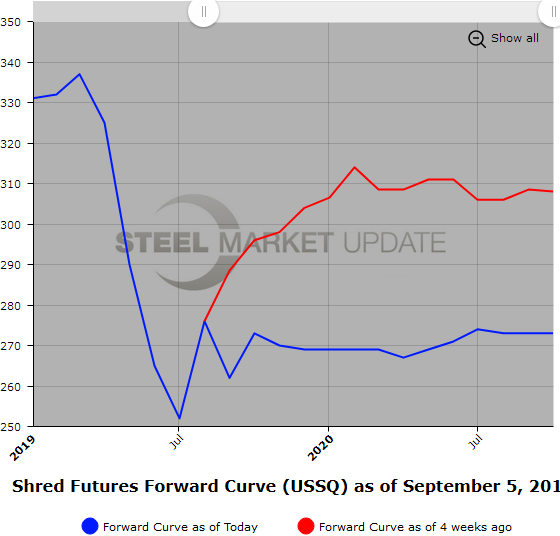

In the last 30 days we have seen the prices in the HR forward curve drop by an average of $70/ST for the Oct’19 through Dec’20 forward months, with the nearer date prices dropping the least as the curve shifted from a slight contango to what is basically a flat curve as of the latest settlements. Mid $560/ST curve.

The impact to global GDP due to the escalating trade war between the U.S. and China along with declining Global steel prices has negatively affected U.S sentiment going into the final quarter of the year.

In an HR futures market that was already skewed to the downside due to more selling interest than buying interest, lower forecasted HR prices coming out of the Steel Summit in Atlanta in late August by various analysts and economists left the HR futures market with buyers interests at much lower levels. ($555/ST)

HR futures volumes have been a bit softer in the last 30 days. Some causes include, Price. The $580 ish spot price level has left participants unsure as to future price direction.

Sellers have become more cautious as the forward HR curve shifted lower and flattened. $555/$565 per ST from roughly $630/ST in early August.

On the flip side futures buyers focus on mill lead times has kept inquiries muted as they look for any signs of a change in the perceived overcapacity. A push lower to the mid $530’s will likely generate some further buying inquiries.

Current HR open interest is running about 311,000 ST and traded volume for the last month is running around 110,000 ST.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

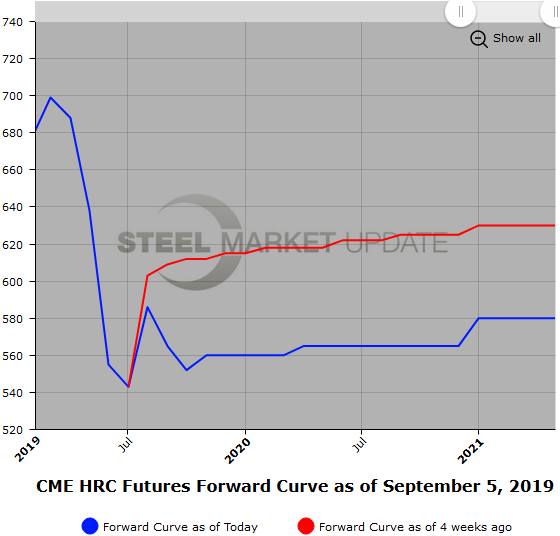

Scrap

BUS futures have also tracked the decline in HR futures with the curve easing about $45/GT on average for 12 months forward. The current mid value for 1H’20 BUS futures is about $295/GT which is about flat with last months BUS settlement. Natural futures buyers remain scarce on the back of the steep price decline in HR futures. Quiet export market for 80/20 scrap has also put some further downward pressure on price expectations.

Early chatter has Sep’19 BUS dropping in the neighborhood of $40/GT with the south declining even more.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.