Prices

September 5, 2019

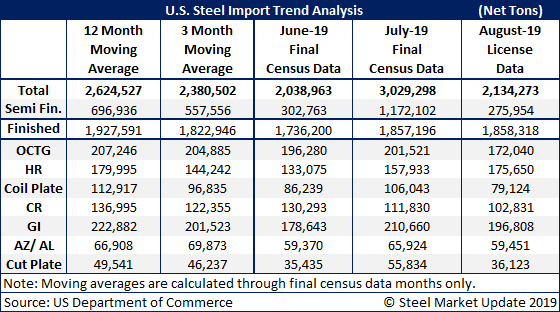

August Import Licenses Trending Toward 2.1 Million Ton Month

Written by John Packard

As many of our trading company contacts have been telling SMU, finished steel imports have bottomed at just under 2 million short tons.

Total foreign steel imports for the month of August are forecast to be 2.1 million net tons based on license data released on Tuesday of this week. Only 275,954 net tons are semi-finished steels (mostly slabs) as Brazil, who has been supplying 63 percent of all semi-finished steels since the beginning of the year, had minimal exports of semi to the U.S. during the month due to quota restrictions.

Some interesting observations made by Steel Market Update regarding flat rolled products:

Hot Rolled – Canada accounted for 63 percent the HRC exports to the U.S. with 111,559 net tons of the 175,650 net tons of licenses being Canadian. The second largest supplier was 36,692 net tons of licenses. Third was The Netherlands with 9,295 net tons of HRC licenses.

Cold Rolled – Canada led again with 34 percent of the CRC imports. Behind Canada were Mexico, Vietnam and Australia.

Galvanized – Canada led here as well with 44 percent of the GI import licenses for the month of August. Following Canada with slightly more than 10 percent of the total was South Korea. Then came Vietnam, Taiwan and Australia.